Women’s Health – Q1 2022 Acquisition Activity and Outlook

Urology – Q1 2022 Acquisition Activity and Outlook

Orthopedics – Q1 2022 Acquisition Activity and Outlook

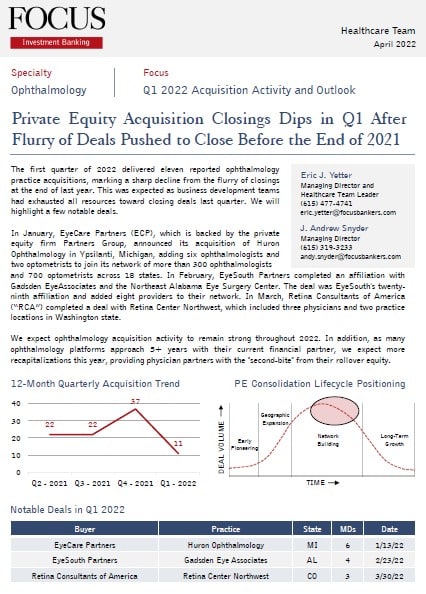

Ophthalmology – Q1 2022 Acquisition Activity and Outlook

Home Health & Hospice – Q1 2022 Acquisition Activity and Outlook

Gastroenterology – Q1 2022 Acquisition Activity and Outlook

ENT & Allergy – Q1 2022 Acquisition Activity and Outlook

Dermatology – Q1 2022 Acquisition Activity and Outlook

Behavioral Health – Q1 2022 Acquisition Activity and Outlook

Cardiology – Q1 2022 Acquisition Activity and Outlook

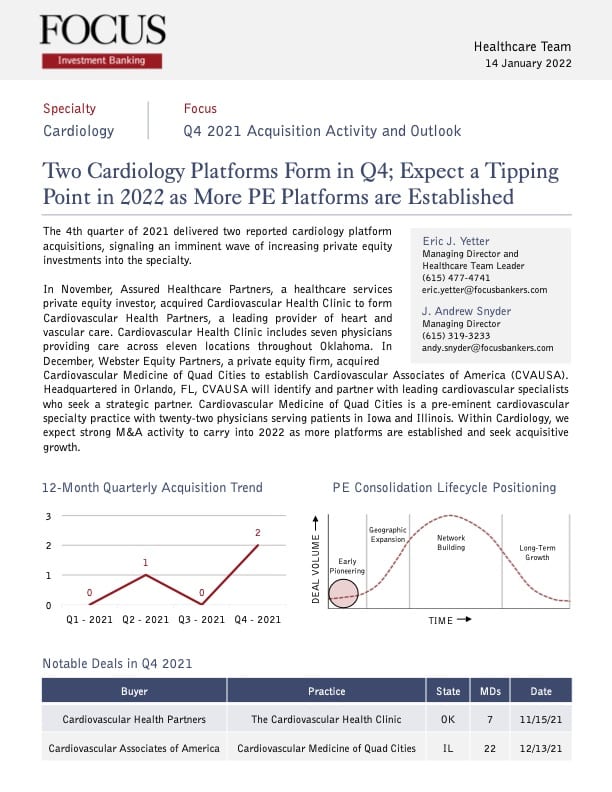

Cardiology – Q4 2021 Acquisition Activity and Outlook

White Paper: Understanding Investor Interest in Home Healthcare and Hospice

Is Now the Time to Sell Your Medical Practice?

70% of Larger Physician Groups Use an Investment Banker