FOCUS U.S. Communications Service Provider Quarterly: Summer 2021 Report

FOCUS Telecom Business Services Quarterly: Summer 2021 Report

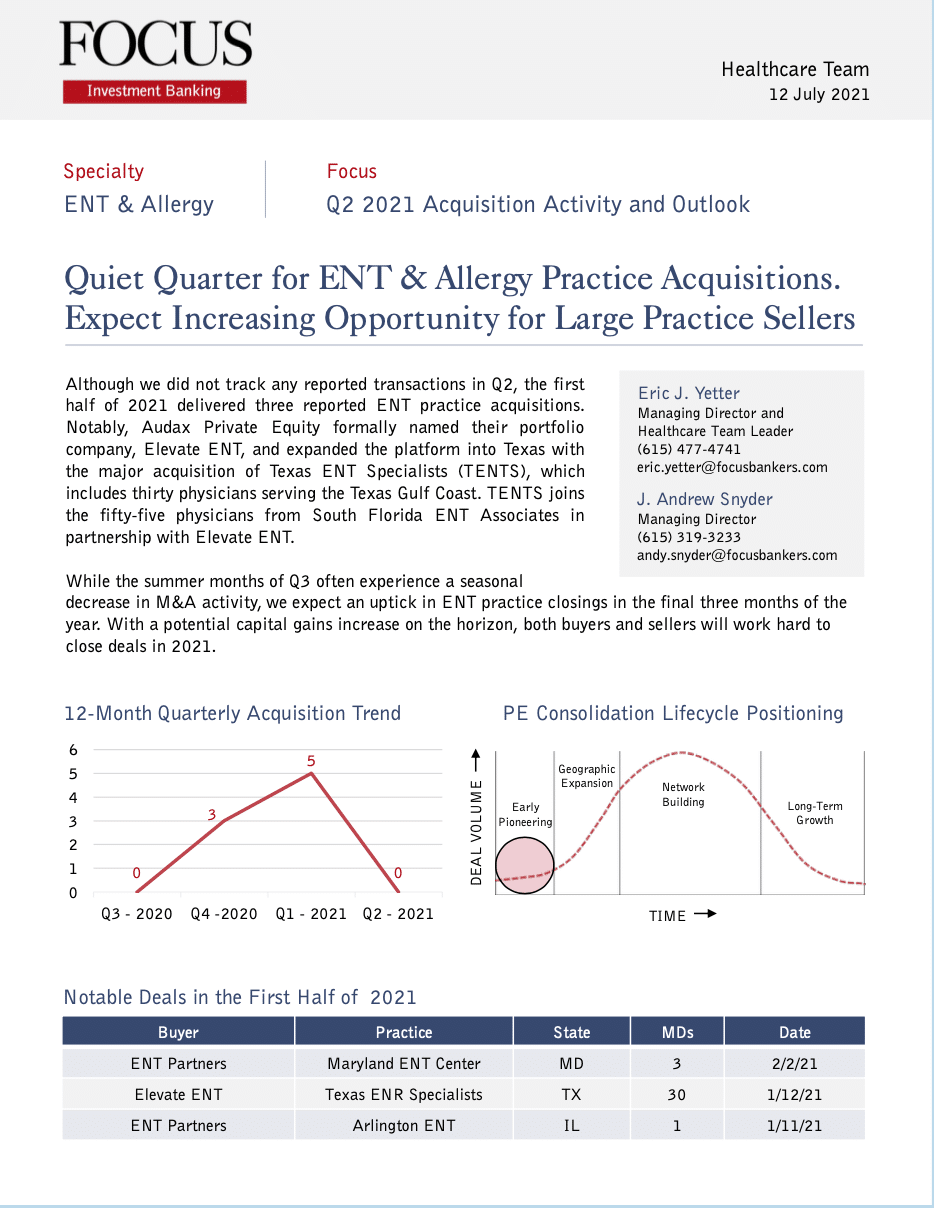

