ENT & Allergy Report – Q1 2021 Acquisition Activity and Outlook

Private Equity Interest in ENT & Allergy Practices Accelerates. Expect Increasing Opportunity for Large Practice Sellers.

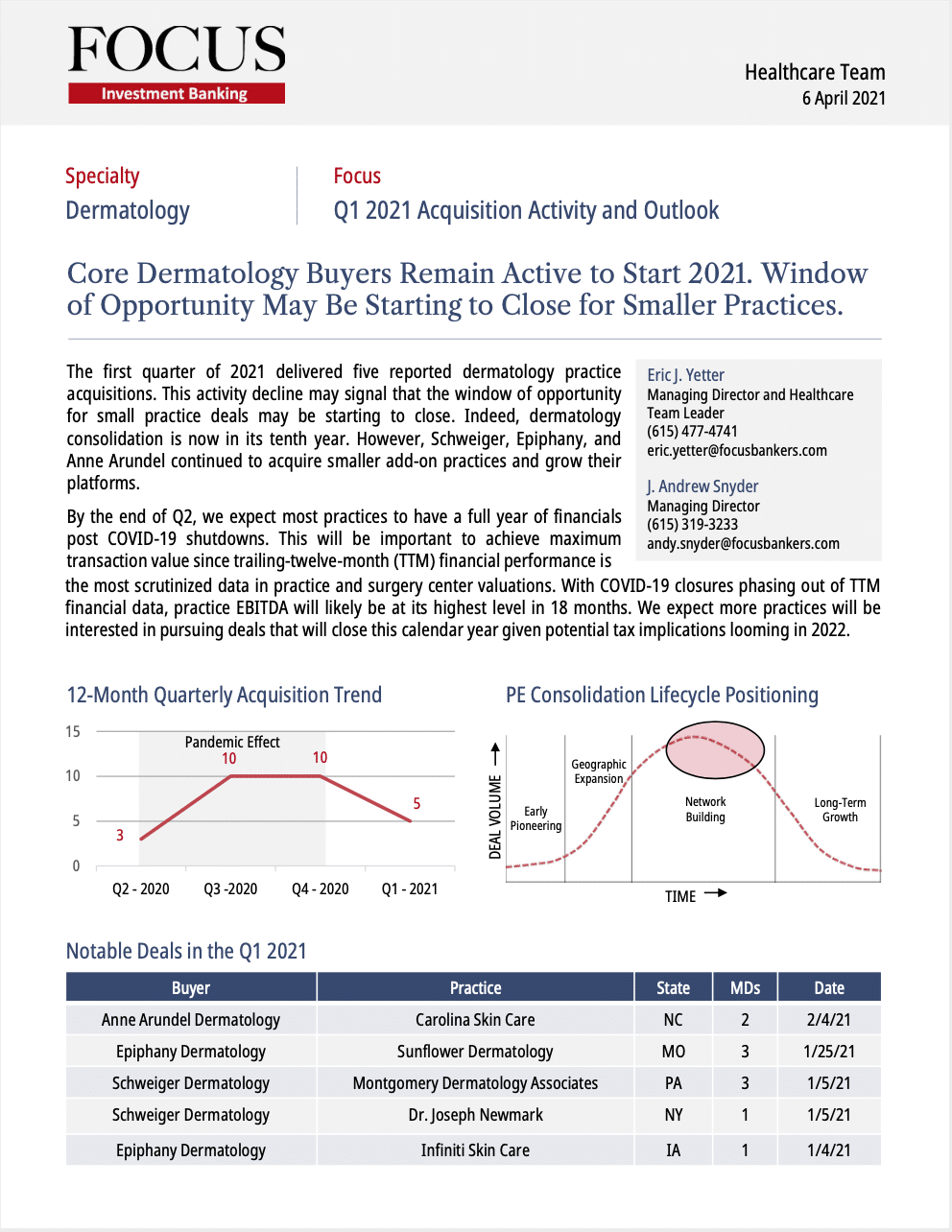

The first quarter of 2021 delivered five reported ENT practice acquisitions marking the most active three-month M&A period we have seen in the specialty. Notably, Audax Private Equity formally named its portfolio company “Elevate ENT” and expanded into Texas with the major acquisition of Texas ENT Specialists. While the next quarter may not produce as many deals, activity should remain high throughout this year.Gastroenterology Report – Q1 2021 Acquisition Activity and Outlook

