Urology – Q3 2021 Acquisition Activity and Outlook

Urology Practice Acquisitions Fall to a Six Month Low. Is a Q4 Rebound In Process?

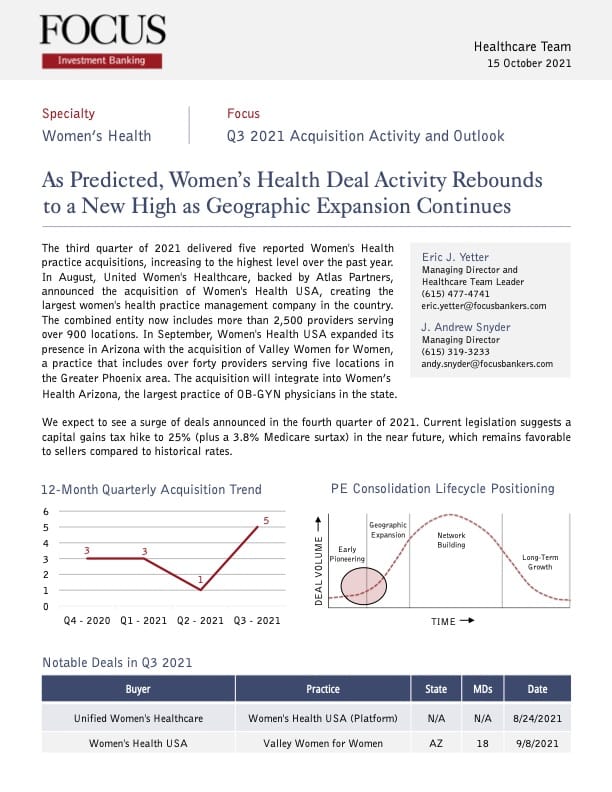

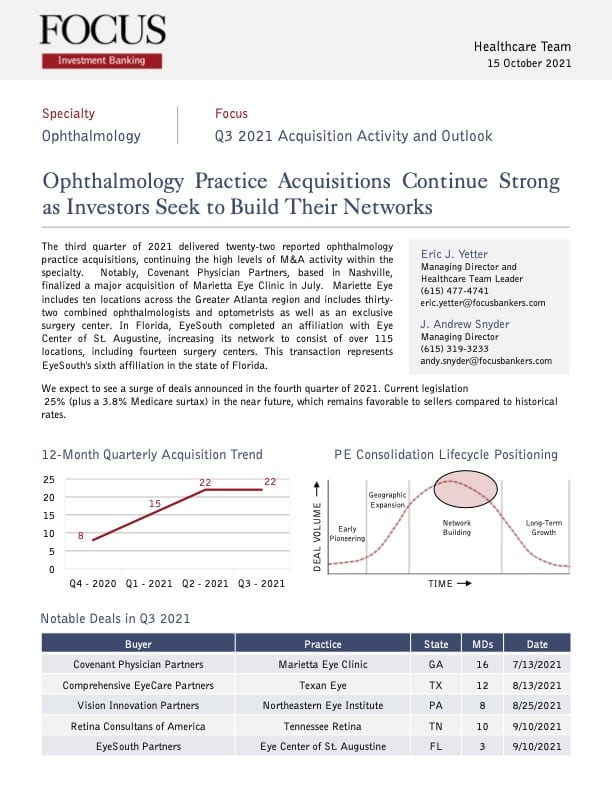

The third quarter of 2021 did not have any major reported urology practice acquisitions, coming down from the peak activity in Q1. The latest deal closed in May, when Genesis Healthcare Partners inked a platform partnership with Triton Pacific Capital Partners to form Urology Partners of America (UPA).Orthopedics – Q3 2021 Acquisition Activity and Outlook

Orthopedic Practice Acquisitions Surge in the Third Quarter Indicating a Potential Tipping Point