ENT & Allergy Report – Q2 2021 Acquisition Activity and Outlook

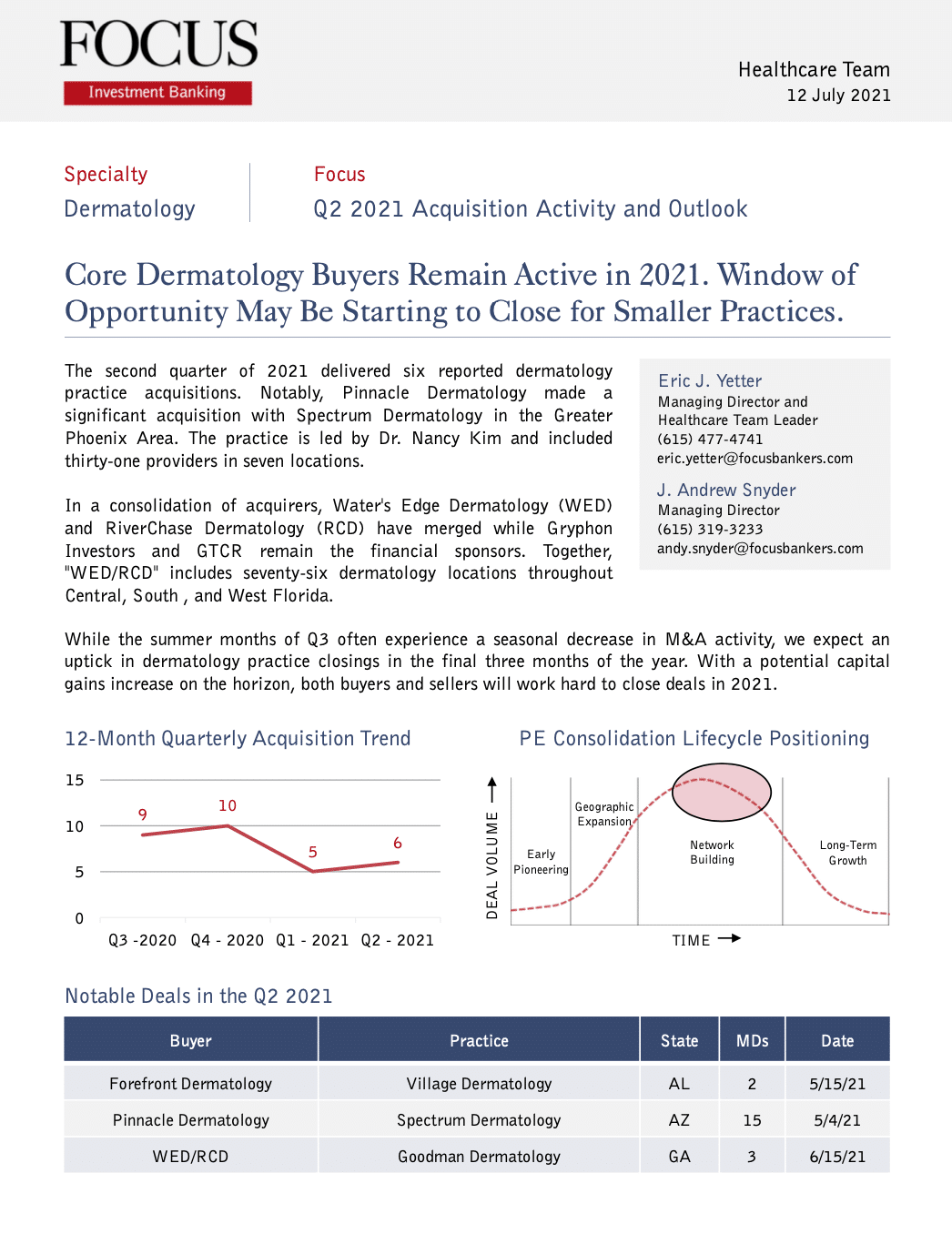

Dermatology Report – Q2 2021 Acquisition