As Predicted, Gastroenterology Acquisition Activity Surges to New High in Q1 2021 – Major Opportunity for Selling Physicians

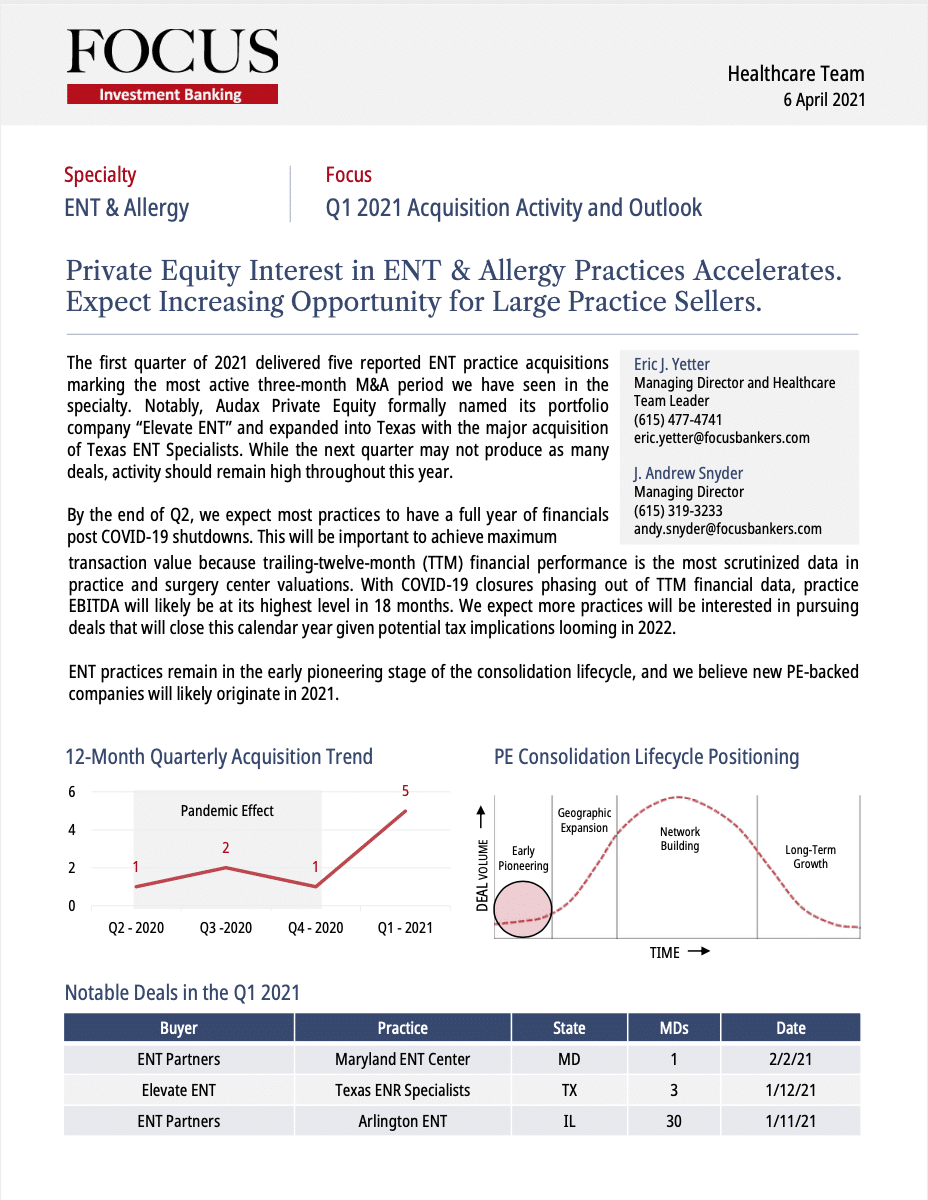

The first quarter of 2021 delivered nineteen gastroenterology practice acquisitions, marking an enormous surge of M&A activity within the specialty. To put that into context, the past three months had more acquisitions than the entire year of 2020. We expect that higher level of activity to continue as GI moves through the expansion lifecycle stage.Home Health and Hospice Report – Q1 2021 Acquisition Activity and Outlook

Transaction Volume Continues to Increase Across Home Health & Hospice. Heaviest Activity in the West and Southwest.

