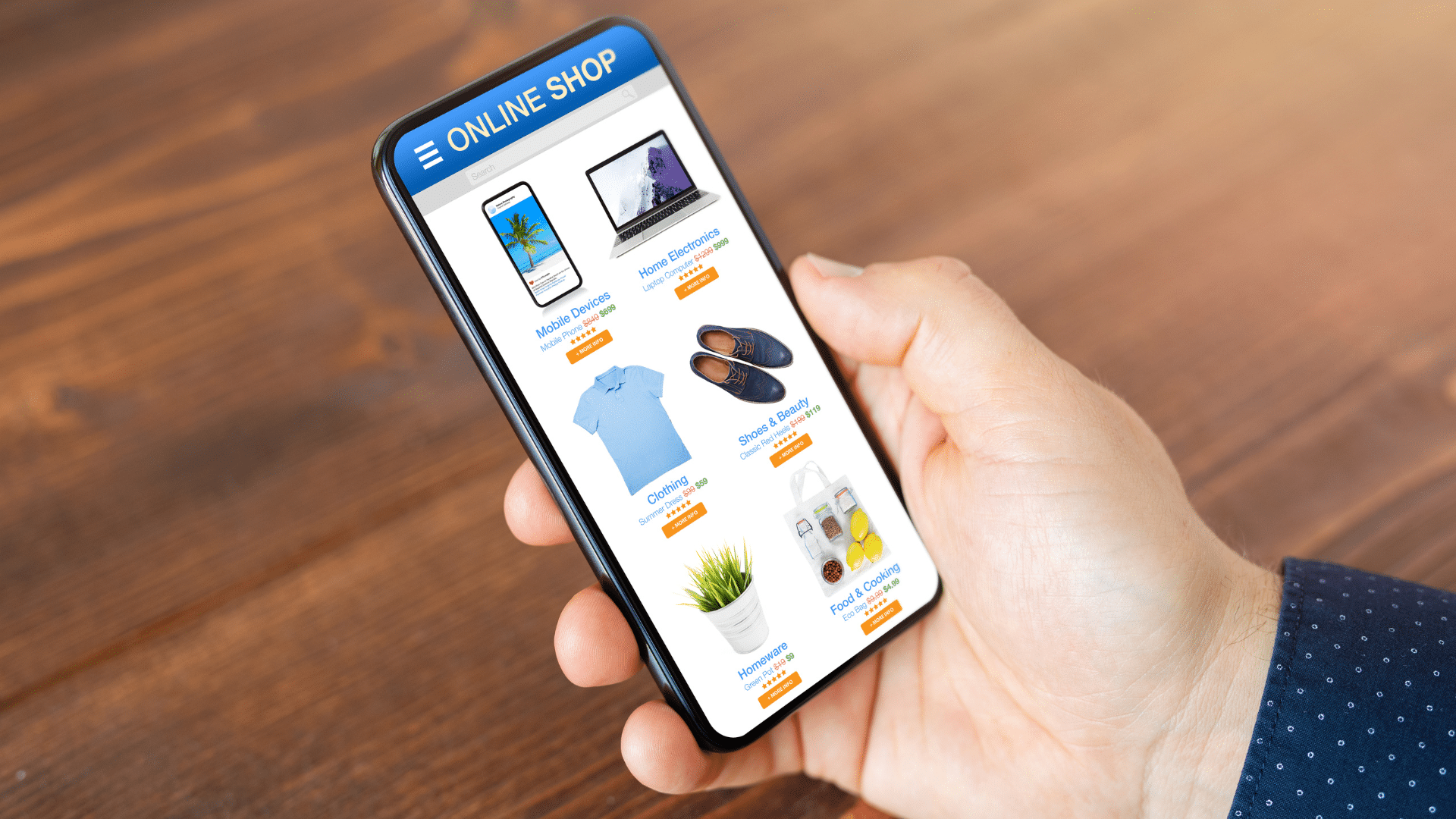

Future proofing your e-commerce business

It’s understandable that most if not all companies were not prepared for the Covid pandemic and resulting economic shutdown—after all, such an event had never happened before. But there’s no excuse for not being prepared for the next debacle—even if it never occurs.