Buyer Spotlight: BlueSprig Pediatrics

Founded in 2017 and based in Houston, BlueSprig Pediatrics is already one of the largest and fastest- growing ABA (Applied Behavior Analysis) therapy providers in the country. It is the largest autism services provider in Texas and the Southeast, with over 40 centers in Texas, and now has centers in 18 states, from Illinois and Massachusetts to Oregon and Washington. BlueSprig’s mission is to “change the world for children with autism” and it is “committed to providing compassionate, individualized, and evidence-based behavior analysis treatment.”

The Perfect Storm Roiling the Behavioral Health Industry

COVID-19 affected behavioral health in a substantial way which is creating a path for M&A opportunities.

Buyer Spotlight: EyeSouth Partners

EyeSouth is One of the Most Active Ophthalmology Practice Management Companies with 23 Acquisitions Since 2017

We profile investors to provide our clients with an important understanding of the types of private equity firms, independent investors, and family offices active in the healthcare verticals we work in every day. Although it is not feasible to create case studies for every investor, we profile those that represent the most active practices common in today’s acquisition market.White Paper: The Physician’s Guide to Private Equity Transactions – June 2021

Designed to help physician owners considering a sale to private equity, this paper examines the key questions common to our initial client conversations. The learnings apply to all practice verticals from ophthalmology .. to gastroenterology .. to dermatology. Topics include: The Best Time to Sell, Determining the Best Buyer, The Private Equity Investment Model, Calculating Adjusted EBITDA for Medical Practices, Practice Valuation and Multiples, How to Get Associate Physicians to Buy-in.

FOCUS Investment Banking Represents Microconsult Inc. in Sale to Certified Laboratories

Washington, DC, (June 4, 2021) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, announced today that Microconsult, Inc., a Carrollton, Texas-based industry leader in cosmetic, supplement and personal care product testing, has been acquired by Certified Laboratories, a Melville, New York-based operator of food, supplements, cosmetic, and personal care laboratories. FOCUS represented Microconsult in this transaction.

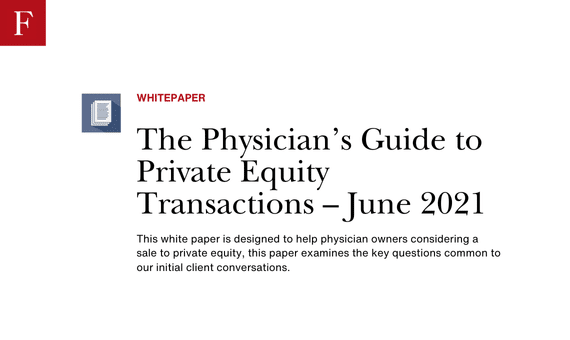

Private Equity’s Medical Practice Consolidation Curve. Where Different Specialties Lie.

We think about private equity-backed consolidations as part of a lifecycle. Like most business cycles, it starts out with pioneering that accelerates through further adoption.

FOCUS Investment Banking Announces Merger of Physicians First to Enhance and Expand Healthcare Practice

Washington, DC, (May 10, 2021) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture and corporate finance services, announced today that Physicians First, a Nashville, Tennessee-based boutique investment banking firm focused on healthcare, has merged its practice into FOCUS. Physicians First founders Eric Yetter and Andy Snyder are joining FOCUS as Managing Directors. Yetter will lead the FOCUS Healthcare Team.

History of Private Equity Investors in Dermatology

There are now thirty private equity firms with investments in dermatology practices and surgery centers.