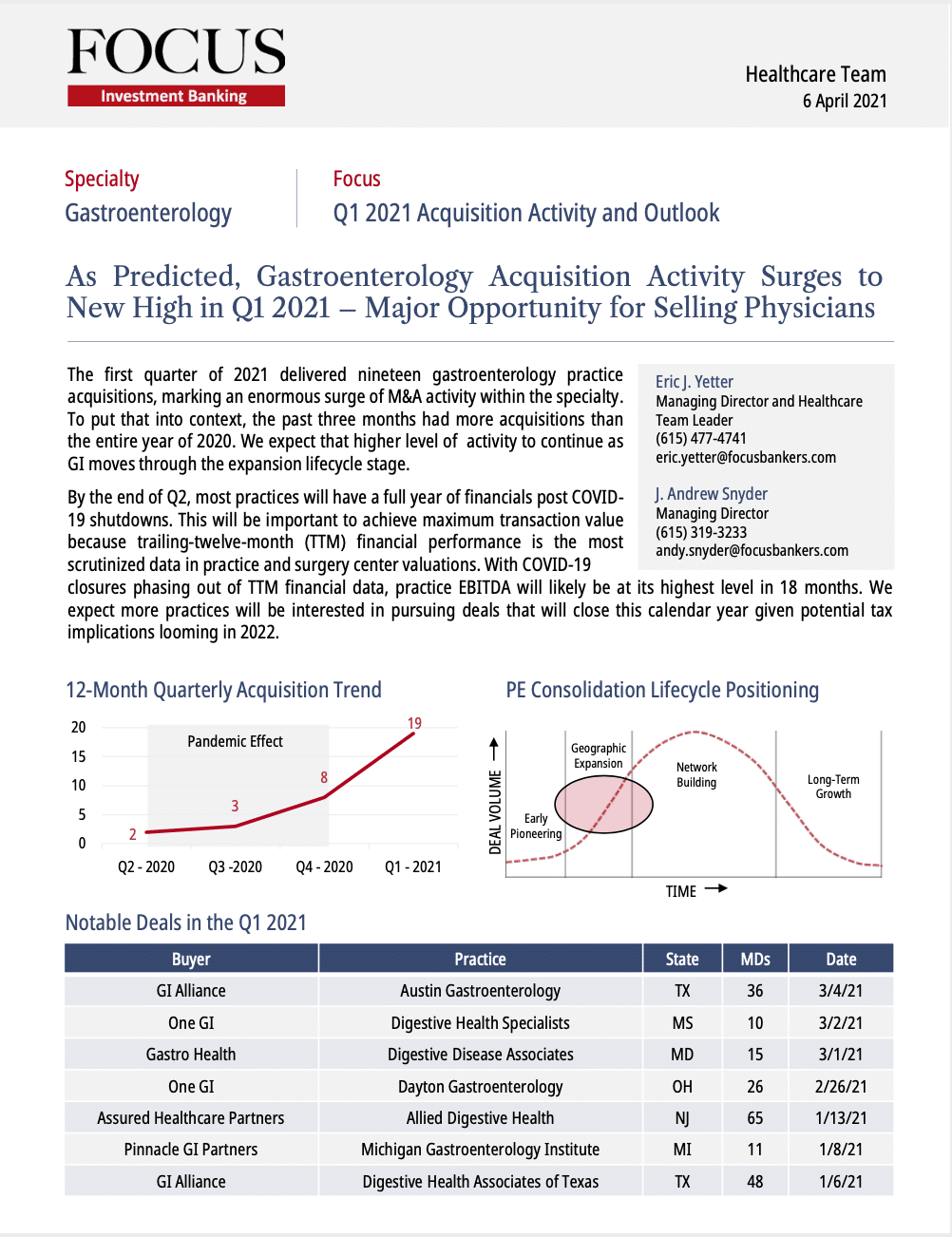

The first quarter of 2021 delivered 35 reported home health and hospice transactions. We expect some of this activity reflects deals that were delayed due to COVID-19, however the pandemic generally increased attention on the sector. We expect high deal flow throughout 2021, supported by strong private equity interest, a favorable government, and a seller pool that is ready to transact. Transactions in the West and Southwest dominated the landscape.Ophthalmology Report – Q1 2021 Acquisition Activity and Outlook

