BUSINESS SERVICES

M&A Advisory for Middle Market Business Owners

Well-run businesses know that outsourcing non-core functions to other service providers empowers them to focus, grow and excel in their own marketplace, by leveraging the expertise of others who excel at what they do.

FOCUS brings deep experience and a track record of success in several of these B2B service sectors, including Information and Document Management; and Infrastructure Services. Since 1982, FOCUS Investment Banking has been providing advisory services to entrepreneurs, owners, and investors in the Business Services sector. Contact us to learn more about the process we have used to close business services deals in the last few decade.

Our team works across multiple sectors:

Building & Infrastructure Services

Professional Services

Professional Services

Services

Our practice concentrates on providing investment banking services to middle market clients:

Differentiators

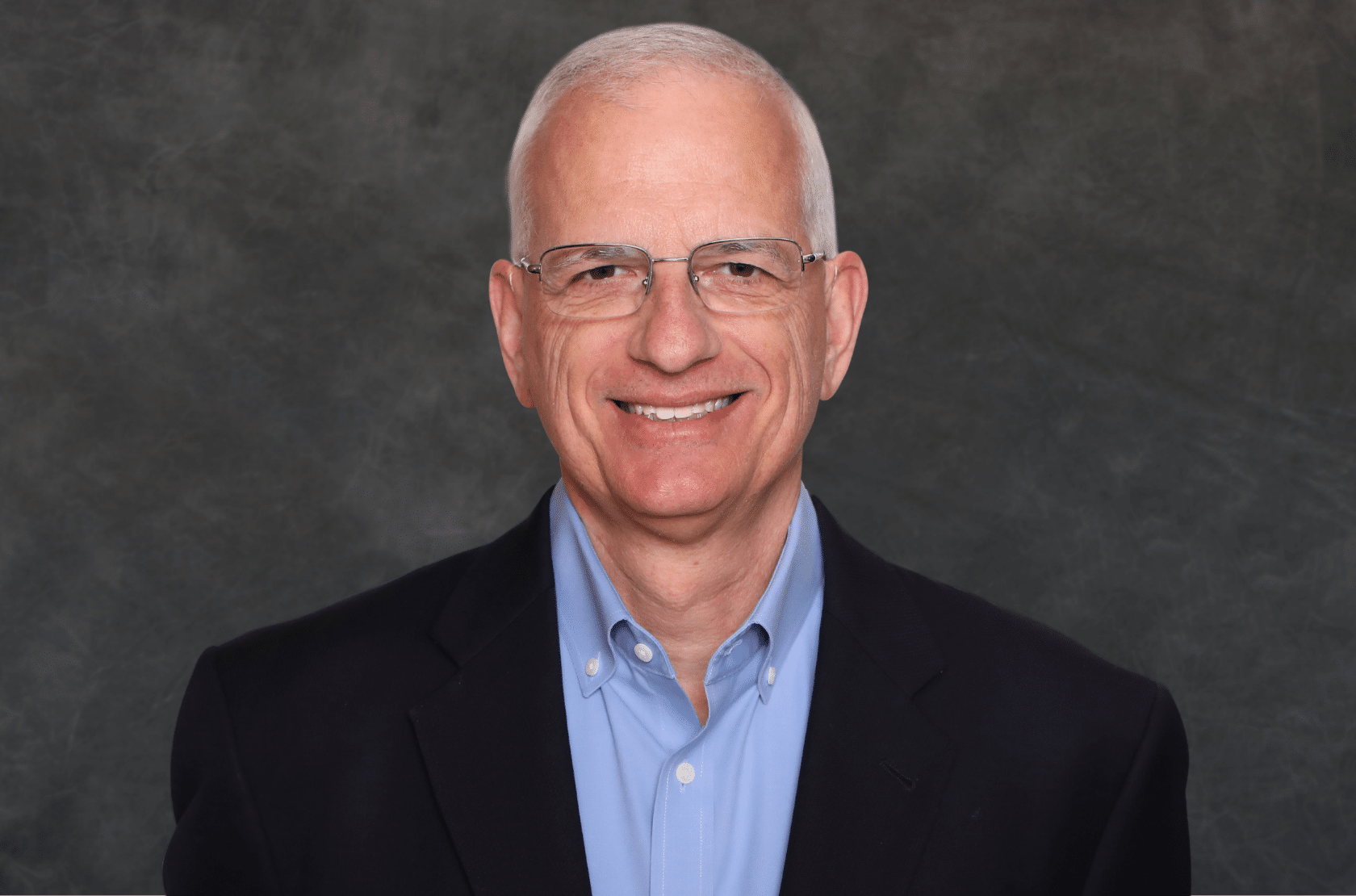

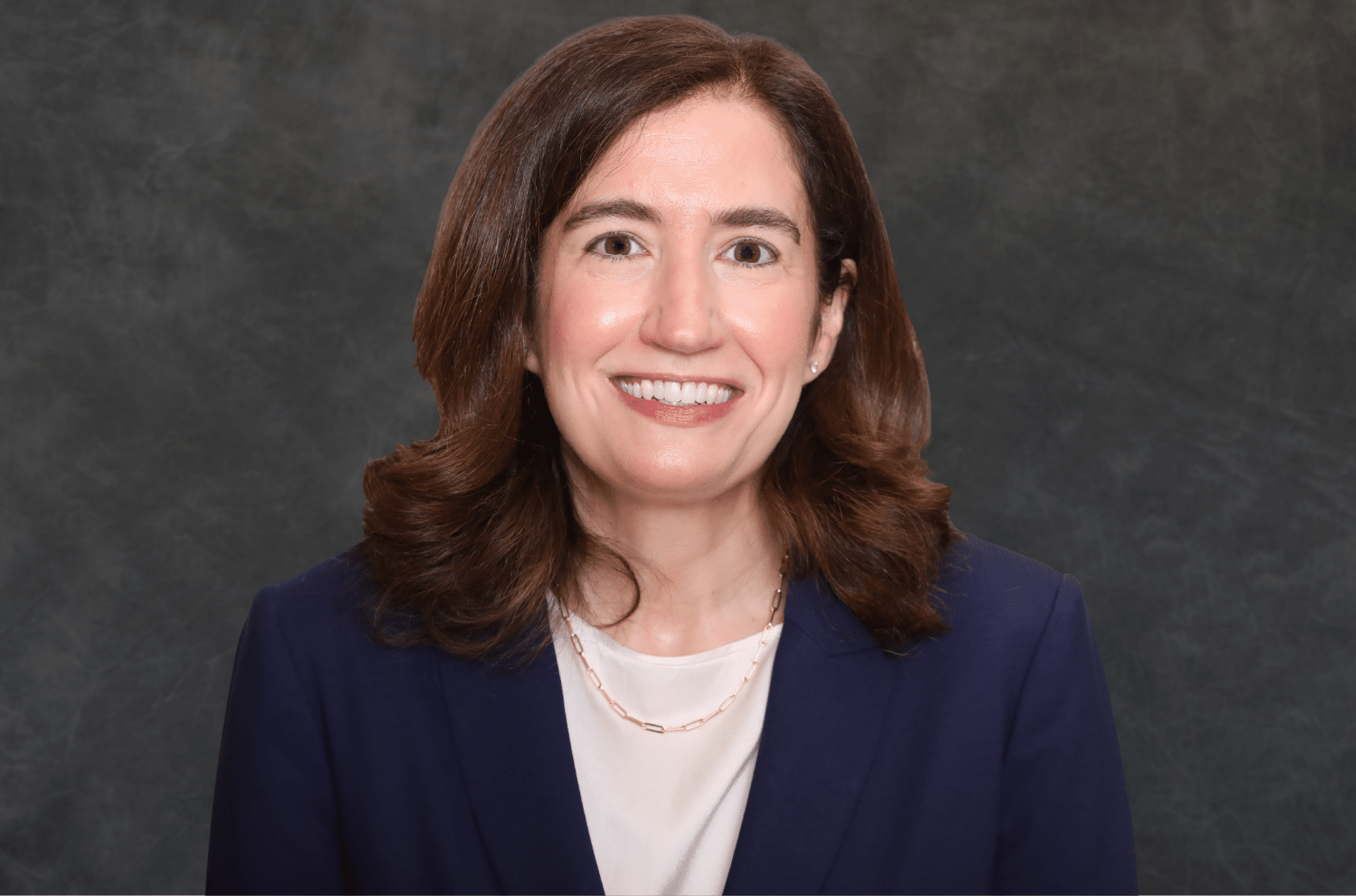

BUSINESS SERVICES TEAM

Driving M&A Success

NEWS & INSIGHTS

Latest Trends and Industry Insights

HEAR FROM OUR CLIENTS

Success Stories From Recent Transactions

“We are grateful for the expertise and professionalism that FOCUS brought to this transaction. The sale of Alpha Systems to Databank would not have gone as seamlessly as it did had it not been for FOCUS. They understand the needs of both buyers and sellers and ensured that the transaction went as smoothly as possible. Their bankers bring a methodical execution strategy that delivers consistent results. This is the second transaction FOCUS has completed for us, which demonstrates the confidence we have in their process and in their firm.”

Brett Griffith, President

Alpha Systems