Using M&A with Peers to Attract Private Equity

What is a PE Backed MSP Platform?

Valuations of Vertical Specific, as Opposed to Industry Agnostic MSPs

The Next “BIG Thing”: Private Equity May “Double Down” on MSPs

Can MSP deals stand up to higher interest rates?

Data “Signals” Provide Best MSP M&A Targets for Private Equity

Three Ways to Top the Inc. 5000 & ChannelE2E’s Top 100 MSPs

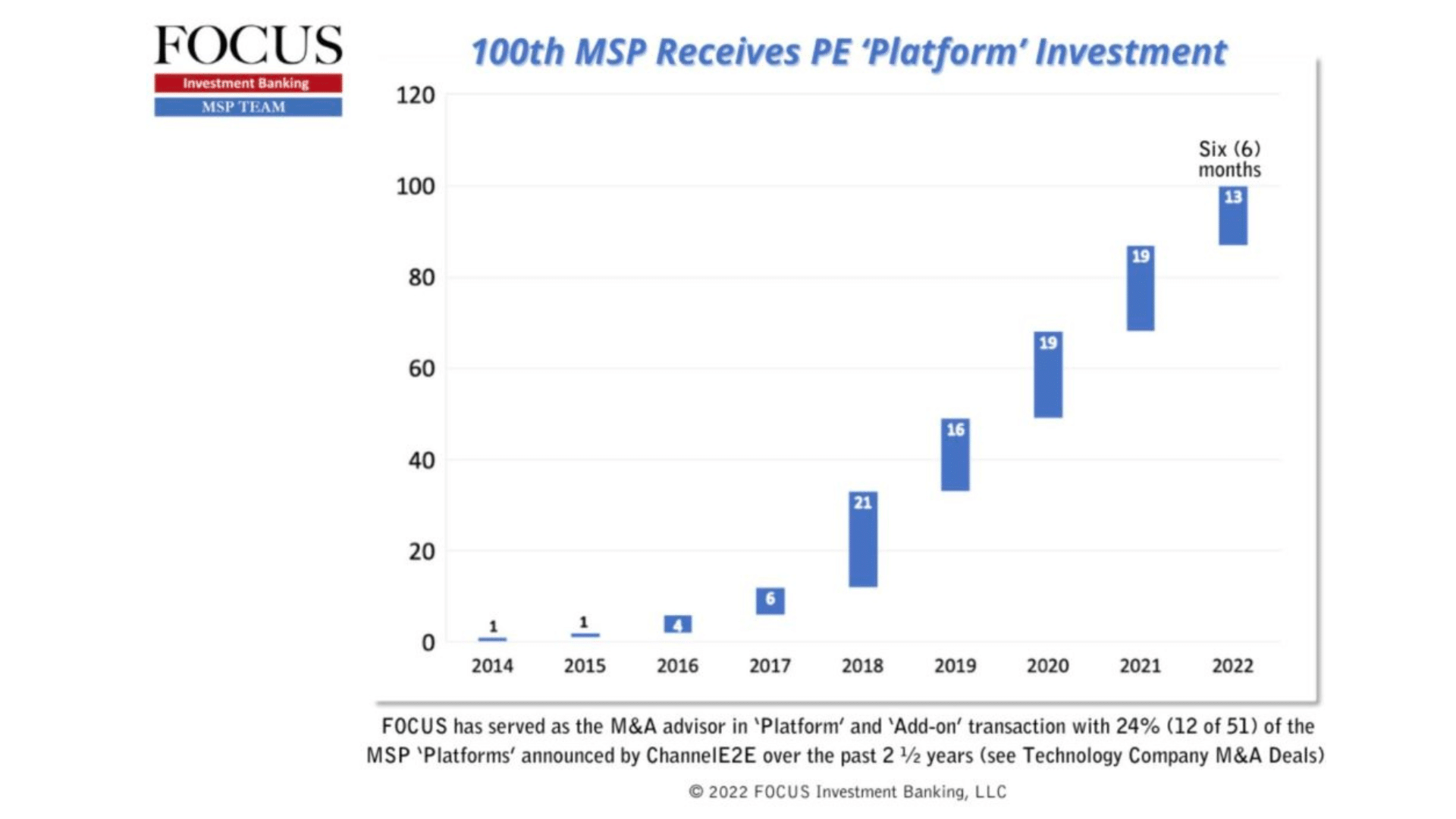

Our Top Prediction for MSP M&A: It’s a Platform Grab Right Now

Private Equity 101 for MSPs: Part 1 – New Platforms

Private Equity 101 for MSPs: Part 2 – Add-Ons

Managed Service Providers: Part 2