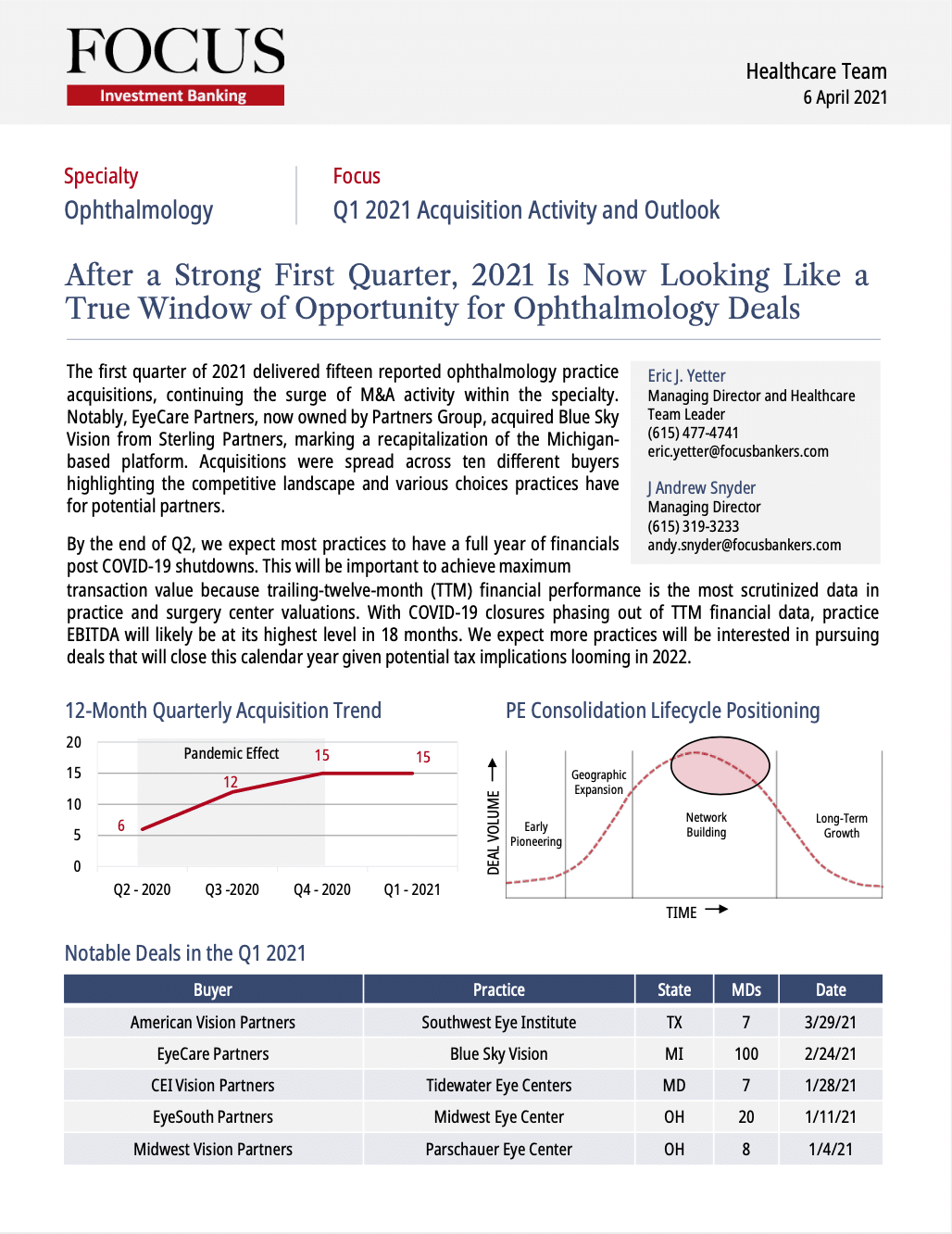

After a Strong First Quarter, 2021 Is Now Looking Like a True Window of Opportunity for Ophthalmology Deals

The first quarter of 2021 delivered fifteen reported ophthalmology practice acquisitions, continuing the surge of M&A activity within the specialty. Notably, EyeCare Partners, now owned by Partners Group, acquired Blue Sky Vision from Sterling Partners, marking a recapitalization of the Michigan-based platform. Acquisitions were spread across ten different buyers highlighting the competitive landscape and various choices practices have for potential partners.Orthopedics Report – Q1 2021 Acquisition Activity and Outlook

