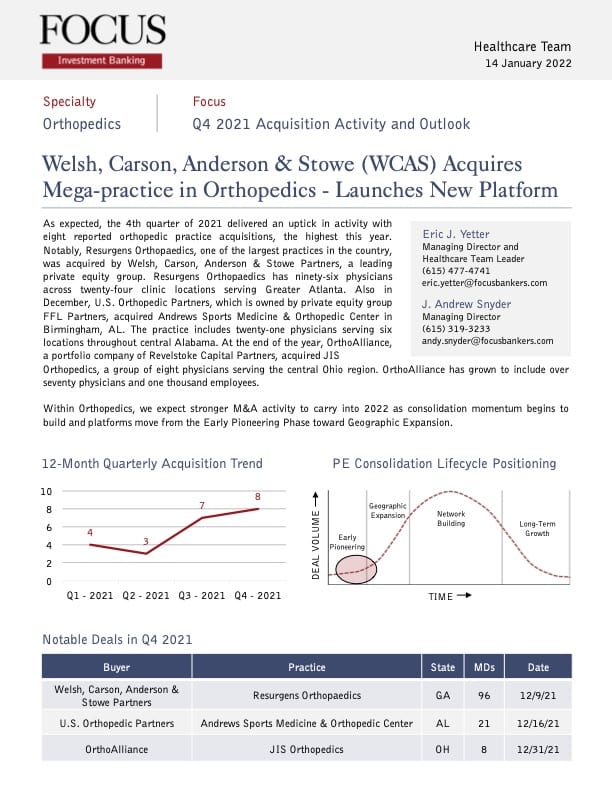

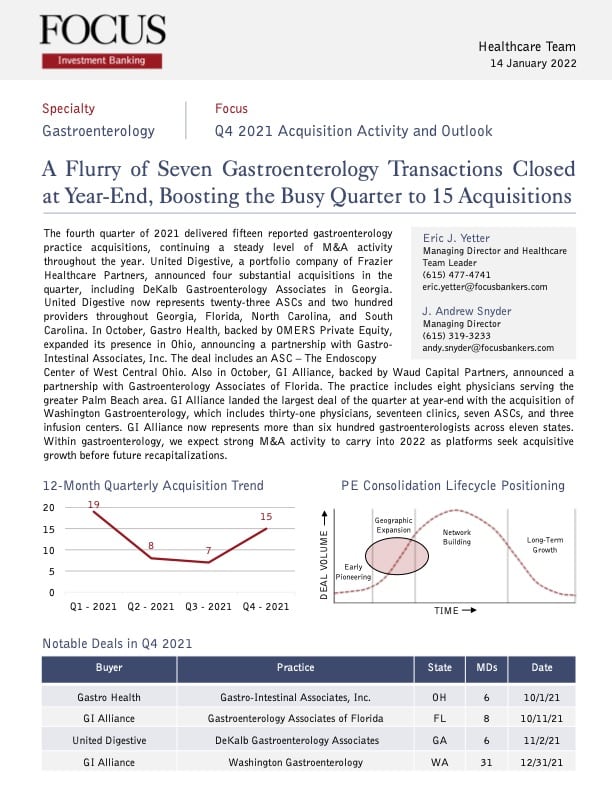

Ophthalmology – Q4 2021 Acquisition Activity and Outlook

Vision Partners Acquired by EyeCare Partners; Panorama Eyecare forms in the Mountain Region

The fourth quarter of 2021 delivered a very strong thirty-seven reported ophthalmology practice acquisitions, reaching peak levels of M&A activity within the specialty. There were a few notable deals from the period.Home Health & Hospice – Q4 2021 Acquisition Activity and Outlook