Activity and Outlook

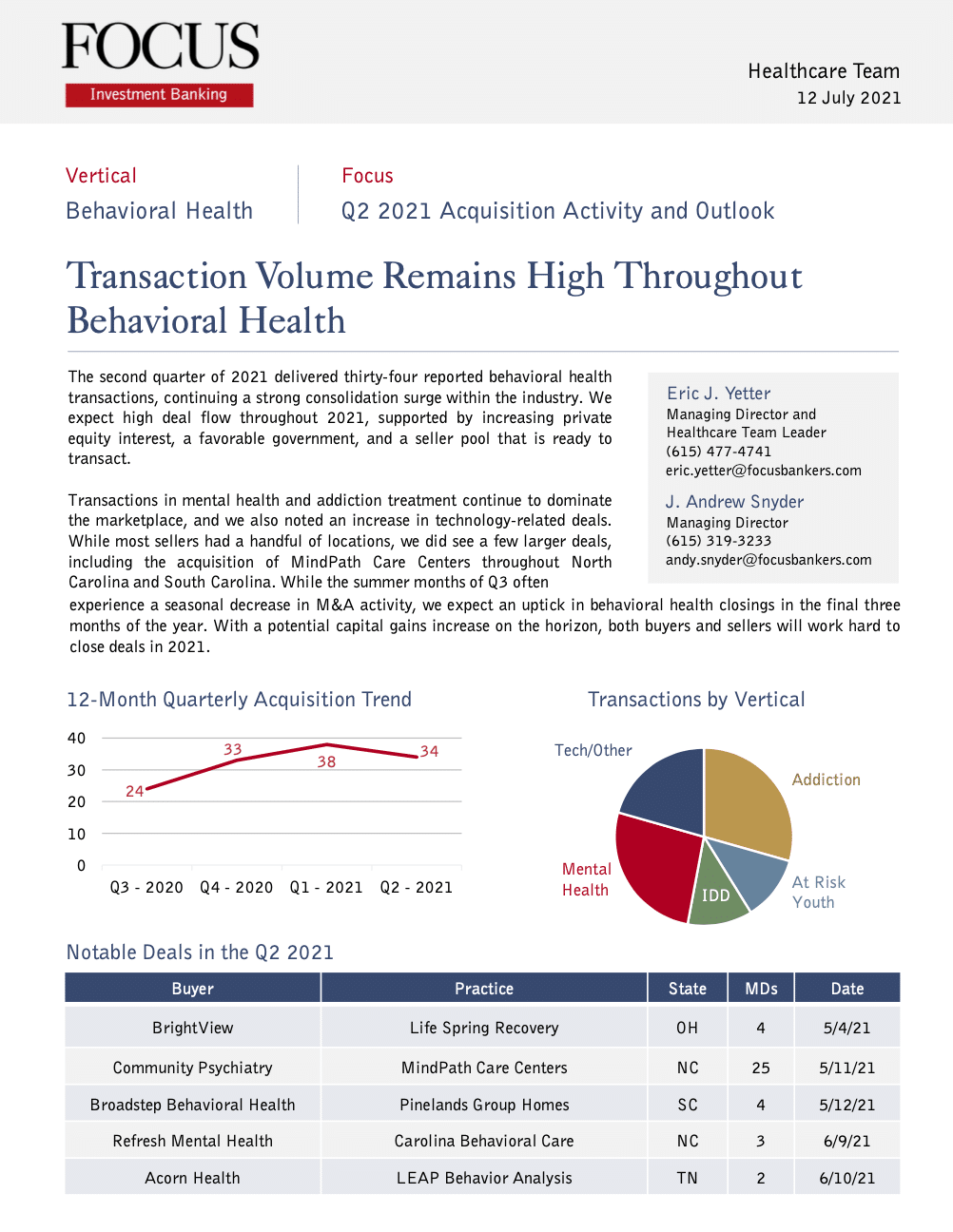

Behavioral Health Report – Q2 2021 Acquisition Activity and Outlook

Women’s Health Report – Q2 