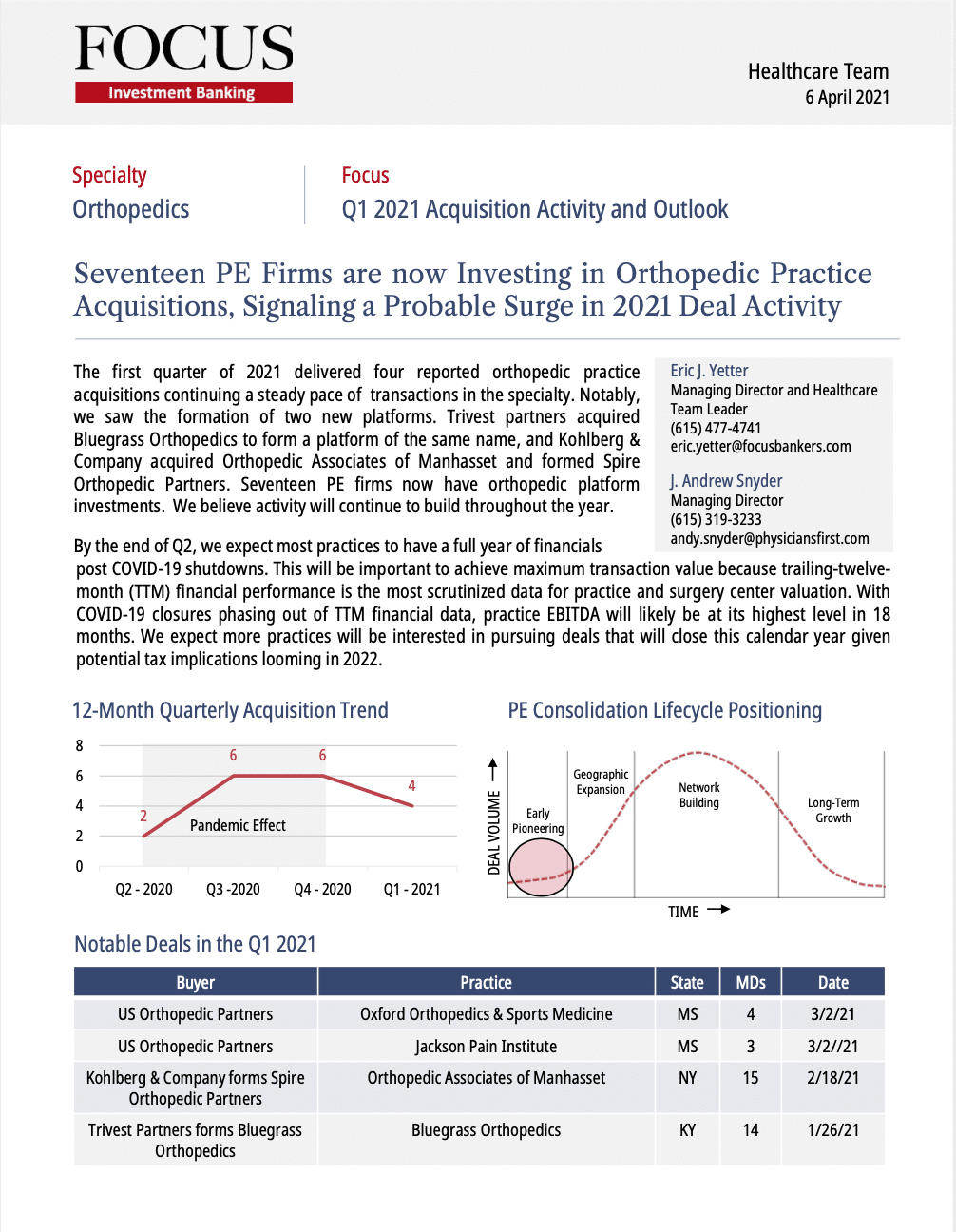

Seventeen PE Firms are now Investing in Orthopedic Practice Acquisitions, Signaling a Probable Surge in 2021 Deal Activity

The first quarter of 2021 delivered four reported orthopedic practice acquisitions continuing a steady pace of transactions in the specialty. Notably, we saw the formation of two new platforms. Trivest partners acquired Bluegrass Orthopedics to form a platform of the same name, and Kohlberg & Company acquired Orthopedic Associates of Manhasset and formed Spire Orthopedic Partners. Seventeen PE firms now have orthopedic platform investments. We believe activity will continue to build throughout the year.Urology Report – Q1 2021 Acquisition Activity and Outlook

