AUTOMOTIVE

Automotive M&A Advisors for Middle Market Business Owners

The automotive is changing fast. Electric vehicles, self-driving cars, ride sharing, and continuing industry consolidation stand to have a major impact on independent dealers and auto service chains. There will be winners and losers and many companies will be faced with a “grow or go” decision.

FOCUS Investment Banking is one of the most active M&A advisors in the U.S. automotive. We’ve helped dozens of companies in car washes, dealerships, collision repair, oil & lube, parts & accessories, paint jobbers, tire & service, and automotive distribution achieve their strategic objectives, whether it’s buying, selling, or raising capital.

With over 40 years of experience in the automotive, we understand industry dynamics to help business owners maximize their outcome. Our clients trust us to deliver positive results.

To find out how we can help, it’s best to start with a confidential, no-obligation discussion.

Our team works across multiple sectors:

Differentiators

The FOCUS Automotive team delivers superior results for our clients, bringing specific expertise in:

Why FOCUS?

We know the market like no one else. The FOCUS Automotive team has helped hundreds of business owners plan for an exit. Our team has worked in the aftermarket as business owners, district managers, marketing managers, financial analysts, business development specialists, as well as investment bankers. We know the levers that drive value and help our clients achieve maximum results.

We advise business owners on their financial options and run a process to find the best strategic investors or private equity buyers for their particular situation. We comb the market to find the right buyers, get the best offers, and help close the deal.

Preparing Your Business for Sale: Maximizing Value

Ready to start planning? Let’s talk.

