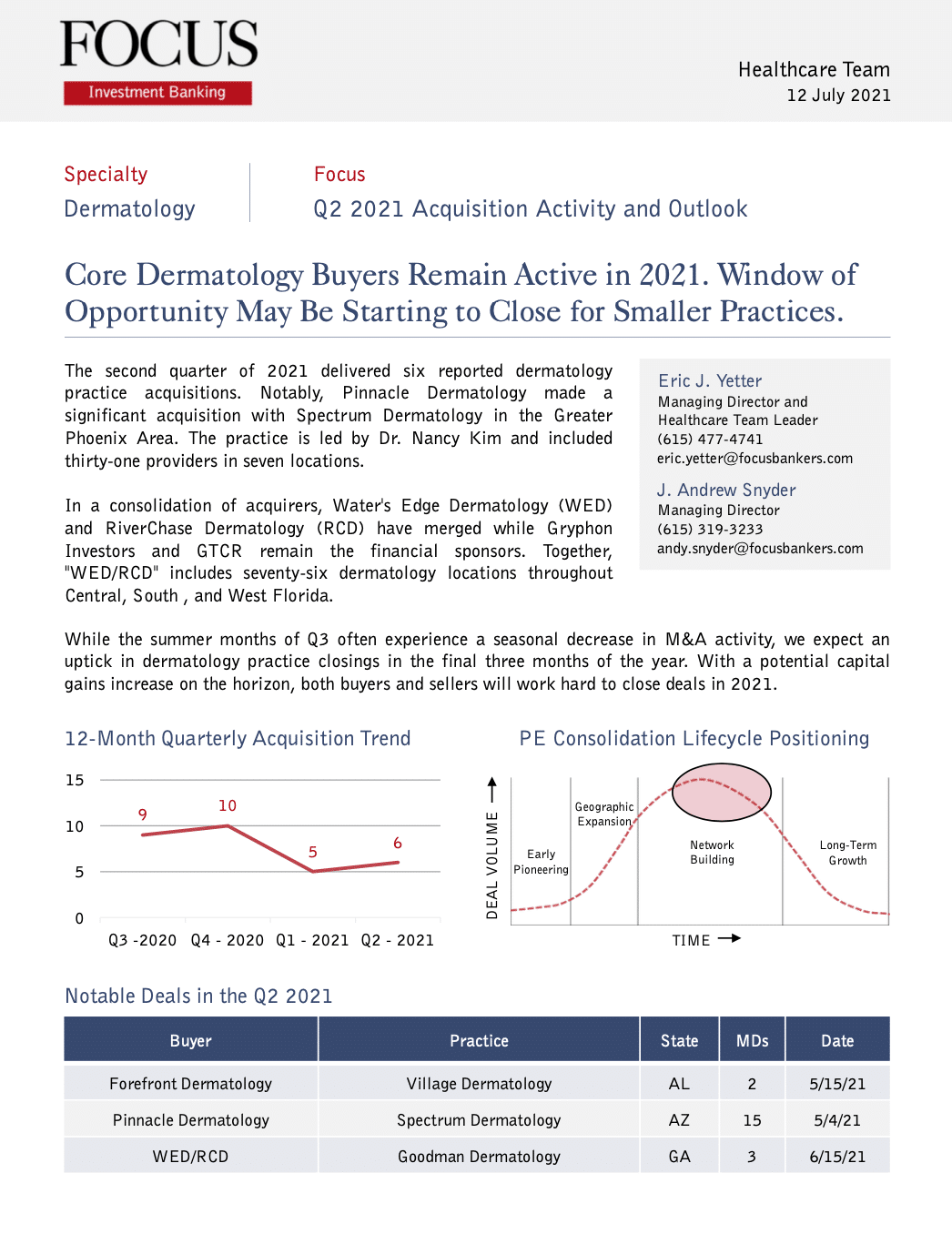

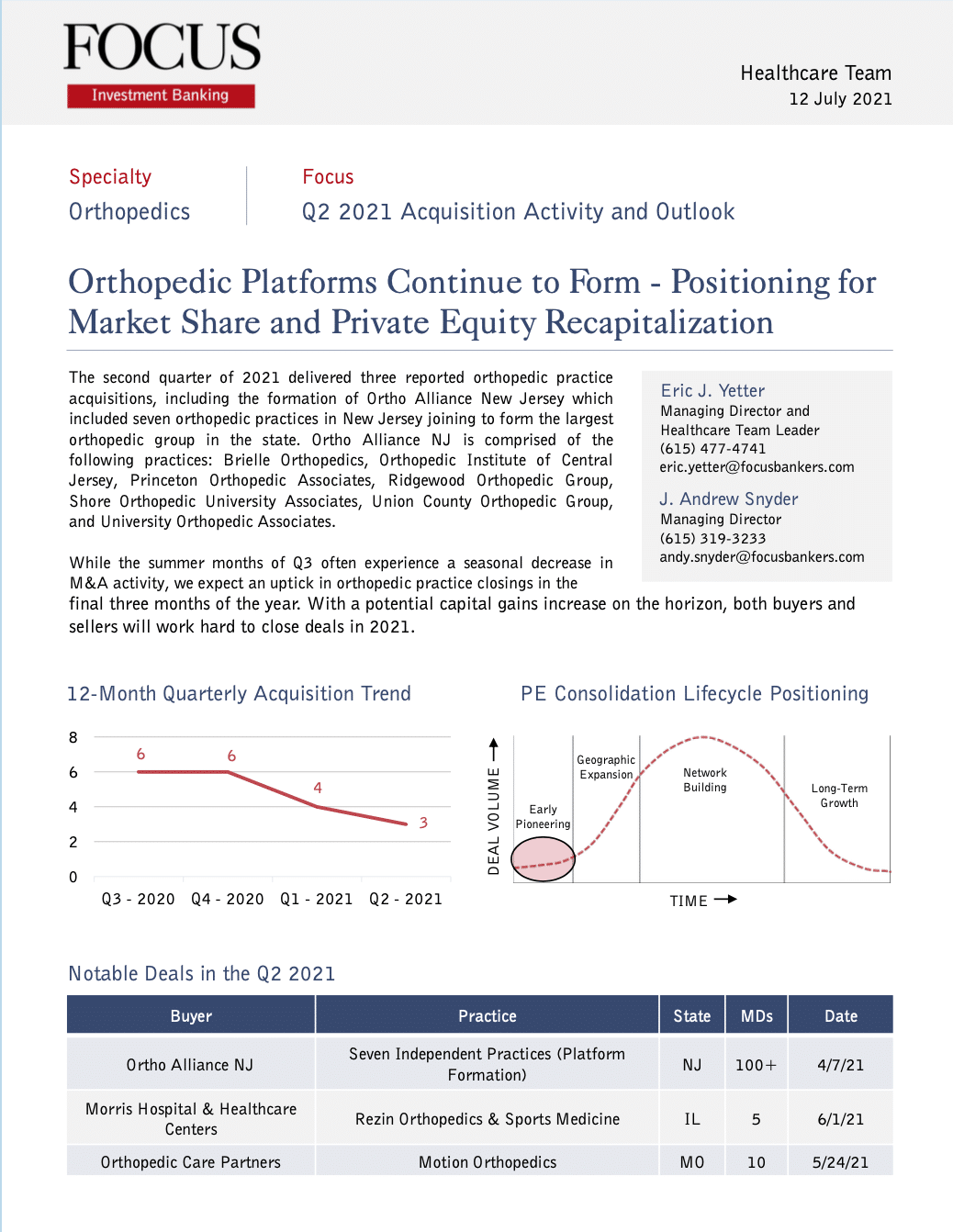

Behavioral Health Report – Q2 2021 Acquisition Activity and Outlook

Transaction Volume Remains High Throughout Behavioral Health

The second quarter of 2021 delivered thirty-four reported behavioral health transactions, continuing a strong consolidation surge within the industry. We generally expect high deal flow throughout 2021, supported by increasing private equity interest, a favorable government, and a seller pool that is ready to transact.Women’s Health Report – Q2 2021 Acquisition Activity and Outlook

