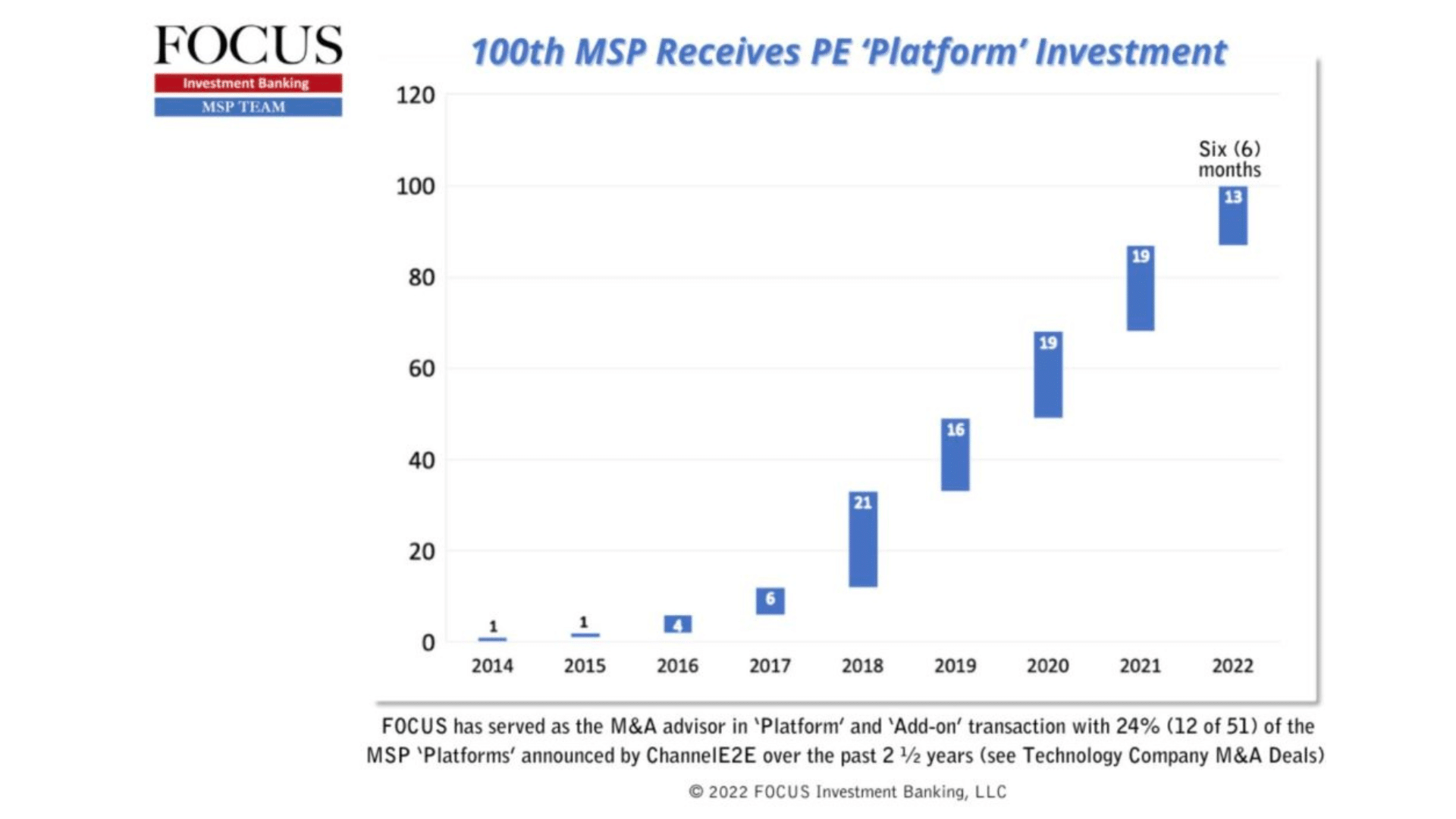

Insights on private equity trends, investment strategies, and M&A opportunities in the lower middle market.

The Next “BIG Thing”: Private Equity May “Double Down” on MSPs

Why does FOCUS Investment Banking's Abe Garver believe growth in private equity-backed MSP Platforms may accelerate? Here is Garver's thesis.