Data “Signals” Provide Best MSP M&A Targets for Private Equity

Ice hockey legend Wayne Gretzky once famously defined what made him such a great player: “I skate to where the puck is going, not where it has been.”

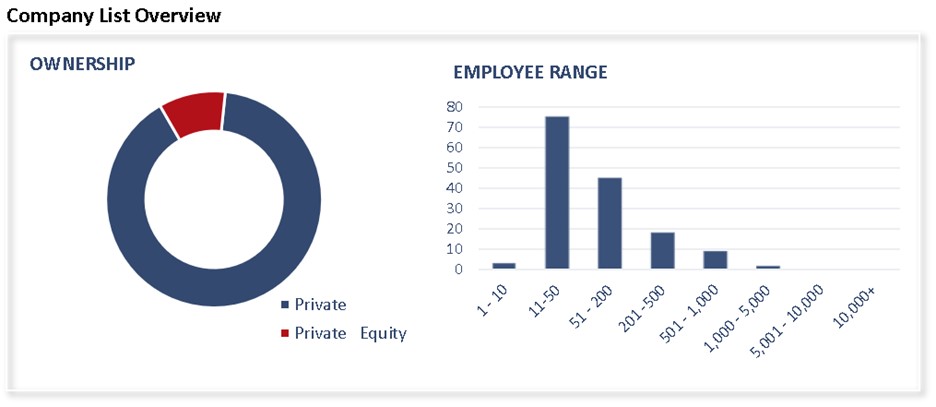

To help private equity firms skate to the proverbial “MSP Puck,” FOCUS Investment Banking’s Managed Service Provider (MSP) Team has created the first and only predictive “signal-driven” custom scoring of the top 1,138 MSP targets that appear on the most prominent industry lists (MSP 501, CRN 500, ChannelE2E Top 100 Vertical, Inc. 5000 – IT Management and/or Redmond Channel Partners, Microsoft’s Top 350).

Our proprietary algorithm looks for demonstrative organic growth “signals” that influence a company’s rank, including:

- Growth intent (e.g., % change of new job postings on LinkedIn, Indeed and Glassdoor)

- Employee count (12 months % growth rate)

- Web traffic (12 months Alexa rank % change)

The onus is on modern dealmakers to differentiate themselves and position their firms for growth by conceiving “New School” approaches to help their clients find and create exceptional assets—and close deals.

FOCUS believes its research will shine a well-deserving light on MSP founders and CEOs (and their respective teams) and make it easier for them to access private equity capital to fuel even more growth.

Announcing the “MSP Market Maker Unicorns” for 2022

FOCUS has risen to the occasion by creating a list of “MSP M&A Unicorns,” which it believes will provide outsized returns to MSP Founder/CEOs and their private equity investors by mining the predictive growth “signals” described above. Today we are announcing the “Second 50” Ranking for 2022:

MSP Market Maker Unicorns – “Second 50”

| Ranking | Informal Name | City | State |

| 51 | Mytech Partners | Saint Paul | MN |

| 52 | Helion Technologies | Lutherville | MD |

| 53 | Integrated IT Solutions | Milford | MA |

| 54 | Applied Tech Solutions | Madison | WI |

| 55 | AT-NET Services | Charlotte | NC |

| 56 | Innovien Solutions | Atlanta | GA |

| 57 | Hub Technical Services | South Easton | MA |

| 58 | ComputerSupport | Chelmsford Center | MA |

| 59 | NENS | Lowell | MA |

| 60 | Merit Technologies | Greenville | SC |

| 61 | GRIT Technologies | Clinton Township | MI |

| 62 | Forthright Technology Partners | Hollywood | FL |

| 63 | Iuvo Technologies | Westford | MA |

| 64 | Lantium | Blue Bell | PA |

| 65 | E-N Computers | Waynesboro | VA |

| 66 | Netrix IT | Saint Paul | MN |

| 67 | ASi Networks | San Dimas | CA |

| 68 | ITPartners+ | Grand Rapids | MI |

| 69 | Revel Technology | Houston | TX |

| 70 | Salvus TG | Lee’s Summit | MO |

| 71 | Veracity Technologies | Hopkins | MN |

| 72 | Syand | Burnsville | MN |

| 73 | DLC Technology Solutions | Marlton | NJ |

| 74 | Bell Techlogix | Indianapolis | IN |

| 75 | Expedient | Pittsburgh | PA |

| 76 | Systems Engineering | Portland | ME |

| 77 | Cerium Networks | Spokane | WA |

| 78 | PEI | Boulder | CO |

| 79 | Safety Net | Traverse City | MI |

| 80 | IntegraONE | Allentown | PA |

| 81 | iCorps Technologies | Woburn | MA |

| 82 | Kinettix | Cincinnati | OH |

| 83 | Solutions II | Littleton | CO |

| 84 | TechMD | Santa Ana | CA |

| 85 | CyberlinkASP Technology | Dallas | TX |

| 86 | Envision Technology Advisors | Pawtucket | RI |

| 87 | Texas Systems Group | Austin | TX |

| 88 | Magnitech | Naperville | IL |

| 89 | Adopt Technologies | Phoenix | AZ |

| 90 | Method Technologies | Cypress | CA |

| 91 | VirtuIT Systems | Nanuet | NY |

| 92 | Vector Choice Technology Solutions | Duluth | GA |

| 93 | Radcomp Technologies | White Salmon | WA |

| 94 | PICS ITech | Mount Holly | NJ |

| 95 | Nerds Support | Miami | FL |

| 96 | A Couple Of Gurus | Minneapolis | MN |

| 97 | DEVsource | Murray | KY |

| 98 | Networking Technologies + Support | Midlothian | VA |

| 99 | PSM | Chicago | IL |

| 100 | Wheelhouse IT | Fort Lauderdale | FL |

If you’re looking for the Top 50 unicorns, that list has been reserved for new FOCUS buy-side clients who are seeking:

- New MSP Platforms in the $2.5MM-$20.0MM EBITDA Range, and

- Add-on Acquisitions in the $500K-$10.0MM EBITDA Range

About the FOCUS MSP Team

In addition to pioneering the first and only predictive “signal-driven” custom scoring of the top 1,138 MSP targets, no investment bank has been more active or aggressive in serving the MSP market than FOCUS Investment Banking.

For example, FOCUS served as M&A advisor to five of the 10 MSP platforms that were established in 2020 and announced by ChannelE2E (see 2020 MSP & Technology M&A List).

Most recently we have served as catalyst for, and exclusive financial advisor on, MSP/MSSP transactions with 18 legendary MSP Founder/CEO/President references including: Tom Andrulis, Rashaad Bajwa, Kevin Blake, Willis Cantey, Steven Cariglio, Kevin Cook, Brian Desrosier, Jim Kennedy, Buddy Martin, Donald C. Monistere, Karl Muehlberger, Eric Noonan, Edward M Reade, David Robinson, Tony Schafer, Jake Spanberger, Mohit ‘Mo’ Vij and Mike Williams.

These deals resulted in nine MSPs becoming newly-minted PE-backed platforms, with five more currently under Letters of Intent.

For more information, please contact FOCUS Managing Director and MSP Team Leader Abraham Garver at [email protected].