FOCUS Telecom Business Services Quarterly: Summer 2024 Report

OVERVIEW

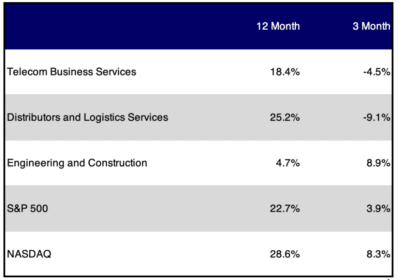

After two straight periods of double-digit returns, the FOCUS Telecom Business Services Index (TBSI) reversed course and fell 4.5% over the past three months.

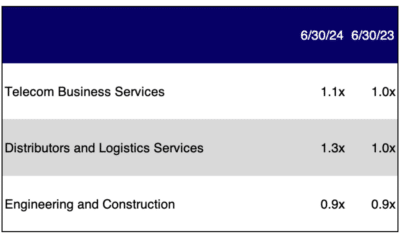

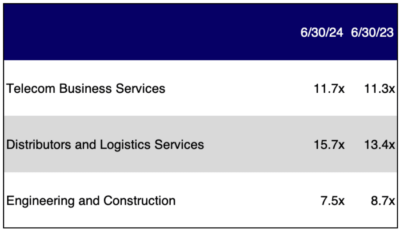

This was despite a strong overall market that pushed the S&P 500 up 3.9% and the NASDAQ up 8.3% over the same three-month time frame. The TBSI is still trading more than 18% higher than it was a year ago. However, this performance once again lags the broader indices by a fairly wide margin, as both the S&P 500 and NASDAQ gained more than 20% over the past year. Sector multiples are also trending higher over the past 12 months. Sector multiples closed out the period at 1.1x revenue and 11.7x EBITDA. Both of these values compare favorably to year-ago multiples of 1.0x revenue and 11.3x EBITDA.

The Distributors and Logistics Services sub sector was clearly the weaker of the TBSI’s two sub sectors as it declined 9.1% in our summer reporting period. Losses were broad-based, with three of the four companies in the index in negative territory. This included a 12.5% drop at sub sector bellwether CDW. In contrast, the Engineering and Construction sub sector delivered a solid performance with an 8.9% increase for the period. We also noted that the two U.S.-based companies in the index, Dycom and MasTec, enjoyed gains of 17.6% and 14.7%, respectively.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

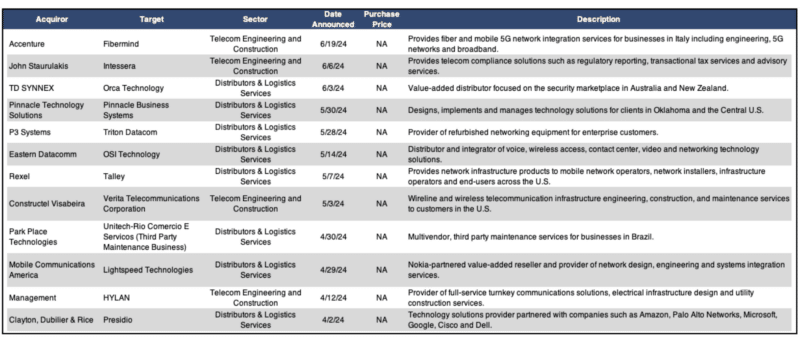

M&A ACTIVITY

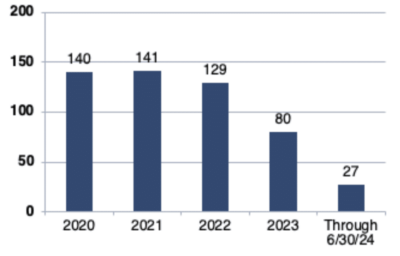

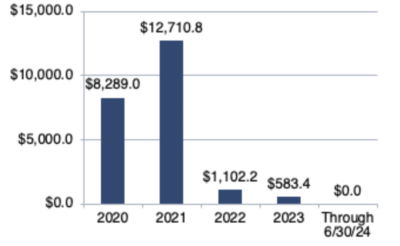

For the second straight reporting period the Telecom Business Services sector saw a relatively low level of M&A activity.There were only 12 announced transactions this period, and none of them had an announced transaction dollar value.Halfway through 2024, we only have 27 total transactions and are still awaiting a deal with an announced transaction dollar value. This is well below levels that we saw in 2023, which itself had an unusually low amount of M&A activity.

The sub sector that has seen the biggest slowdown is the Engineering and Construction sub sector, which had only four transactions this past three months.While activity in the Distributors and Logistics Services sub sector was also fairly slow, it at least saw the acquisition of Presidio by private equity giant Clayton, Dubilier & Rice.While the parties did not disclose a valuation for this deal, it was almost certainly a multi-billion dollar transaction.When Presidio was taken private by former owner BC Partners back in 2019, it was for a valuation north of $2 billion.

There were no transactions with announced multiples this period.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (4/1/24 – 6/30/24)

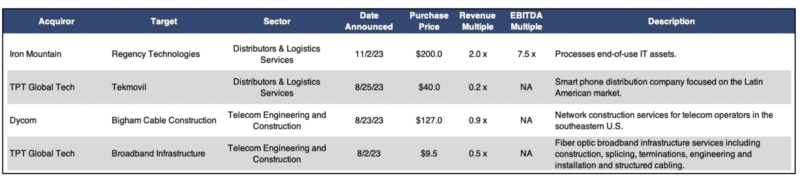

M&A TRANSACTIONS WITH ANNOUNCED MULTIPLES (7/1/23 – 6/30/24)