2021 Acquisition Activity and Outlook

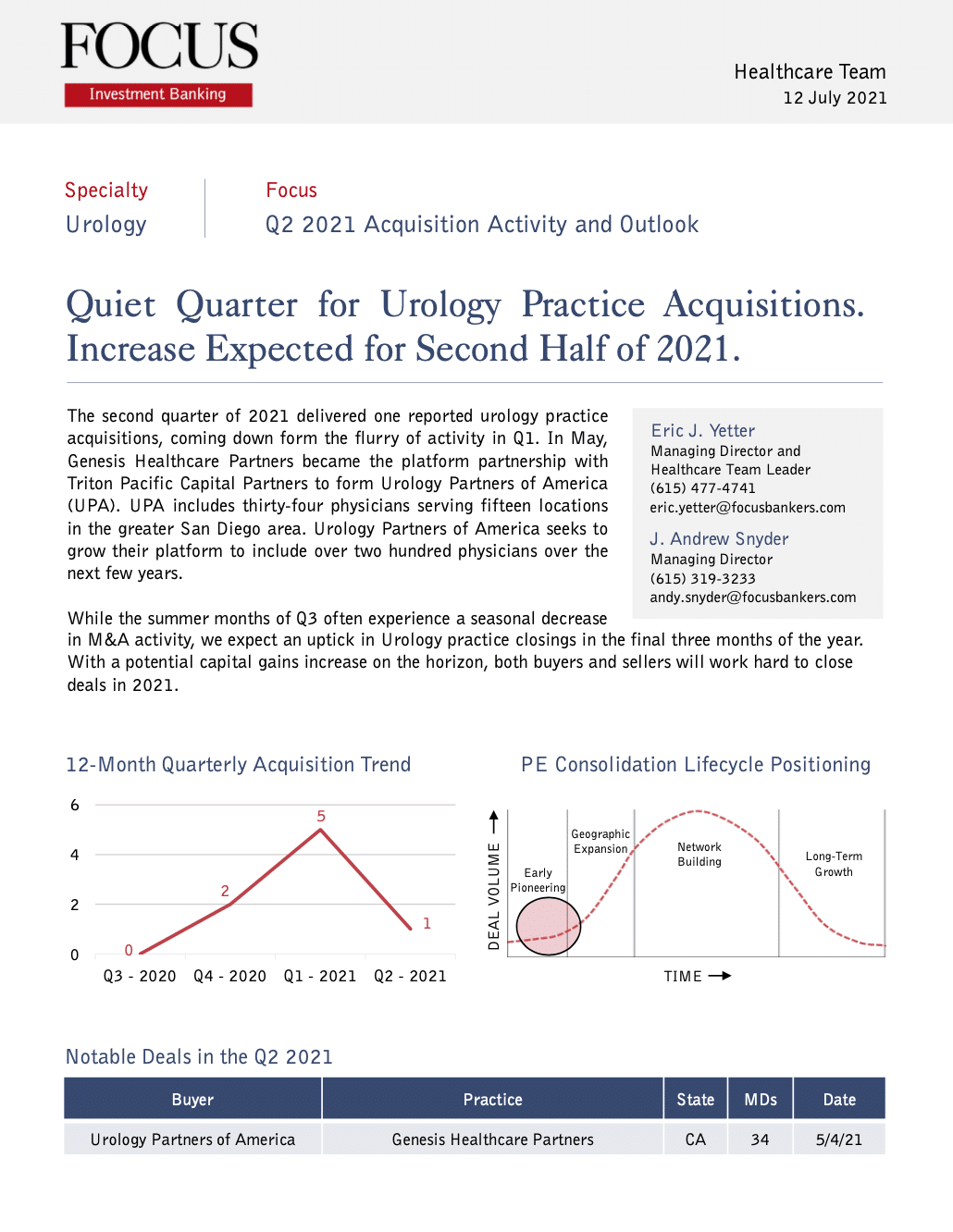

Urology Report – Q2 2021 Acquisition Activity and Outlook