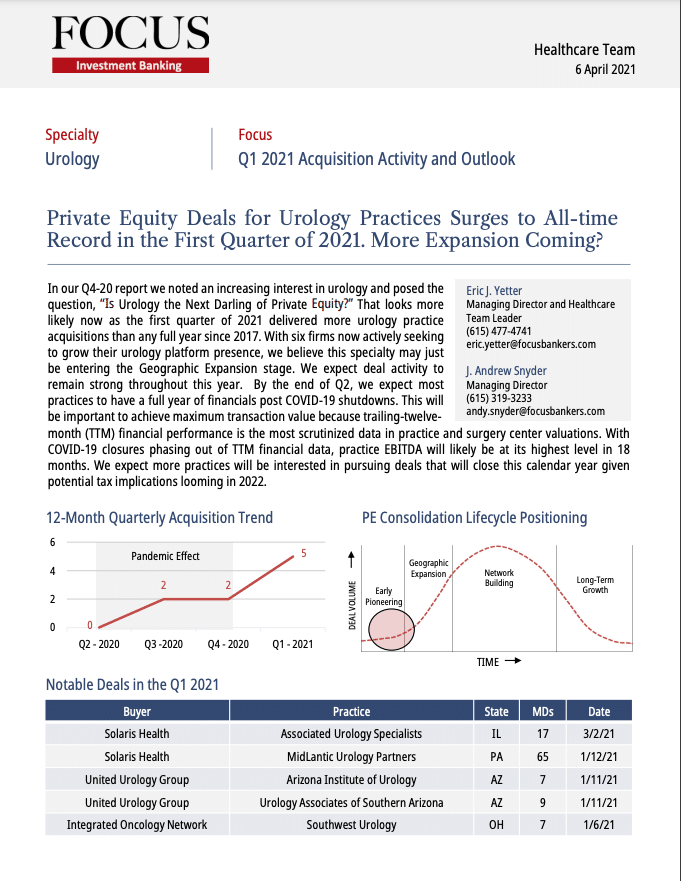

Private Equity Deals for Urology Practices Surges to All-time Record in the First Quarter of 2021. More Expansion Coming?

In our Q4-20 report we noted an increasing interest in urology and posed the question, “Is Urology the Next Darling of Private Equity?” That looks more likely now as the first quarter of 2021 delivered more urology practice acquisitions than any full year since 2017. With six firms now actively seeking to grow their urology platform presence, we believe this specialty may just be entering the Geographic Expansion stage.Women’s Health Report – Q1 2021 Acquisition Activity and Outlook

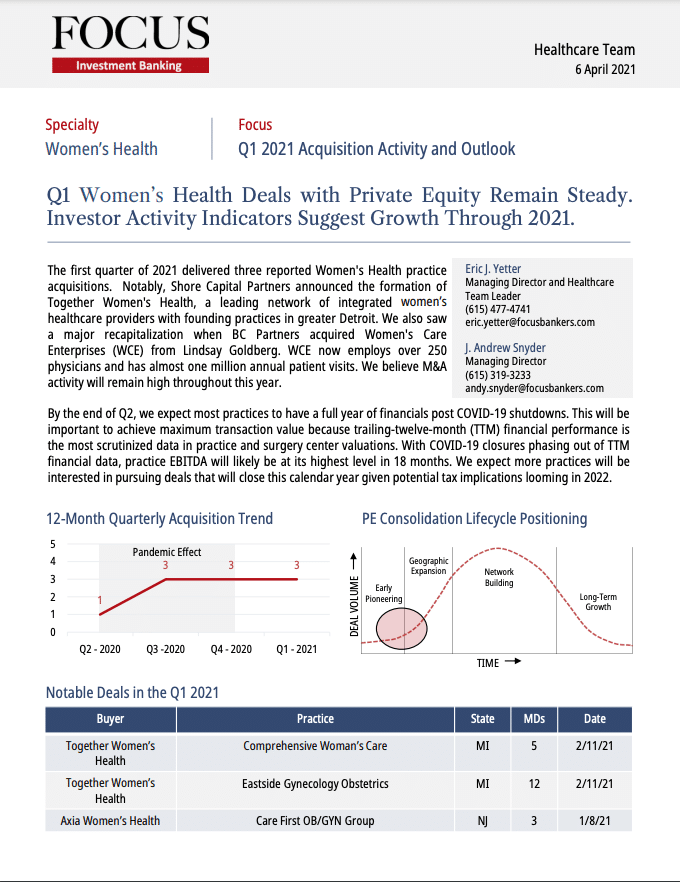

Q1 Women’s Health Deals with Private Equity Remain Steady. Investor Activity Indicators Suggest Growth Through 2021.

The first quarter of 2021 delivered three reported Women's Health practice acquisitions. Notably, Shore Capital Partners announced the formation of Together Women's Health, a leading network of integrated women’s healthcare providers with founding practices in greater Detroit.FOCUS Healthcare Team was one of the Most Active Investment Banking Groups – 2020 Ophthalmology Deals

Our research on ophthalmology transactions in 2020 showed that roughly half of seller groups were represented by an investment banker or M&A advisor.

70% of Larger Physician Groups Use an Investment Banker

An investment banker specialized in medical practice deals can greatly improve the process and outcome of a sale.