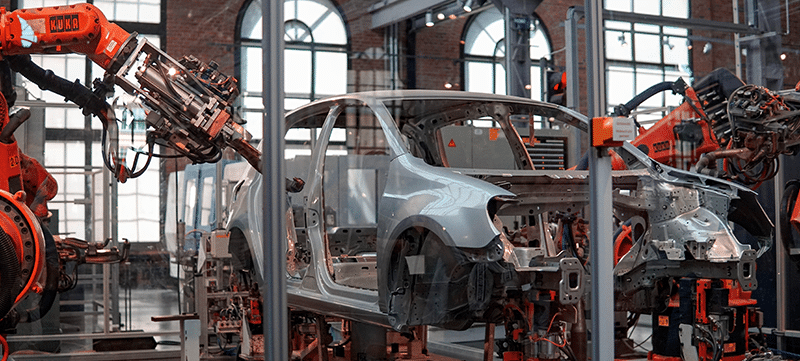

MANUFACTURING

M&A Advisory for Middle Market Business Owners

Firms in the Manufacturing, Distribution Logistics and Automation industries operate in a rapidly evolving environment. The capital markets have taken notice and aggressive, well-funded acquirers are rapidly transforming the competitive landscape.

Connect with our Manufacturing team to discover what your business is worth.

Experts in the Manufacturing Sector

Our team works across multiple sectors:

Manufacturing

Automation Industry

Who We Serve Best

At FOCUS, we specialize in serving lower middle market companies in the manufacturing sector.

Our clients are typically:

We work closely with a variety of ownership structures, including:

Many of our clients face one or more of the following challenges:

If you’re a manufacturing business owner or executive thinking about what’s next—whether it’s growth, succession, or sale—our team brings deep industry experience and a proven track record to guide you through your next chapter. Contact us to learn more.

MANUFACTURING TEAM

Driving M&A Success

MANUFACTURING TEAM

Driving M&A Success

NEWS & INSIGHTS

Latest Trends and Industry Insights

Hear From Our Clients

Success Stories From Our Clients

“John Slater and Jorge Maceyras with FOCUS Investment Banking, expertly coordinated a process that generated significant interest in my company from the market. The ultimate result of that process yielded a positive outcome for me personally and professionally as well as for the employees of HL Precision Manufacturing and its enduring future in an increasingly consolidating industry. Our deal combined elements of a merger, sale, and acquisition all resulting in the formation of a new parent company, H3 Manufacturing Group, LLC which now owns both HL Precision as well as Hi-Grade Welding & Mfg. The work done by the FOCUS team was disciplined, very well documented, and portrayed HL Precision in an accurate and attractive manner. I would very much recommend FOCUS to other business owners and CEO’s looking to take their company to market and/or seek strategic partners for their road ahead.”

Steven C. Hillard, President & CEO

H3 Manufacturing Group, LLC

Frequently Asked Questions

What types of advanced manufacturing companies does FOCUS work with?

We advise a wide range of companies across the advanced manufacturing spectrum, including precision machining, robotics, additive manufacturing (3D printing), industrial automation, contract manufacturing, aerospace and defense suppliers, and component manufacturers.

What services does FOCUS provide to advanced manufacturing clients?

FOCUS offers M&A advisory, capital raising, strategic growth consulting, and business valuation services. Whether you're looking to sell your business, acquire a competitor, raise growth capital, or assess strategic options, our team can help.

How is FOCUS different from other investment banks?

Our deep industry knowledge, extensive buyer/investor network, and senior-level attention set us apart. Each engagement is led by experienced bankers with hands-on expertise in manufacturing and tailored support throughout the transaction process.

Is my company large enough to work with FOCUS?

FOCUS specializes in serving lower middle market companies, typically with revenues between $10 million and $300 million. If you’re unsure whether we’re the right fit, we’d be happy to have a confidential conversation.

How long does it take to sell a manufacturing business?

Most sell-side engagements take 12 months from preparation to closing. The timeline can vary based on market conditions, company readiness, and buyer dynamics.

How do I know what my business is worth?

Valuation depends on a variety of factors including financial performance, customer concentration, competitive differentiation, industry trends, and more. FOCUS can provide a detailed, market-based valuation as part of an initial engagement.

Will the process remain confidential?

Absolutely. We understand the sensitivity of M&A and capital raise processes. All outreach and discussions are conducted with strict confidentiality, and NDAs are used with all potential buyers or investors.

What should I do if I’m not ready to sell but want to explore options?

We regularly advise owners who are 1–3 years away from a transaction. Early planning can significantly enhance value and readiness. We’re happy to start the conversation and help you build a strategy.