Women’s Health Deals Dip in Q2. Expect Resurgence by End of Year

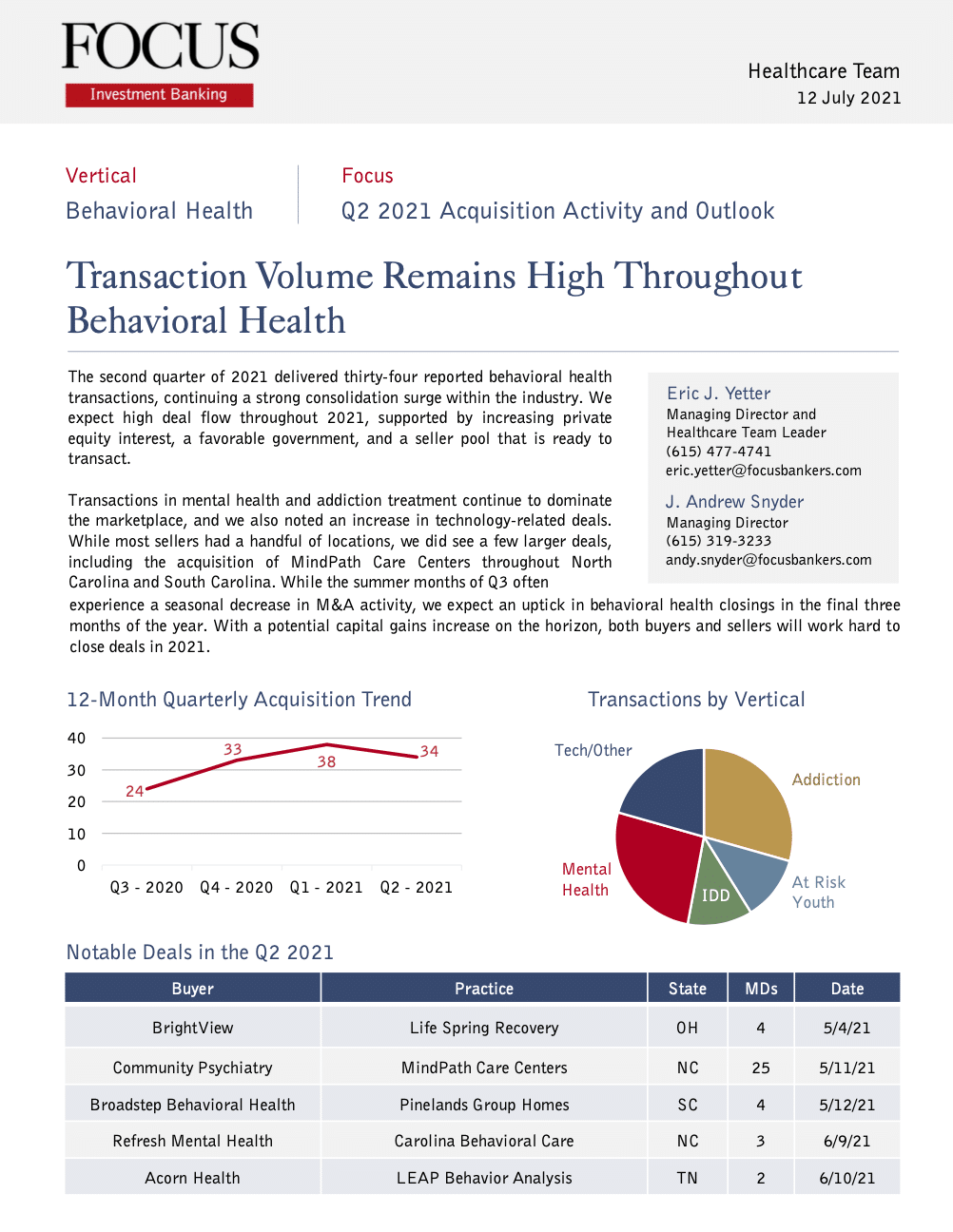

Partners Group recaps Axia. The second quarter of 2021 delivered one reported Women's Health practice acquisition.Urology Report – Q2 2021 Acquisition Activity and Outlook

Quiet Quarter for Urology Practice Acquisitions. Increase Expected for Second Half of 2021