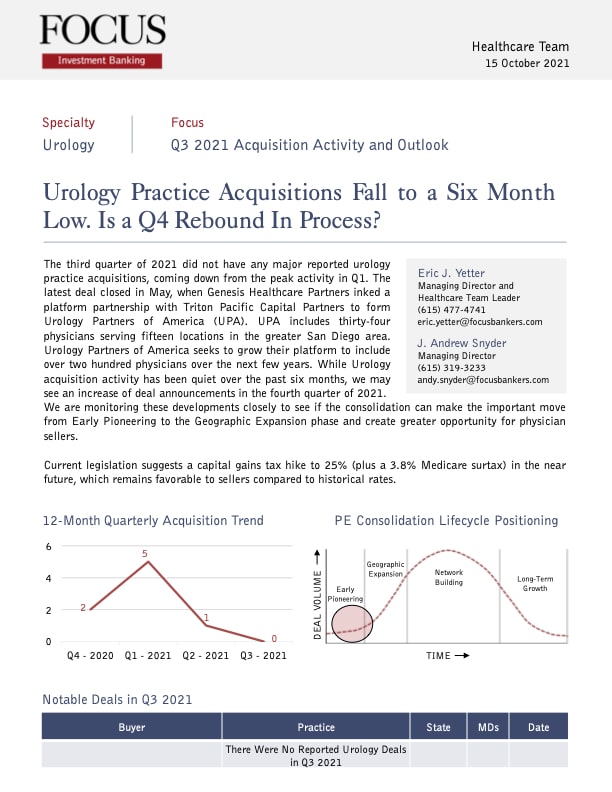

The third quarter of 2021 delivered seven reported orthopedic practice acquisitions, increasing to a new quarterly high for the year. This could be an indication the consolidation is transitioning from Early Pioneering to Geographic Expansion representing an increased opportunity for selling physician owners.Ophthalmology – Q3 2021 Acquisition Activity and Outlook

Ophthalmology Practice Acquisitions Continue Strong as Investors Seek to Build Their Networks

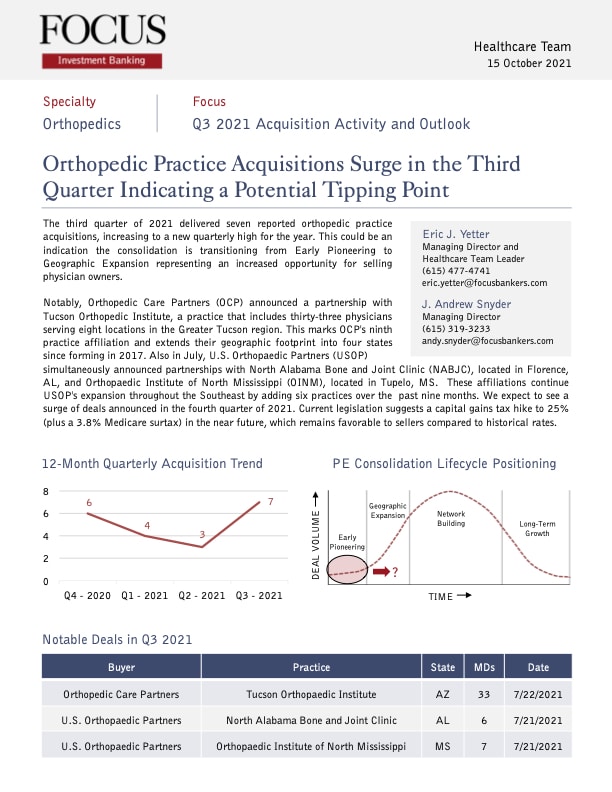

The third quarter of 2021 delivered twenty-two reported ophthalmology practice acquisitions, continuing the high levels of M&A activity within the specialty. Notably, Covenant Physician Partners, based in Nashville, finalized a major acquisition of Marietta Eye Clinic in July.Home Health & Hospice – Q3 2021 Acquisition Activity and Outlook

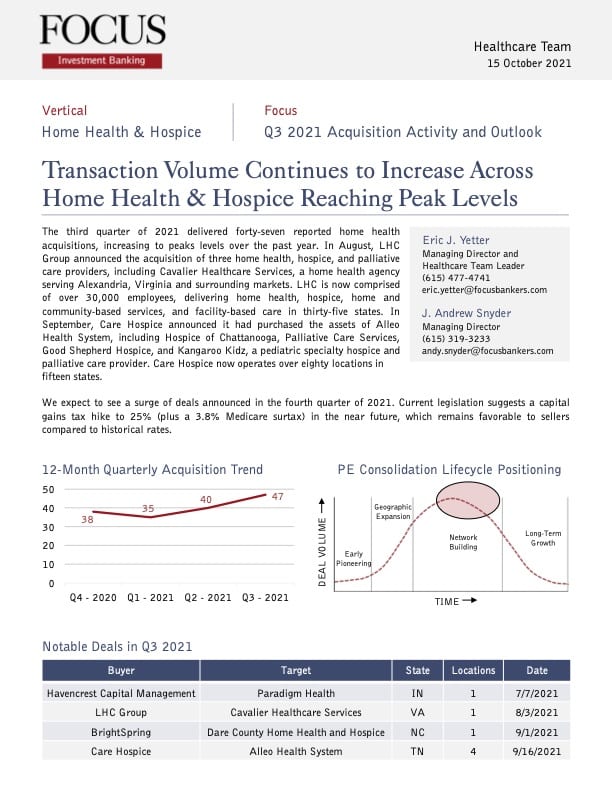

Transaction Volume Continues to Increase Across Home Health & Hospice Reaching Peak Levels

