How Investment Bankers are Different than Brokers

Breaking Down the FOCUS Sell-Side Process

2025 Dental Transactions Update

Sitwell Dental Case Study

FOCUS Investment Banking Represents Sitwell Dental in its Sale to SALT Dental Partners

Infusion Therapy Services Market Update: Q1 2025

More Varied Deal Structures Among Healthcare Providers are Another Reason Sellers Need Competitive Auctions

The Hottest Healthcare Services Verticals for Private Equity in 2025

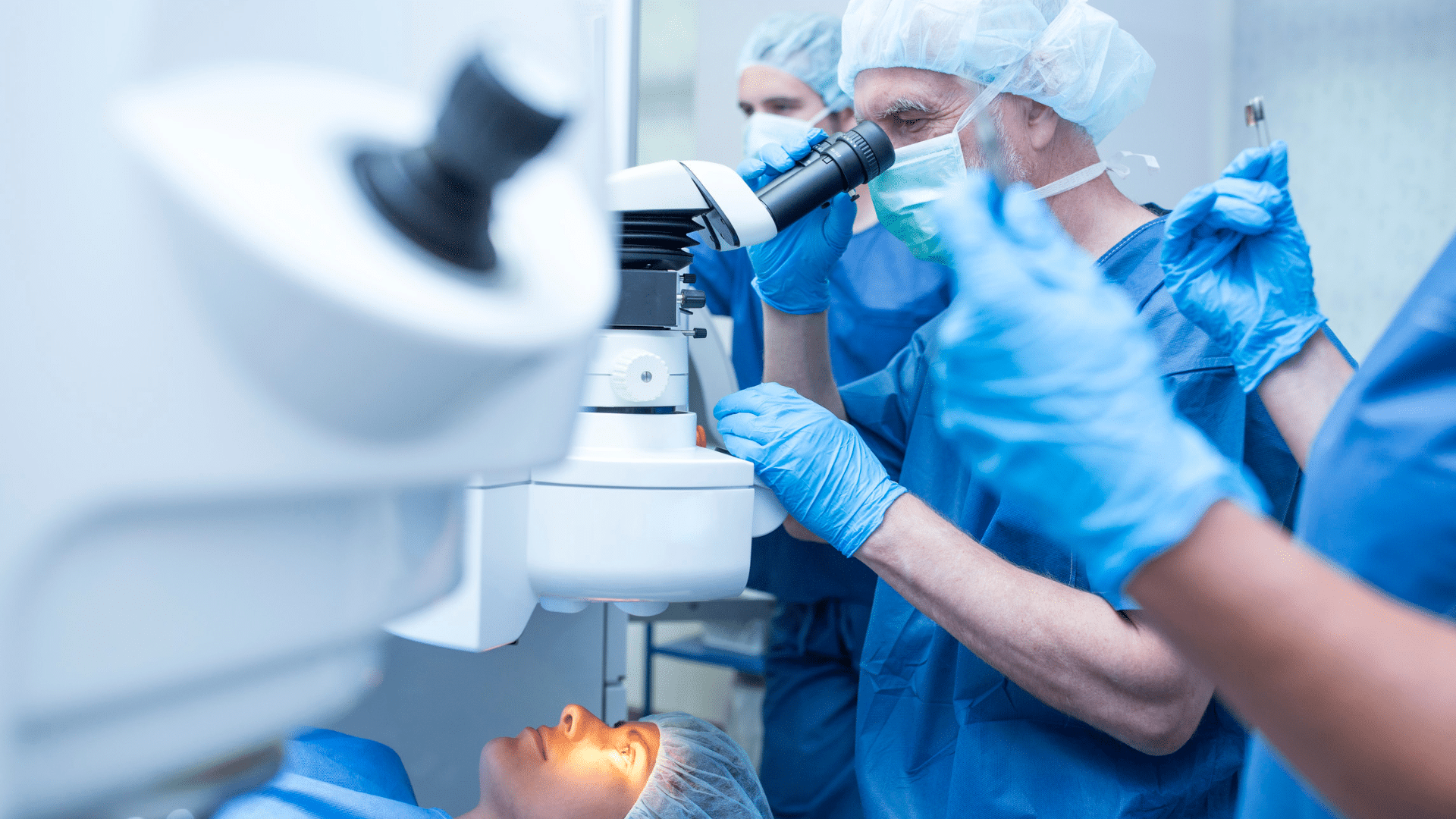

Momentum Builds for Ophthalmology Recapitalizations

2025 Could Be the Year of the Retina Practice Deal

FOCUS Investment Banking Represents Mid-Michigan ENT in its Partnership with Align ENT + Allergy

FOCUS Investment Banking Represents Dulles Eye Associates in its Partnership with ReFocus Eye Health

ENT & Allergy – 2024 Update: Conservative Pace Continues

Ophthalmology – 2024 Update: Entering a Mature Stage