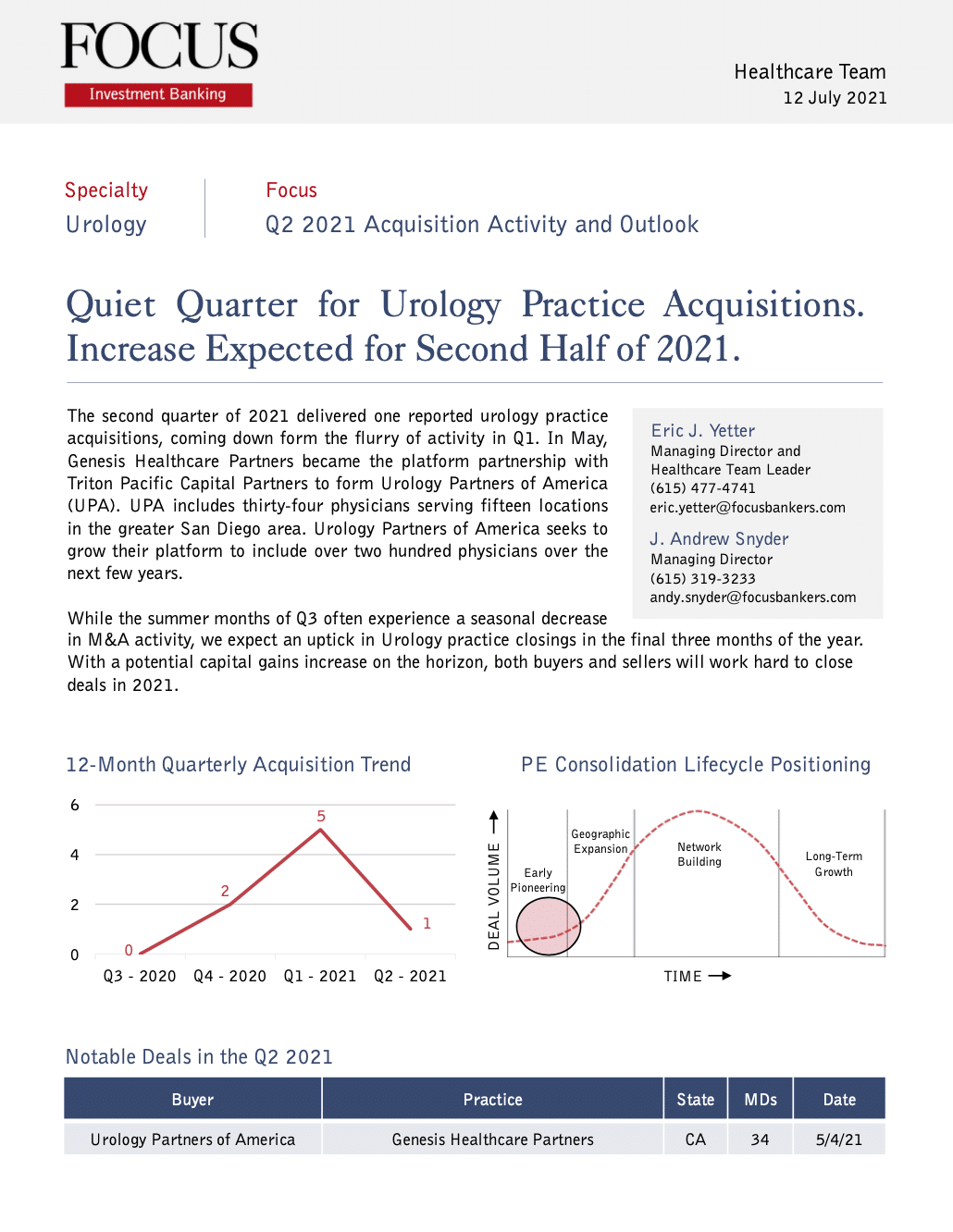

The second quarter of 2021 delivered one reported urology practice acquisitions, coming down form the flurry of activity in Q1.Orthopedics Report – Q2 2021 Acquisition Activity and Outlook

Orthopedic Platforms Continue to Form - Positioning for Market Share and Private Equity Recapitalization

The second quarter of 2021 delivered three reported orthopedic practice acquisitions, including the formation of Ortho Alliance New Jersey which included seven orthopedic practices in New Jersey joining to form the largest orthopedic group in the state.Ophthalmology Report – Q2 2021 Acquisition Activity and Outlook