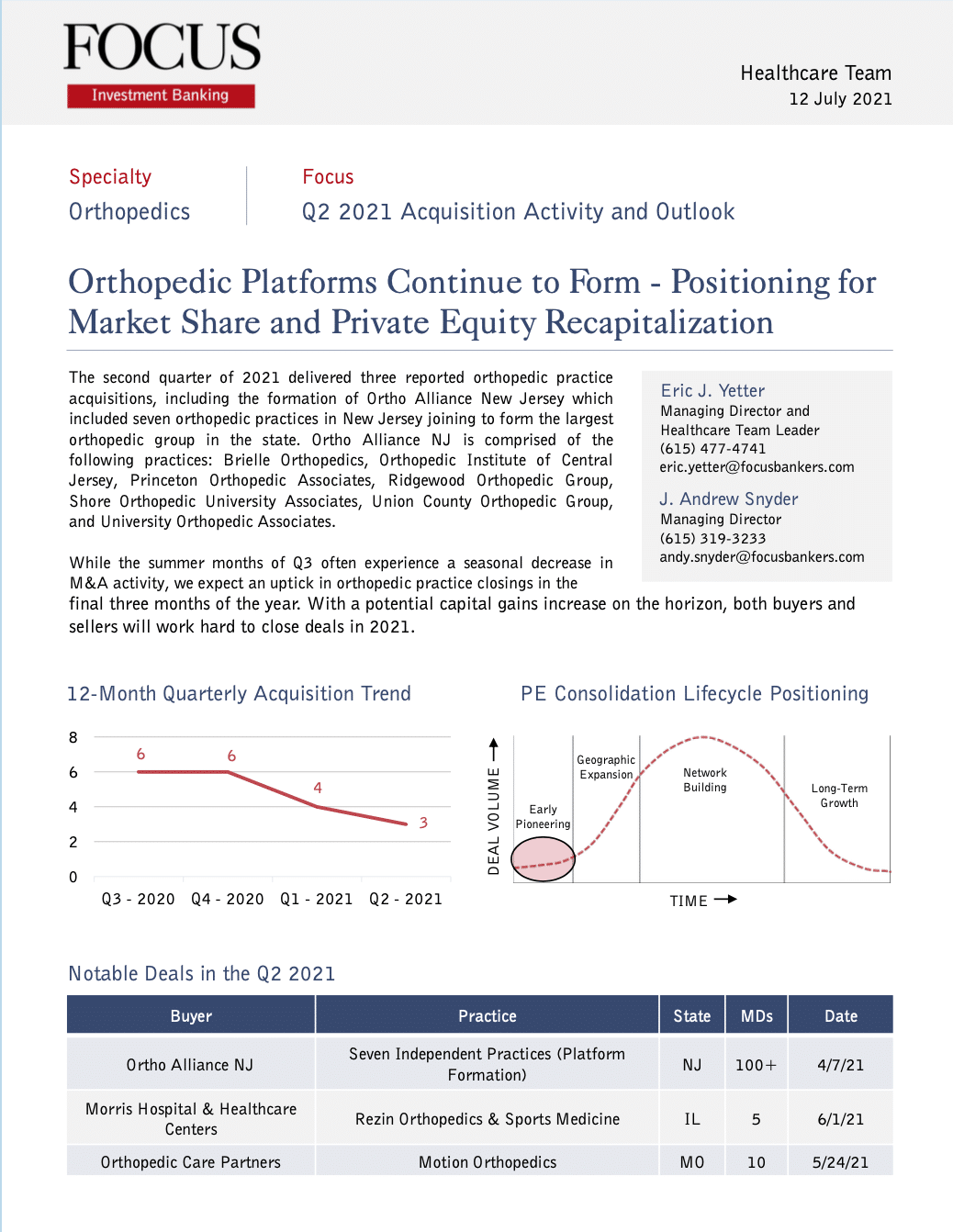

Orthopedics Report – Q2 2021 Acquisition Activity and Outlook

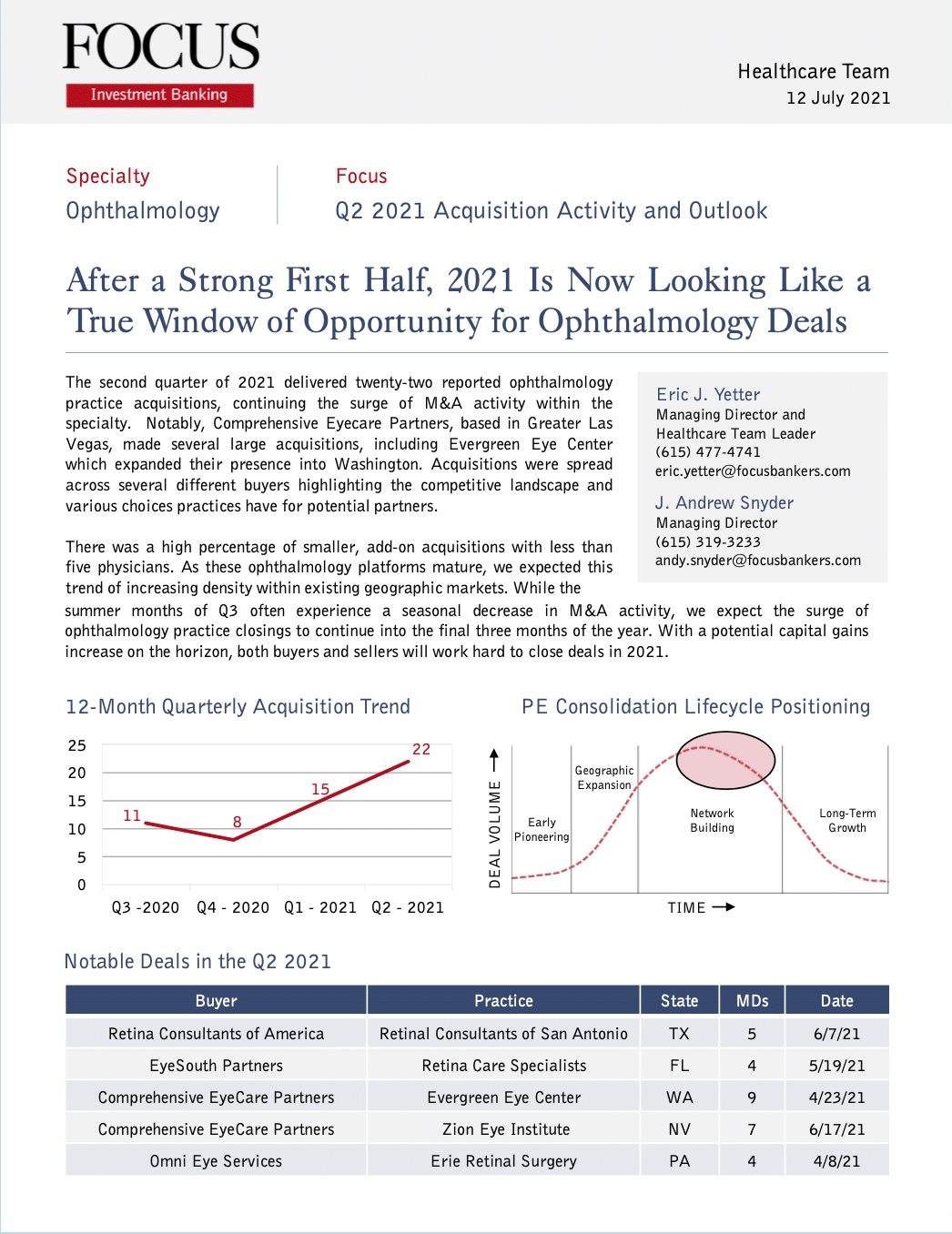

Ophthalmology Report – Q2 2021 