The third quarter of 2021 delivered forty-seven reported home health acquisitions, increasing to peaks levels over the past year. In August, LHC Group announced the acquisition of three home health, hospice, and palliative care providers, including Cavalier Healthcare Services, a home health agency serving Alexandria, Virginia and surrounding markets.Gastroenterology – Q3 2021 Acquisition Activity and Outlook

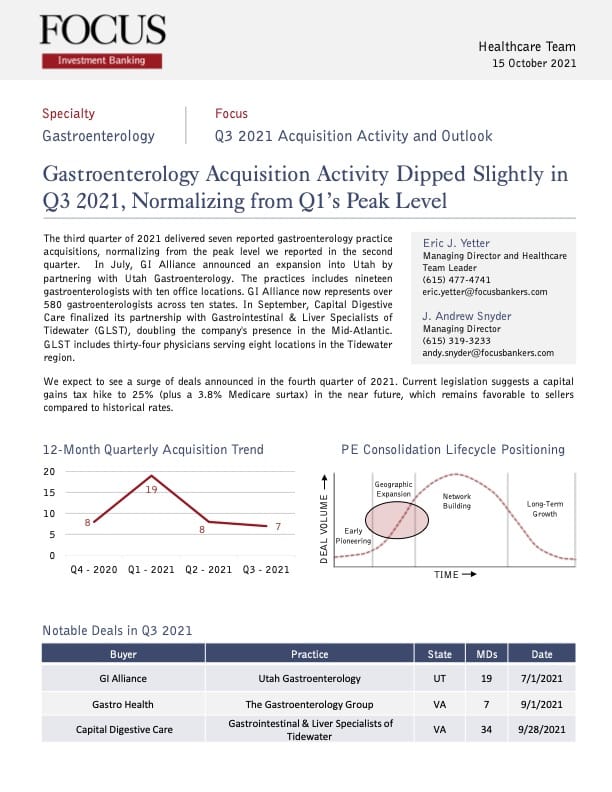

Gastroenterology Acquisition Activity Dipped Slightly in Q3 2021, Normalizing from Q1’s Peak Level

The third quarter of 2021 delivered seven reported gastroenterology practice acquisitions, normalizing from the peak level we reported in the second quarter. In July, GI Alliance announced an expansion into Utah by partnering with Utah Gastroenterology.ENT & Allergy – Q3 2021 Acquisition Activity and Outlook

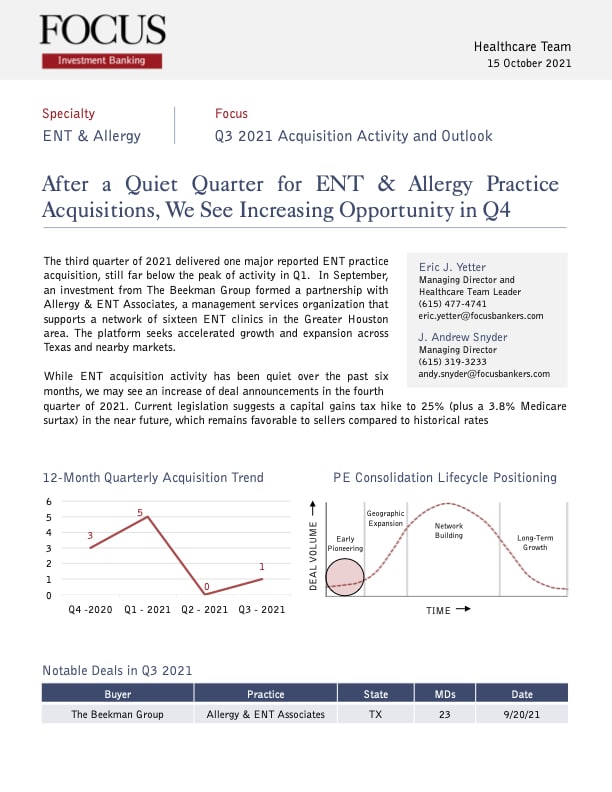

After a Quiet Quarter for ENT & Allergy Practice Acquisitions, We See Increasing Opportunity in Q4

The third quarter of 2021 delivered one major reported ENT practice acquisition, still far below the peak of activity in Q1. In September, an investment from The Beekman Group formed a partnership with Allergy & ENT Associates, a management services organization that supports a network of sixteen ENT clinics in the Greater Houston area.Dermatology – Q3 2021 Acquisition Activity and Outlook