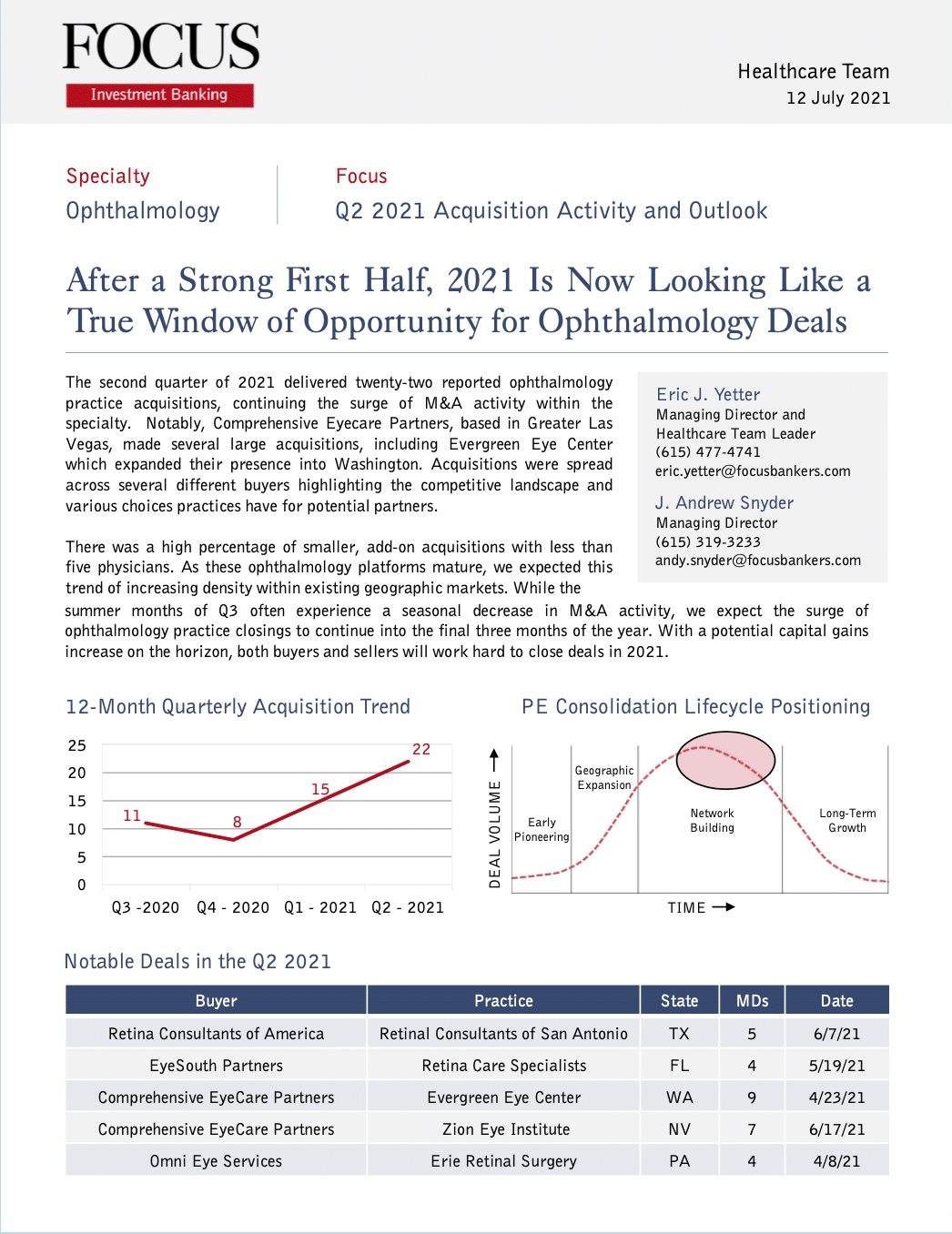

After a Strong First Half, 2021 Is Now Looking Like a True Window of Opportunity for Ophthalmology Deals

The second quarter of 2021 delivered twenty-two reported ophthalmology practice acquisitions, continuing the surge of M&A activity within the specialty.Home Health & Hospice Report – Q2 2021 Acquisition Activity and Outlook