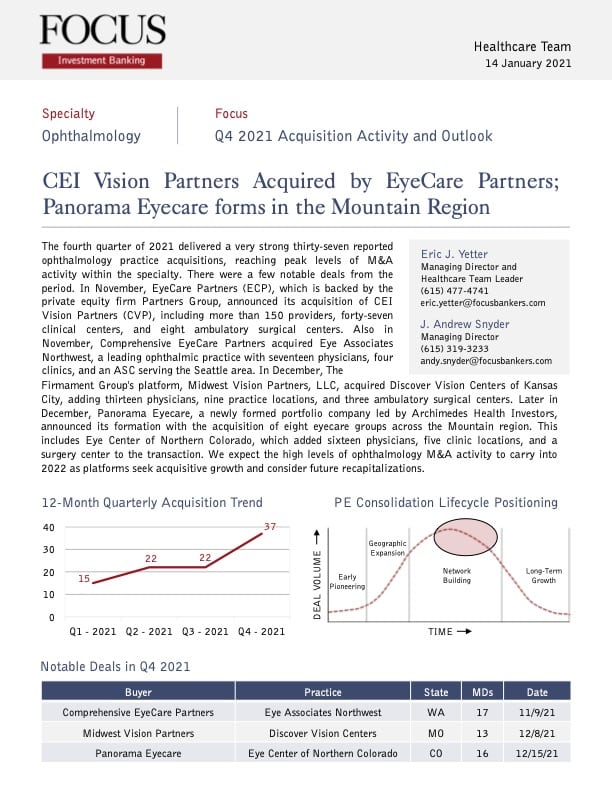

The Home Health and Hospice Surge Continues; Acquisition Demand Remains at Peak Levels

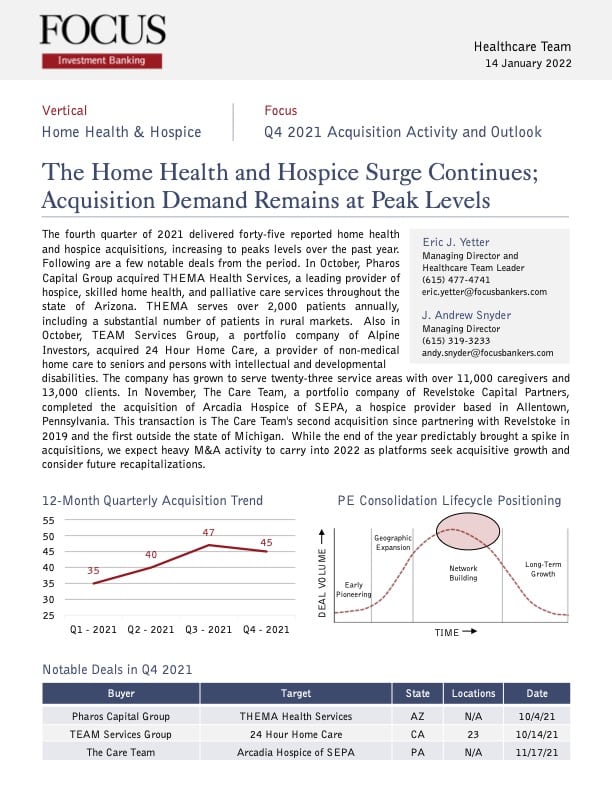

The fourth quarter of 2021 delivered forty-five reported home health and hospice acquisitions, increasing to peaks levels over the past year. Following are a few notable deals from the period.Gastroenterology – Q4 2021 Acquisition Activity and Outlook

A Flurry of Seven Gastroenterology Transactions Closed at Year-End, Boosting the Busy Quarter to 15 Acquisitions

The fourth quarter of 2021 delivered fifteen reported gastroenterology practice acquisitions, continuing a steady level of M&A activity throughout the year. United Digestive, a portfolio company of Frazier Healthcare Partners, announced four substantial acquisitions in the quarter, including DeKalb Gastroenterology Associates in Georgia.ENT & Allergy – Q4 2021 Acquisition Activity and Outlook