Acquisition Activity and Outlook

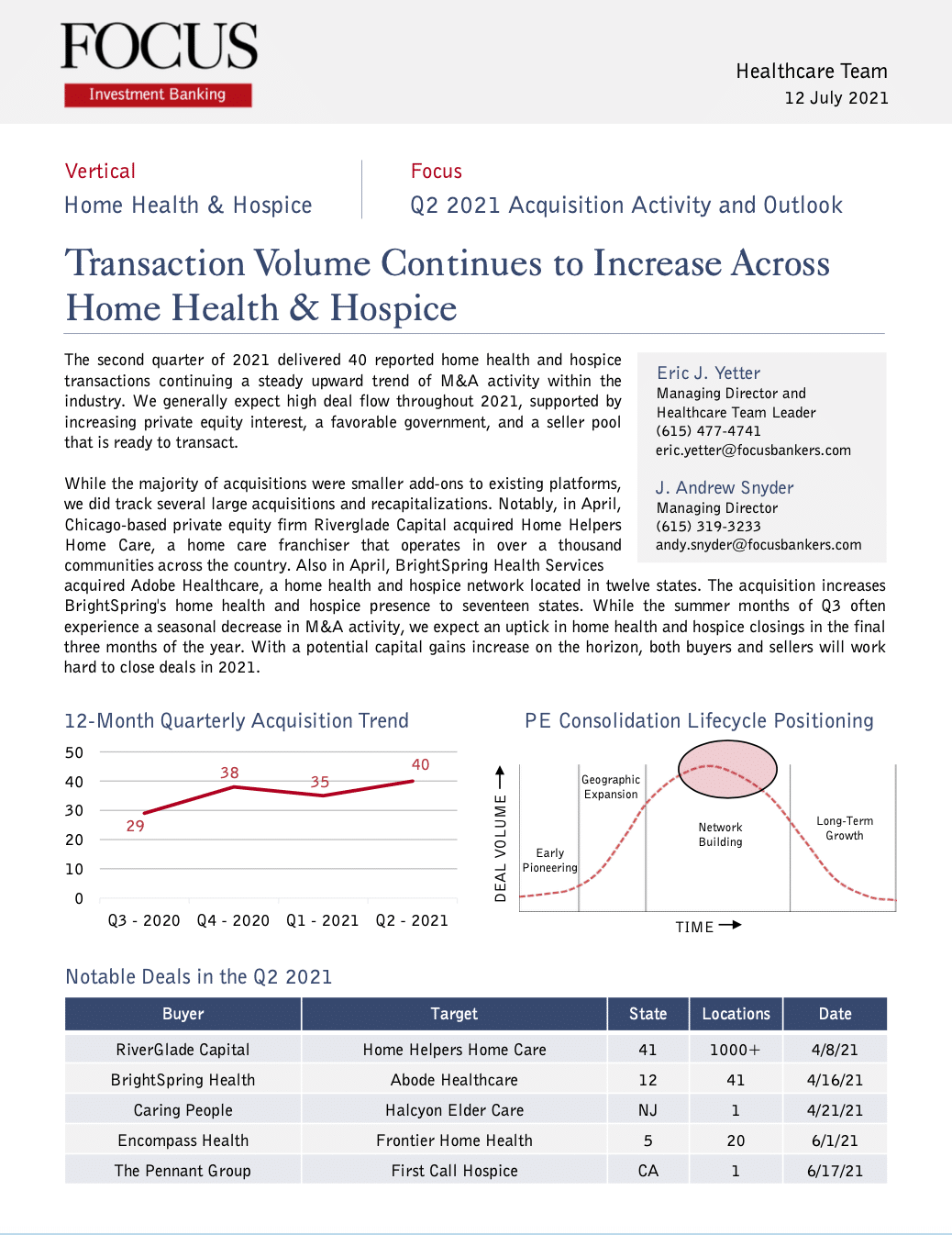

Home Health & Hospice Report – Q2 2021 Acquisition Activity and Outlook