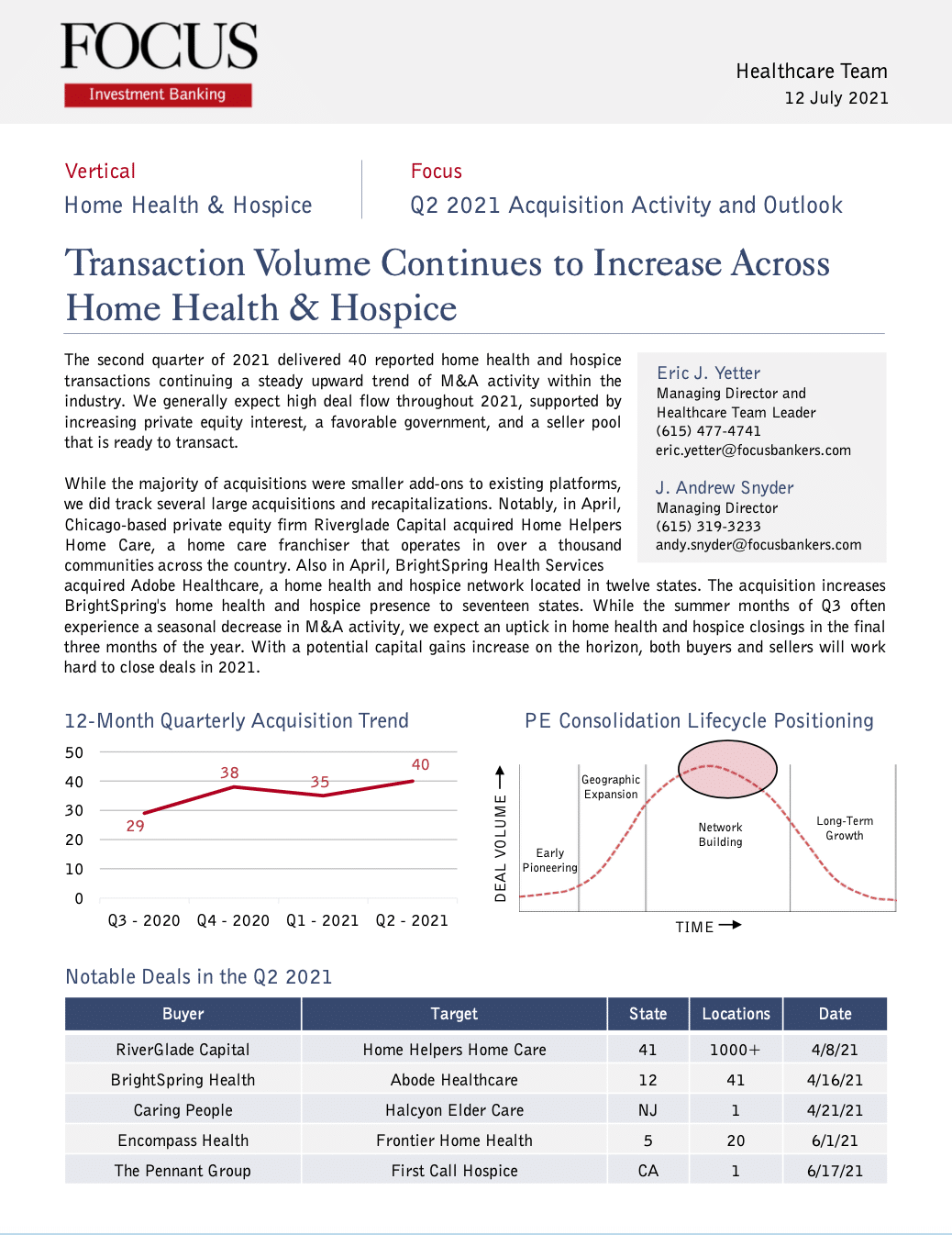

Transaction Volume Continues to Increase Across Home Health & Hospice

The second quarter of 2021 delivered 40 reported home health and hospice transactions continuing a steady upward trend of M&A activity within the industry.Gastroenterology Report – Q2 2021 Acquisition Activity and Outlook