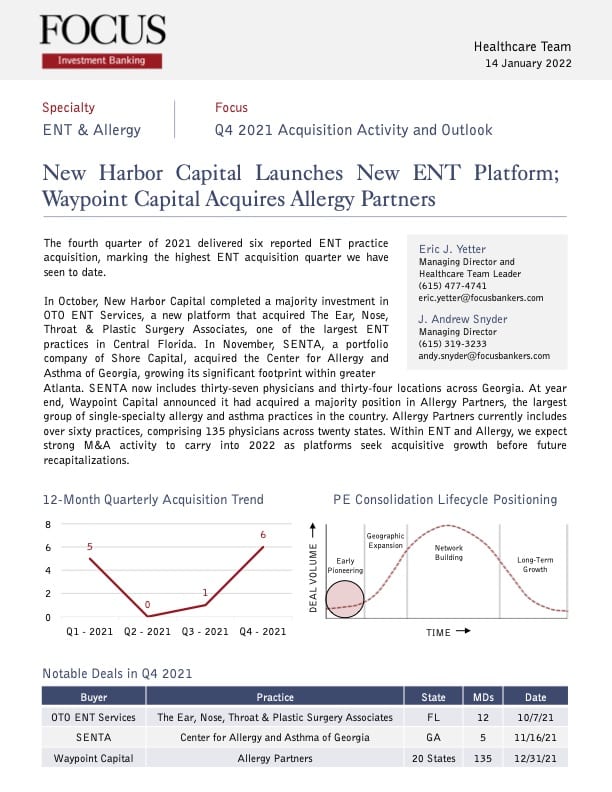

New Harbor Capital Launches New ENT Platform; Waypoint Capital Acquires Allergy Partners

The fourth quarter of 2021 delivered six reported ENT practice acquisition, marking the highest ENT acquisition quarter we have seen to date.Dermatology – Q4 2021 Acquisition Activity and Outlook

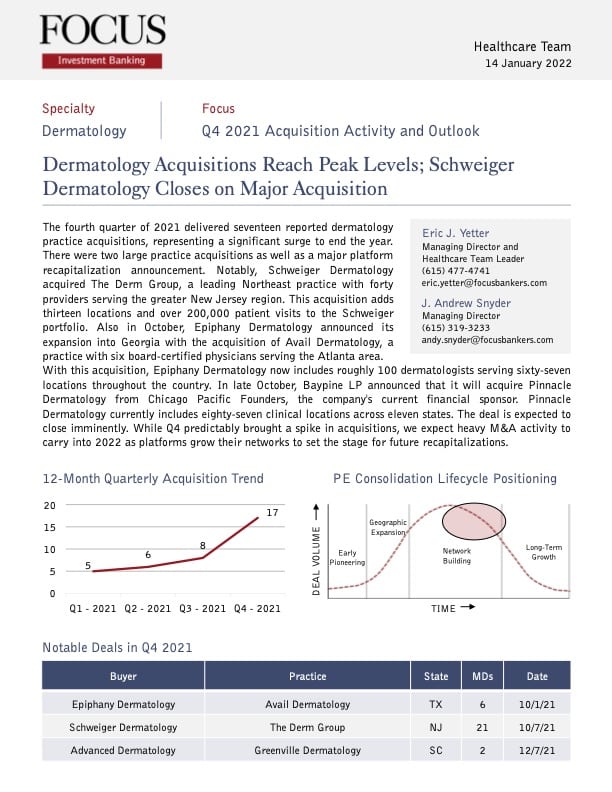

Dermatology Acquisitions Reach Peak Levels; Schweiger Dermatology Closes on Major Acquisition

The fourth quarter of 2021 delivered seventeen reported dermatology practice acquisitions, representing a significant surge to end the year. There were two large practice acquisitions as well as a major platform recapitalization announcement.Cardiology – Q4 2021 Acquisition Activity and Outlook

