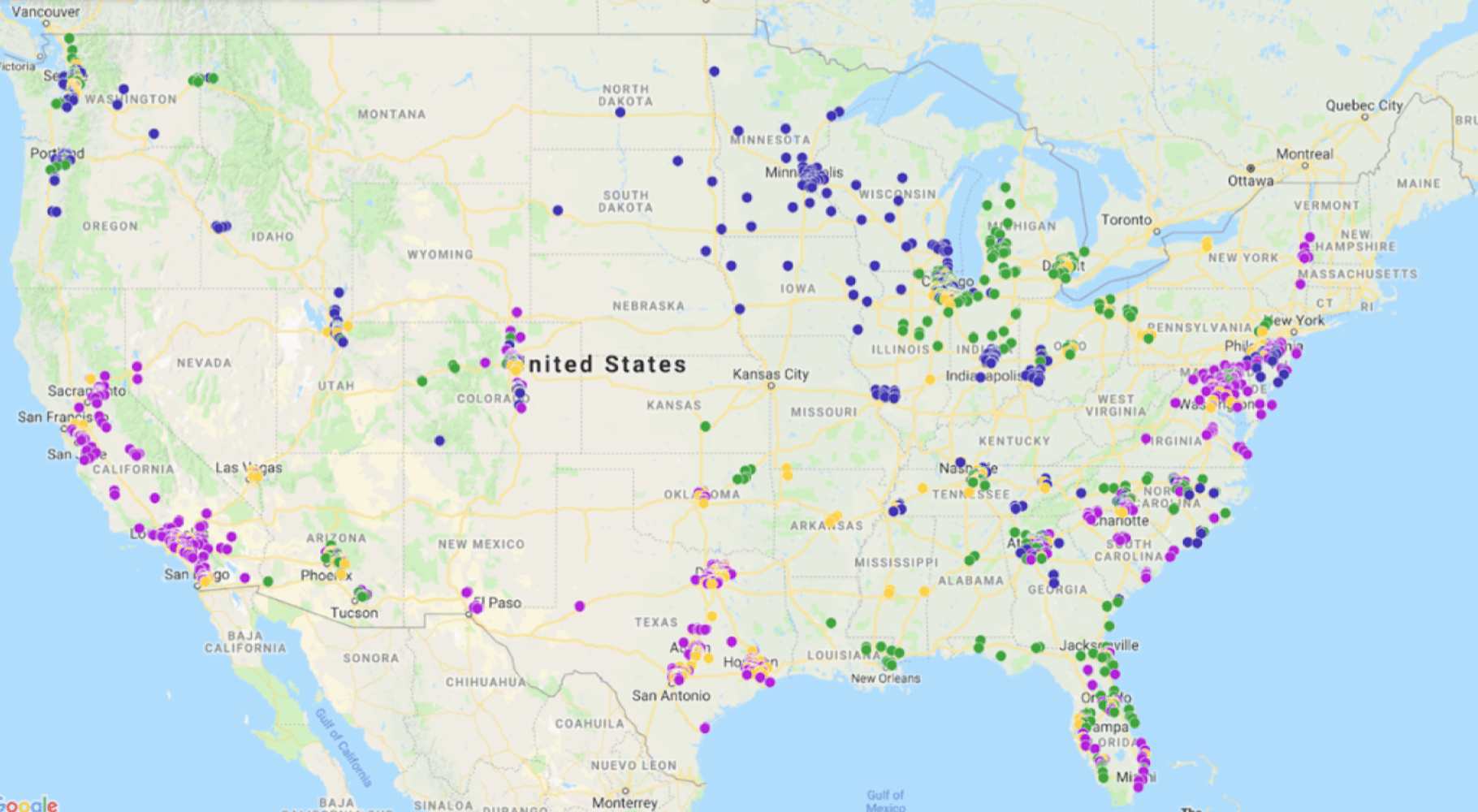

Maps of the Regional and Super Regional MSOs

The FOCUS Automotive and FenderBender article “Rise of the Regional and Super Regional MSOs” published in FenderBender Magazine in Sept 2018 examines the growth strategies of 15 market leading MSOs in the US, interviewing 3 of its top operators.