The Attraction Continues

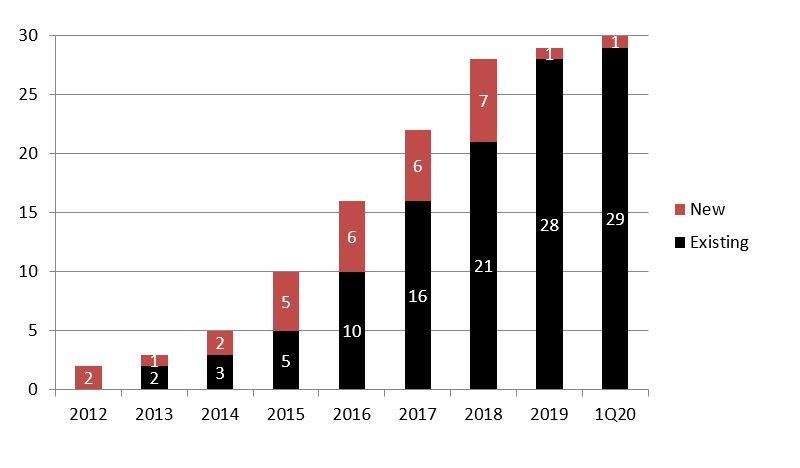

There are now thirty private equity firms with investments in dermatology practices and surgery centers. The number of private equity firms actively investing in dermatology practices increased dramatically from five to twenty-eight during the four-year period from 2015-2018. Then, after three quarters of no new entries, two new firms entered … one in the third quarter of 2019 and another in the first quarter of 2020.

These new entries are an indication that investors continue to see opportunity in dermatology practices and surgery centers.

PE Firms Investing in Dermatology 2012 – 1Q20

Making Sense of all the Names

Making Sense of all the Names

Private equity firms usually create a subsidiary Practice Management Company within their portfolios to acquire and manage dermatology practices and ambulatory surgery centers. Most transactions include some equity ownership in that parent management company.

The combination of the private equity firm names and their practice management company names can be confusing and is simplified below.

Eric Yetter

Eric Yetter

FOCUS Managing Director and Healthcare Team Leader

Direct: 615-477-4741

Making Sense of all the Names

Making Sense of all the Names