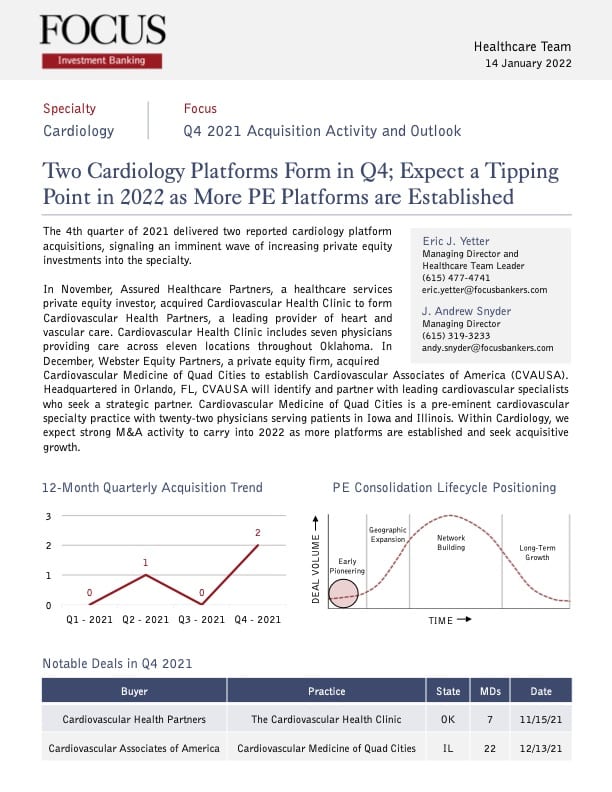

Two Cardiology Platforms Form in Q4; Expect a Tipping Point in 2022 as More PE Platforms are Established

The 4th quarter of 2021 delivered two reported cardiology platform acquisitions, signaling an imminent wave of increasing private equity investments into the specialty.Behavioral Health – Q4 2021 Acquisition Activity and Outlook

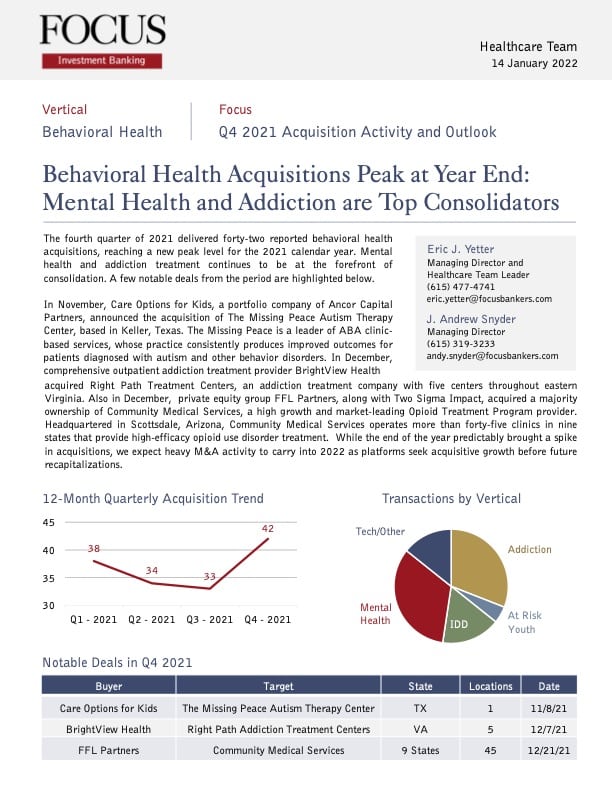

Behavioral Health Acquisitions Peak at Year End: Mental Health and Addiction are Top Consolidators

The fourth quarter of 2021 delivered forty-two reported behavioral health acquisitions, reaching a new peak level for the 2021 calendar year. Mental health and addiction treatment continues to be at the forefront of consolidation. A few notable deals from the period are highlighted below.Hospice and home health care industry: Is now the time to sell?

The home health care and hospice industry is expected to continue its fast growth rate resulting in business owners reviewing when it may be the best time to sell.

Hospice and home health care: A compelling growth story

The hospice and home health care industry is expected to grow strongly over the foreseeable future, driven by powerful demographic trends, including a rising elderly population, longer life spans and more chronic and age-related illnesses.