TECHNOLOGY SERVICES

M&A Advisory for Innovation Technology Services Leaders

Why Our Technology M&A Services

Unlike most technology services specialty groups, we:

Experts for Technology Sector

Our team works across multiple sectors:

Our Impact in Figures

76 Successful MSP Transactions; 12 MSPs into new plattforms

DRIVING M&A SUCCESS

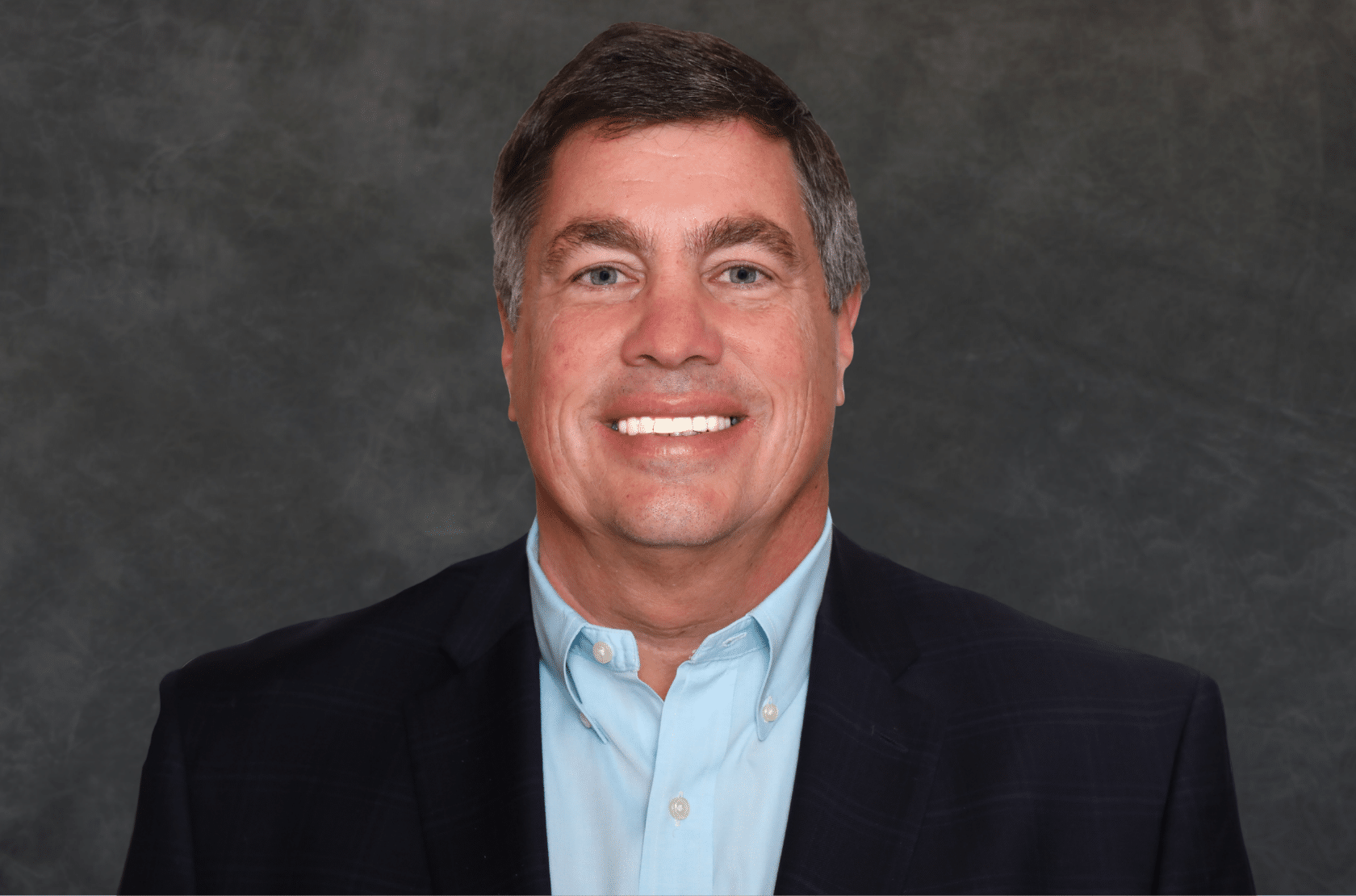

Our M&A Technology Services Team

HEAR FROM OUR CLIENTS

Success Stories From Our Clients

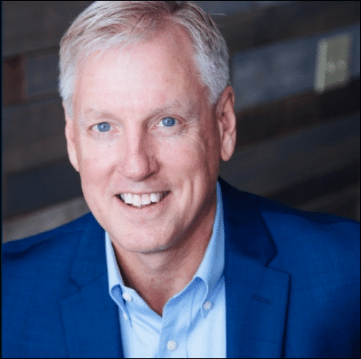

“I could not have chosen a better partner than Abraham and his team at FOCUS Investment Banking. In all my years in business I have never experienced this uniquely powerful combination of customer centric focus, deep industry and financial knowledge, availability, integrity, likeability, and selflessness. With them negotiating the deal I was able to get a price almost (redacted)% higher than I thought likely, and with a buyer who is a great cultural fit.”

Jim Kennedy, Founder & CEO

Jim Kennedy, Founder & CEO, Network Support Co., a portfolio of company of The Riverside Co.

NEWS & INSIGHTS

Latest Trends and Insights

Frequently Asked Questions

What critical factors do you analyze when evaluating a tech company for an M&A transaction?

We assess key drivers such as recurring revenue, client concentration, scalability, proprietary technology or IP, growth trajectory, and leadership strength. We also evaluate market position, customer retention, and the quality of financial reporting to determine value and fit for strategic or financial buyers.

How do you ensure seamless integration and long-term value creation in tech deals?

We work closely with both buyers and sellers to align strategic goals, assess cultural fit, and plan post-close integration early in the process. By identifying operational synergies, retaining key talent, and addressing potential risks upfront, we help set the foundation for long-term value creation.

How does FOCUS Investment Banking support technology transactions?

FOCUS provides end-to-end advisory for technology M&A, including strategic positioning, buyer outreach, valuation, and deal negotiation. Our team—many of whom are former tech executives—brings deep industry expertise and a hands-on approach to ensure each transaction meets our client’s financial and strategic goals.