CONSUMER

M&A Advisory for Middle Market Business Owners

In addition to a strong team of bankers, our team also includes strategic advisors that are former consumer CEOs with experience scaling and exiting businesses. We leverage this experience to help best articulate our client’s value proposition to the marketplace and achieve successful exits.

FOCUS Consumer clients also benefit from our extensive industry relationships and inside knowledge of current valuations and deal structures.

Services

Our practice concentrates on providing investment banking services to middle market clients:

Differentiators

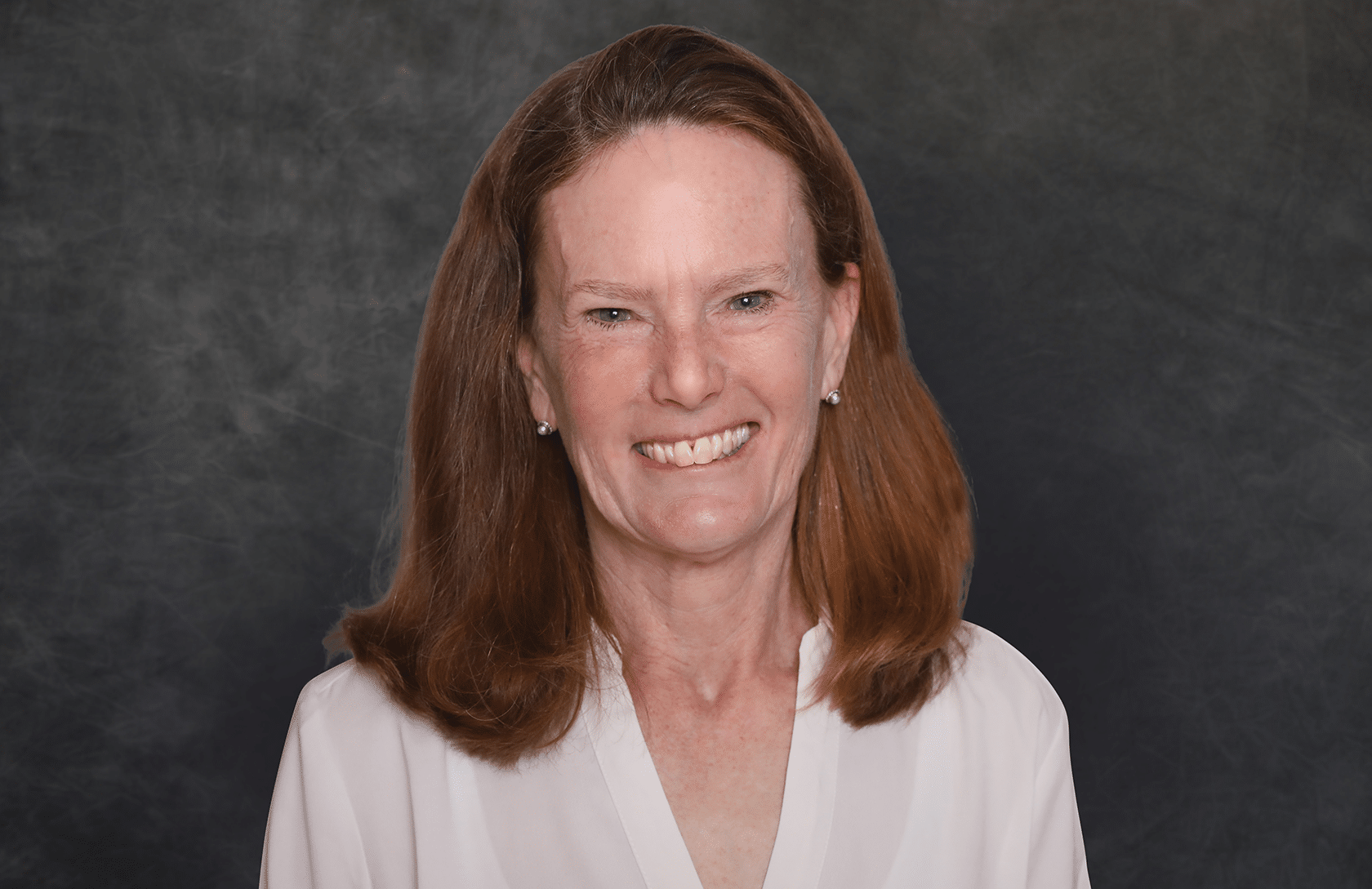

CONSUMER TEAM

Driving M&A Success

Hear From Our Clients

Success Stories From Our Clients

“The team at FOCUS was so helpful and ready and willing to do whatever it took to get things done throughout this transaction. s my first, and possibly my last business sale, I appreciated the way they worked with me and my team at BROTHERS to make sure we were informed and involved with all aspects of the process.”

Jim Flanders, Co-Founder

Brothers Mail Order Industries, Inc.

NEWS & INSIGHTS

Latest Trends and Industry Insights