Explore mergers and acquisitions insights, deal trends, and expert guidance for middle market business owner.

Owners: Keep your eye on your equity!

Precision machine shop owners are experiencing high demand for their services. With the economy re-opening orders are piling up. One of the biggest problem is keeping up with that demand. However, that does not necessarily mean business is destined to continue to get more valuable as revenue grows. This article explores this topic and encourages precision machine owners to consider the big picture.

The Case for Not Selling Goodyear’s Stores

The Case for Not Selling Goodyear's Stores I ...

TBC’s Strategic Shift: Embracing Franchising for Growth

TBC's Strategic Shift: Embracing Franchising for Growth In ...

Building a Moat: Part II

In Part I of this series we talked about what ...

FOCUS Carrier-Focused Telecom Technology Quarterly: Spring 2023 Report

After posting a solid gain in our winter report, the FOCUS Carrier-Focused Telecom Technology Index (CFTTI) dropped 2.2% in our spring reporting period. This was slightly better than the 2.7% drop in the S&P 500, but worse than the 0.1% decline in the NASDAQ. The EFTTI is also down nearly 14% compared to this time last year. Over this time period, the EFTTI lagged the 9.2% decline in the S&P 500 but outperformed the 16.7% drop in the NASDAQ. Sector multiples are also lower than they were at this time last year. The sub sector revenue multiple dropped sharply from 2.5x to 2.1x, while the sector EBITDA multiple posted a more modest decline as it fell from 11.9x to 10.6x.

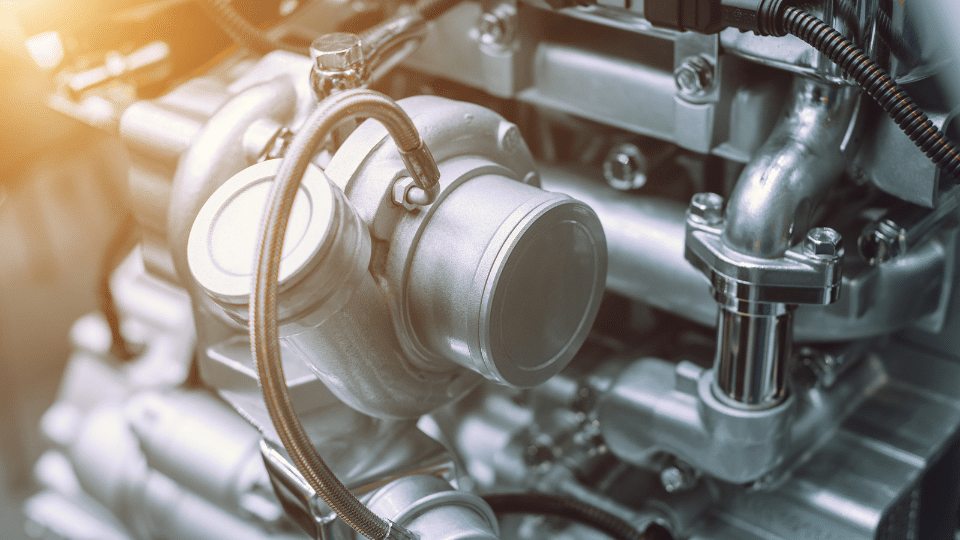

The internal combustion engine still has lots left in the tank

Internal combustion engines (ICEs) have been around for more than 100 years, and despite a surge of competition from electric vehicles (EVs), they are still highly relevant and will likely remain so for a long time to come.

Search Funds and the ‘Silver Tsunami’ in Collision Repair

It’s no secret that the collision repair business—much like most other trade industries—is aging.

FOCUS Enterprise-Focused Telecom Technology Quarterly: Winter 2023 Report

The FOCUS Enterprise-Focused Telecom Technology Index (EFTTI) experienced another disappointing reporting period with a three-month drop of 2.4%. This loss was in stark contrast to the broader indices as the S&P 500 and NASDAQ were up 5.3% and 5.4%, respectively. The EFTTI is also trading 19.0% below the levels of a year ago. This significantly underperformed the 9.7% loss in the S&P 500 but was roughly in line with the 18.7% decline in the NASDAQ. Sector multiples closed out the period at 4.6x revenue and 19.5x EBITDA. Both of these are lower than the corresponding multiples of a year ago of 6.1x revenue and 23.4x EBITDA.

Is your business services firm ready for tougher times?

As the Federal Reserve continues to tighten monetary policy to try to control inflation, two things could happen.

2023 Business Services M&A Outlook – Cautiously Optimistic

The market for small-to-medium company mergers and acquisitions may be down in 2023, but it’s definitely not out.