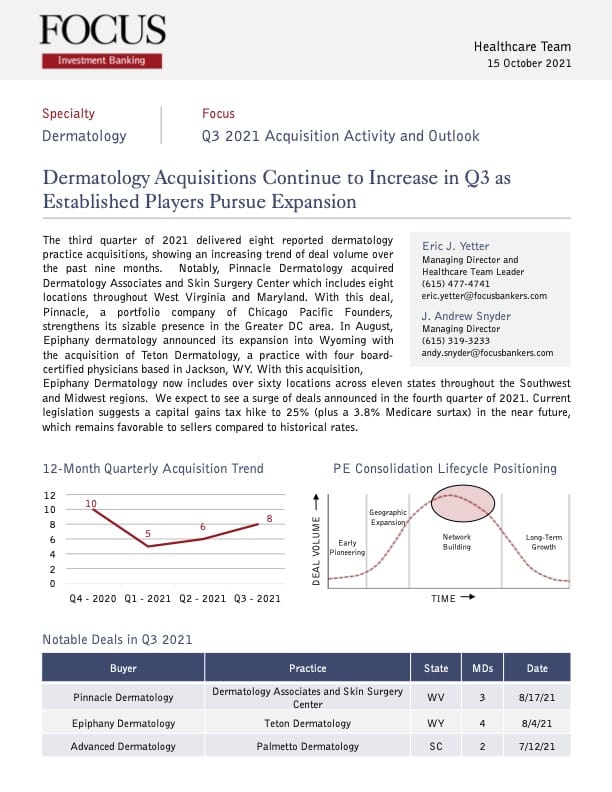

Dermatology Acquisitions Continue to Increase in Q3 as Established Players Pursue Expansion

The third quarter of 2021 delivered eight reported dermatology practice acquisitions, showing an increasing trend of deal volume over the past nine months. Notably, Pinnacle Dermatology acquired Dermatology Associates and Skin Surgery Center which includes eight locations throughout West Virginia and Maryland.Behavioral Health Report – Q3 2021 Acquisition Activity and Outlook

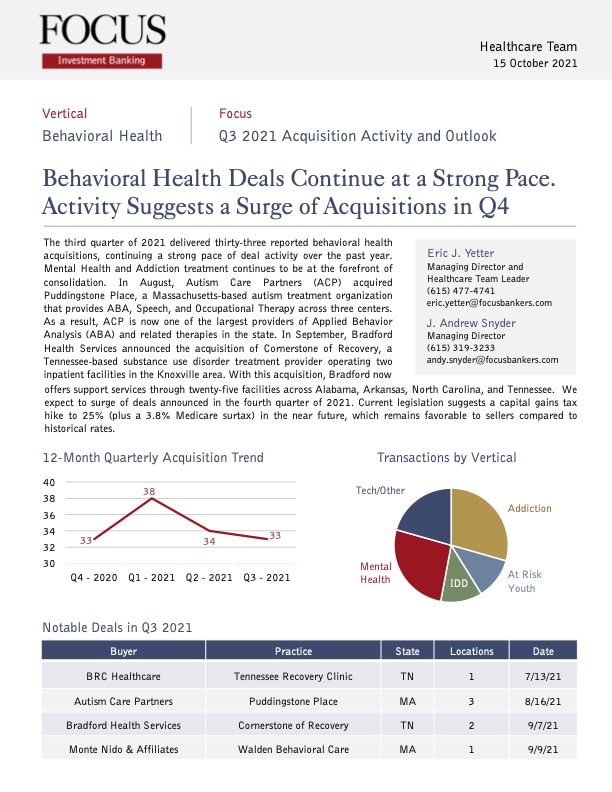

Behavioral Health Deals Continue at a Strong Pace. Activity Suggests a Surge of Acquisitions in Q4.

The third quarter of 2021 delivered thirty-three reported behavioral health acquisitions, continuing a strong pace of deal activity over the past year. Mental Health and Addiction treatment continues to be at the forefront of consolidation.White Paper: Understanding Investor Interest in Home Healthcare and Hospice

A must read for Home Healthcare and Hospice Agency Owners. We examine the key factors that have come together like a perfect storm to create the major industry consolidation currently underway. A unique window of opportunity now exists where eager buyers and motivated sellers can complete win/win deals. Private equity firms and strategic investors are interested in acquiring agencies to expand their home healthcare and hospice businesses at the same time sellers are dealing with the operational challenges created by the recent shift to the Patient Driven Grouping Model. This has led to a record level of deal activity during the first eight months of 2021.