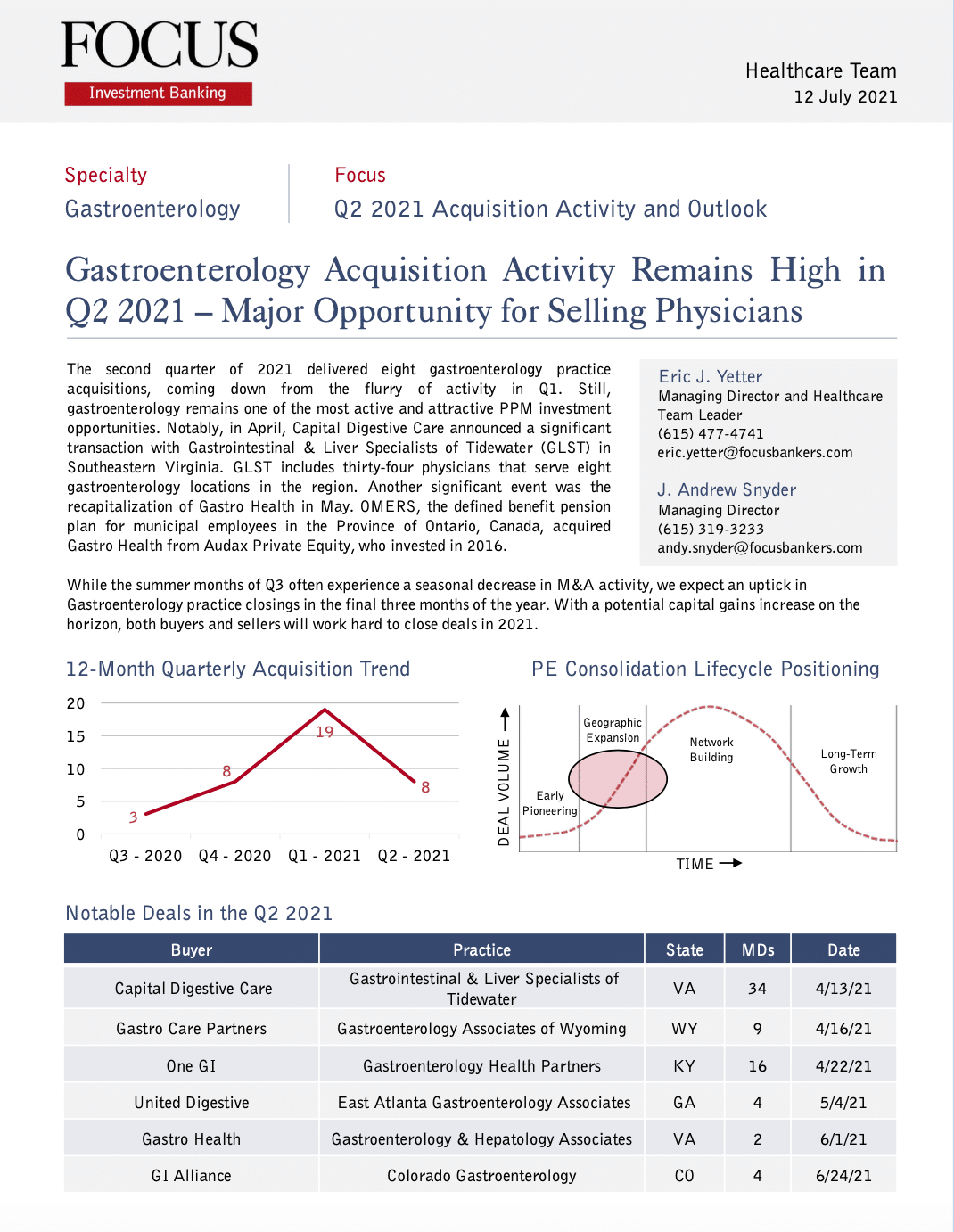

Gastroenterology Acquisition Activity Remains High in Q2 2021 – Major Opportunity for Selling Physicians

The second quarter of 2021 delivered eight gastroenterology practice acquisitions, coming down from the flurry of activity in Q1. Still, gastroenterology remains one of the most active and attractive PPM investment opportunities.Buyer Spotlight: BlueSprig Pediatrics

Founded in 2017 and based in Houston, BlueSprig Pediatrics is already one of the largest and fastest- growing ABA (Applied Behavior Analysis) therapy providers in the country. It is the largest autism services provider in Texas and the Southeast, with over 40 centers in Texas, and now has centers in 18 states, from Illinois and Massachusetts to Oregon and Washington. BlueSprig’s mission is to “change the world for children with autism” and it is “committed to providing compassionate, individualized, and evidence-based behavior analysis treatment.”

The Perfect Storm Roiling the Behavioral Health Industry

COVID-19 affected behavioral health in a substantial way which is creating a path for M&A opportunities.