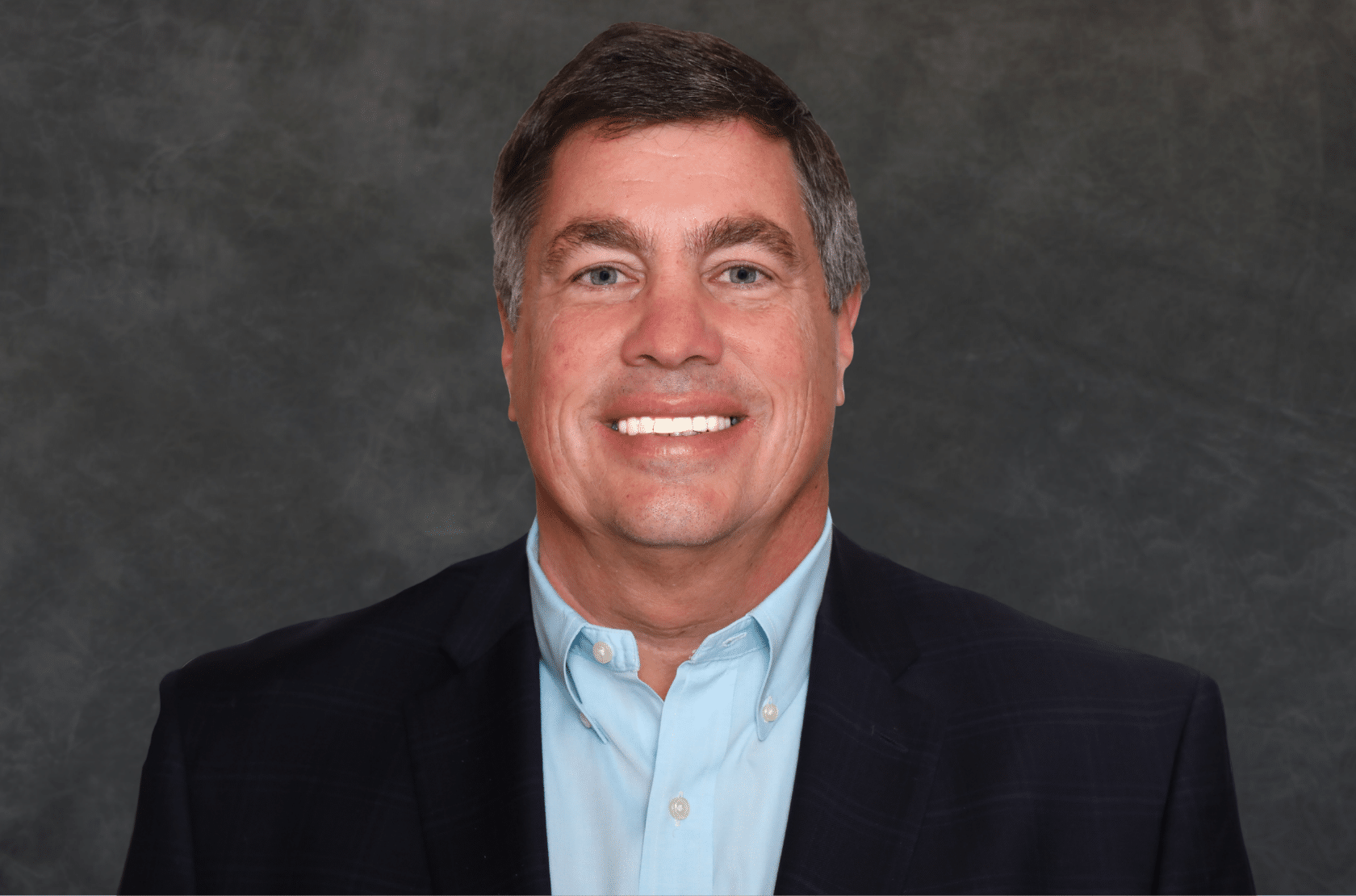

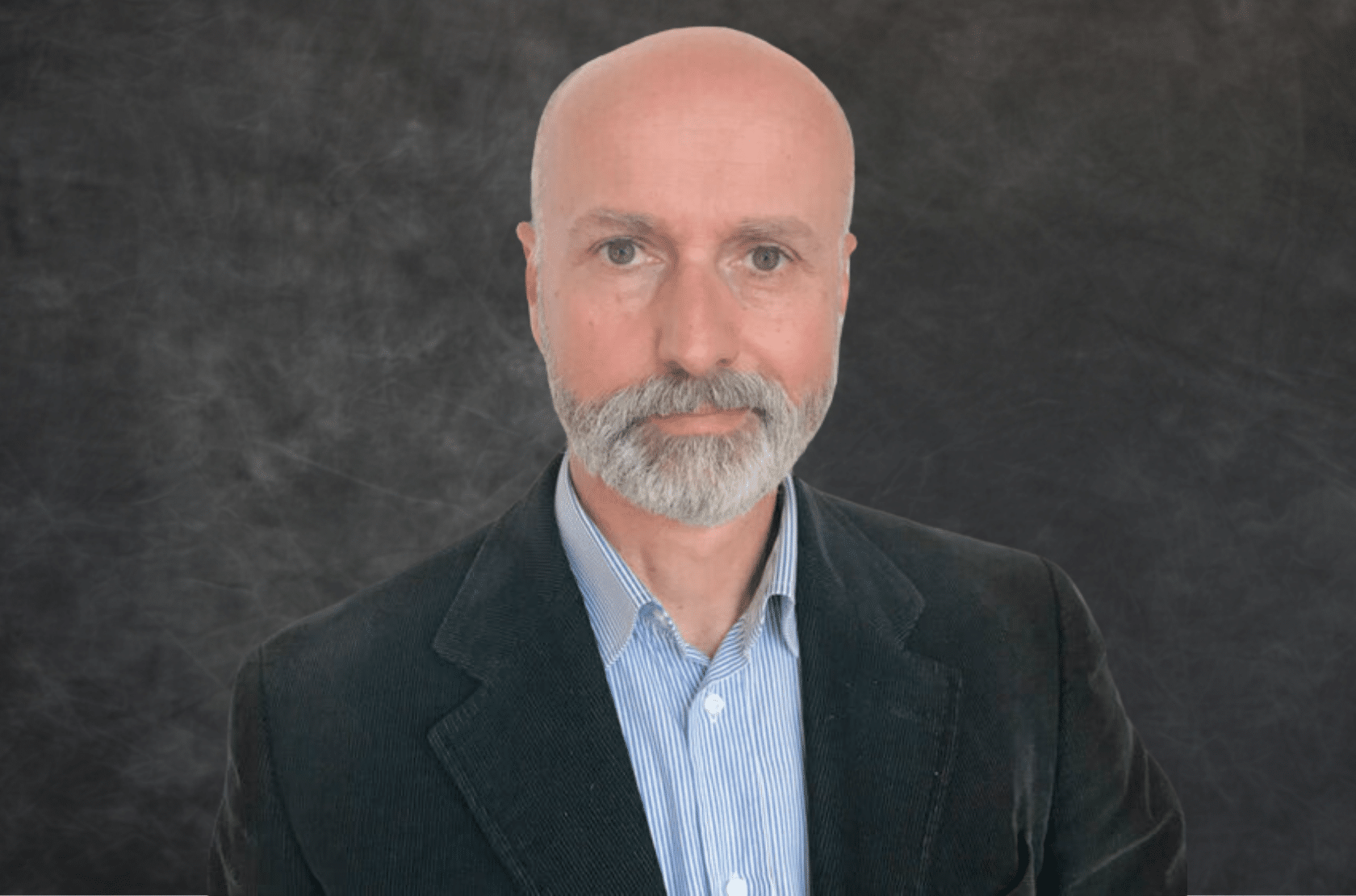

AUTOMOTIVE TEAM

Driving M&A Success

NEWS & INSIGHTS

Growth-Driven Strategic Transactions

Collision Vision Podcast

Single Store Generalist Shops | Why the Era is Coming to an End

The Collision Vision is driven by Autobody News and hosted by Cole Strandberg, a Managing Director on the FOCUS Automotive team. Each episode will feature an industry thought leader, business owner or collision pro diving deep into their knowledge of what it takes to be successful. This podcast will enlighten, engage and entertain while covering the full scope of the current state of the industry—and where it is headed. So come along for the ride, and level up with The Collision Vision.