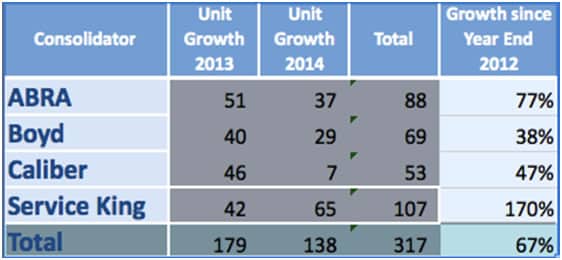

Pedal to the Metal: Consolidation in 2014

Sixteen years ago, after David Roberts and his partner, Matthew Ohrnstein, founded Caliber Collision, he wrote a series of industry articles that were presciently accurate. His subject then? “Shop Consolidation: Is It Inevitable?” His answer was an emphatic “Yes.” Over a period of 8 years as Caliber’s Chairman, Roberts helped lead the initial capital raises and the acquisition of its first 37 shops. Now a leading investment banker in the Automotive Services industry with FOCUS Investment Banking, Roberts has a unique 20-year perspective on the industry. With the dramatic growth of the large consolidators as well as many regional and local MSOs, we asked Roberts to update our audience on consolidation developments, their impact on the industry and how consolidation continues to evolve.