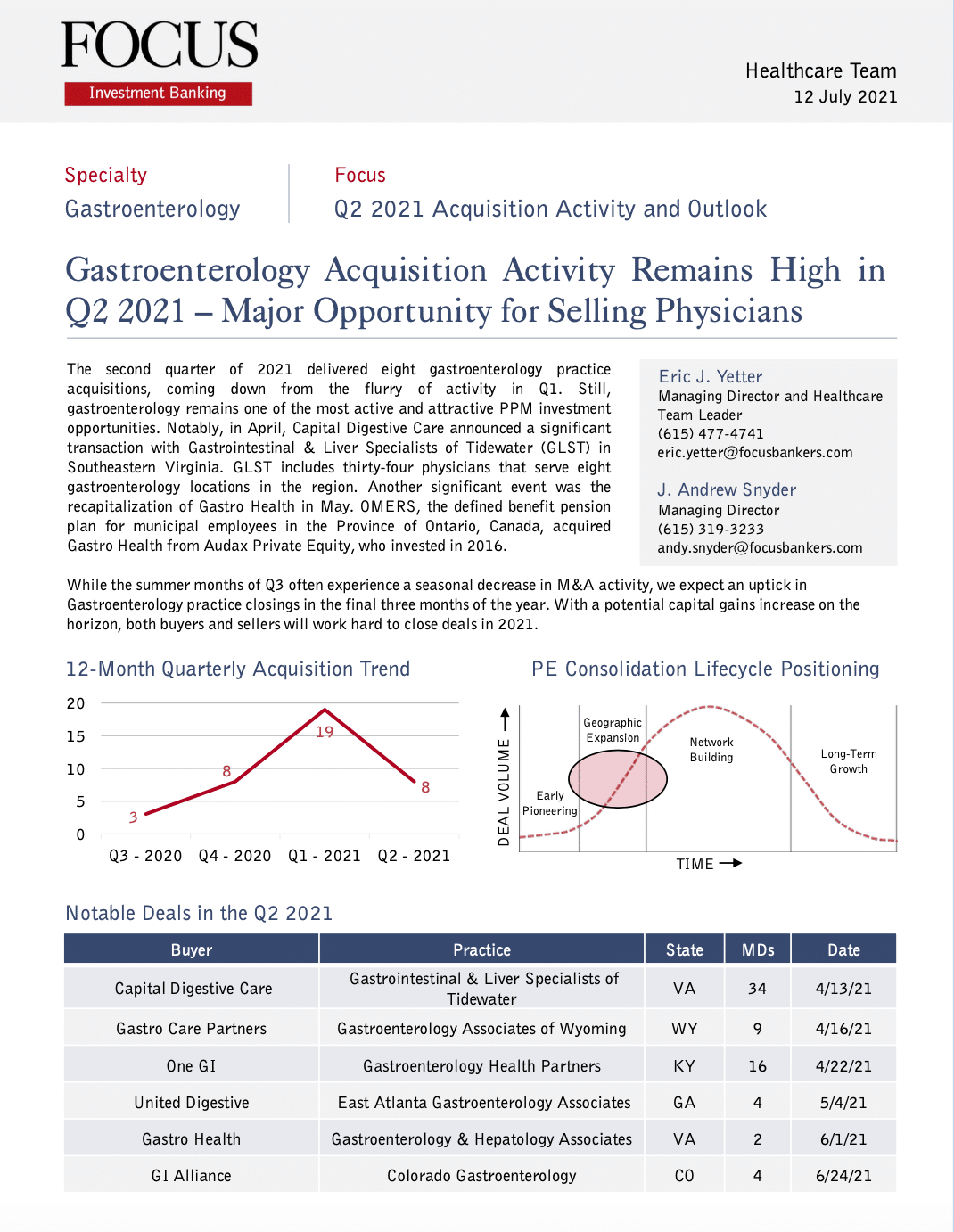

Gastroenterology Report – Q2 2021 Acquisition Activity and Outlook

FOCUS Investment Banking featured in Axial’s 2021 Business Services Top 50

Advanced Manufacturing: An Interview featuring FOCUS’ John Slater and Jorge Maceyras

FOCUS Carrier-Focused Telecom Technology Quarterly: Summer 2021 Report