FOCUS Enterprise-Focused Telecom Technology Quarterly – Spring 2021

FOCUS Investment Banking Strengthens Team With New Marketing Leadership

FOCUS U.S. Communications Service Provider Quarterly: Spring 2021 Report

FOCUS Telecom Business Services Quarterly: Spring 2021 Report

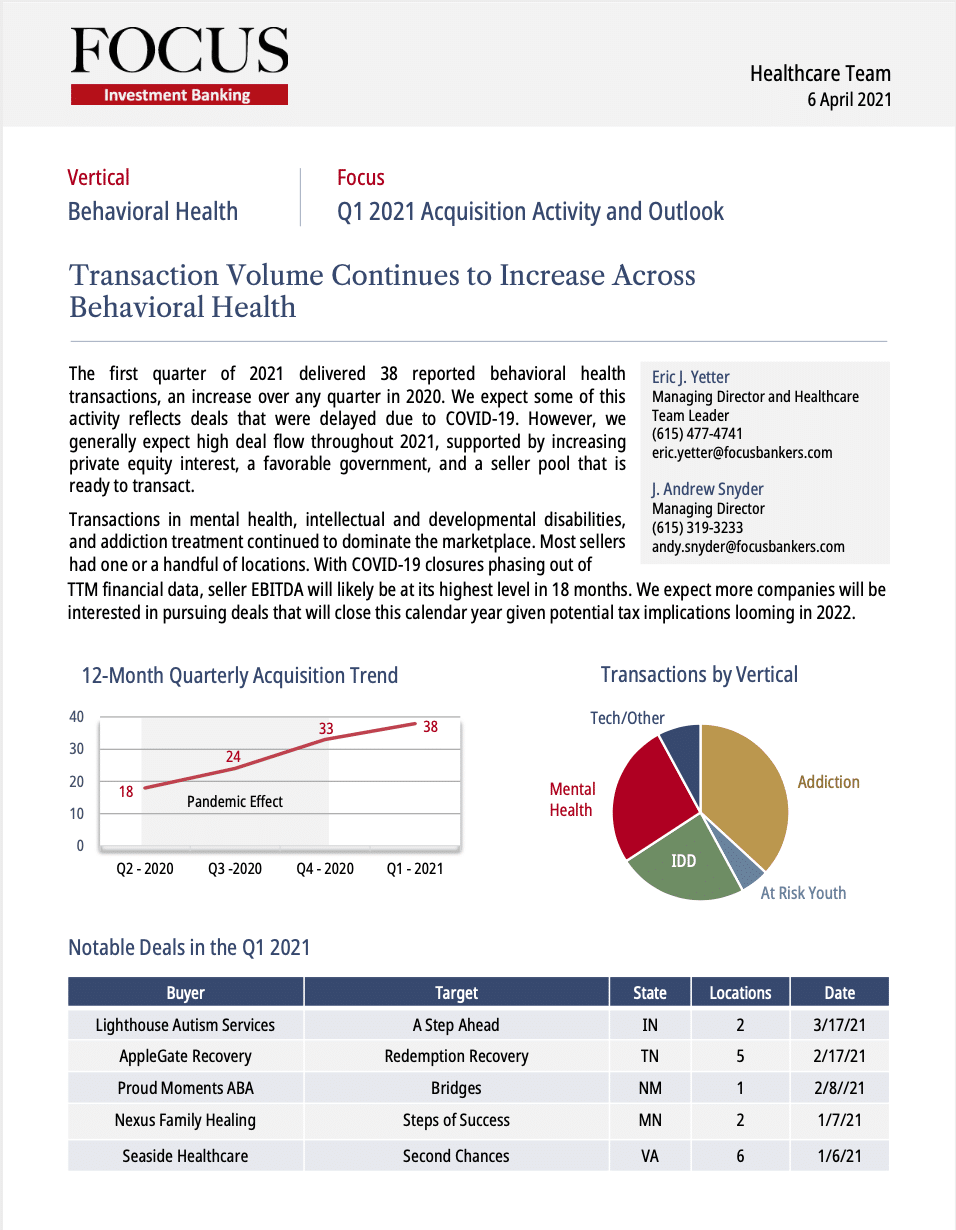

Behavioral Health Report – Q1 2021 Acquisition Activity and Outlook

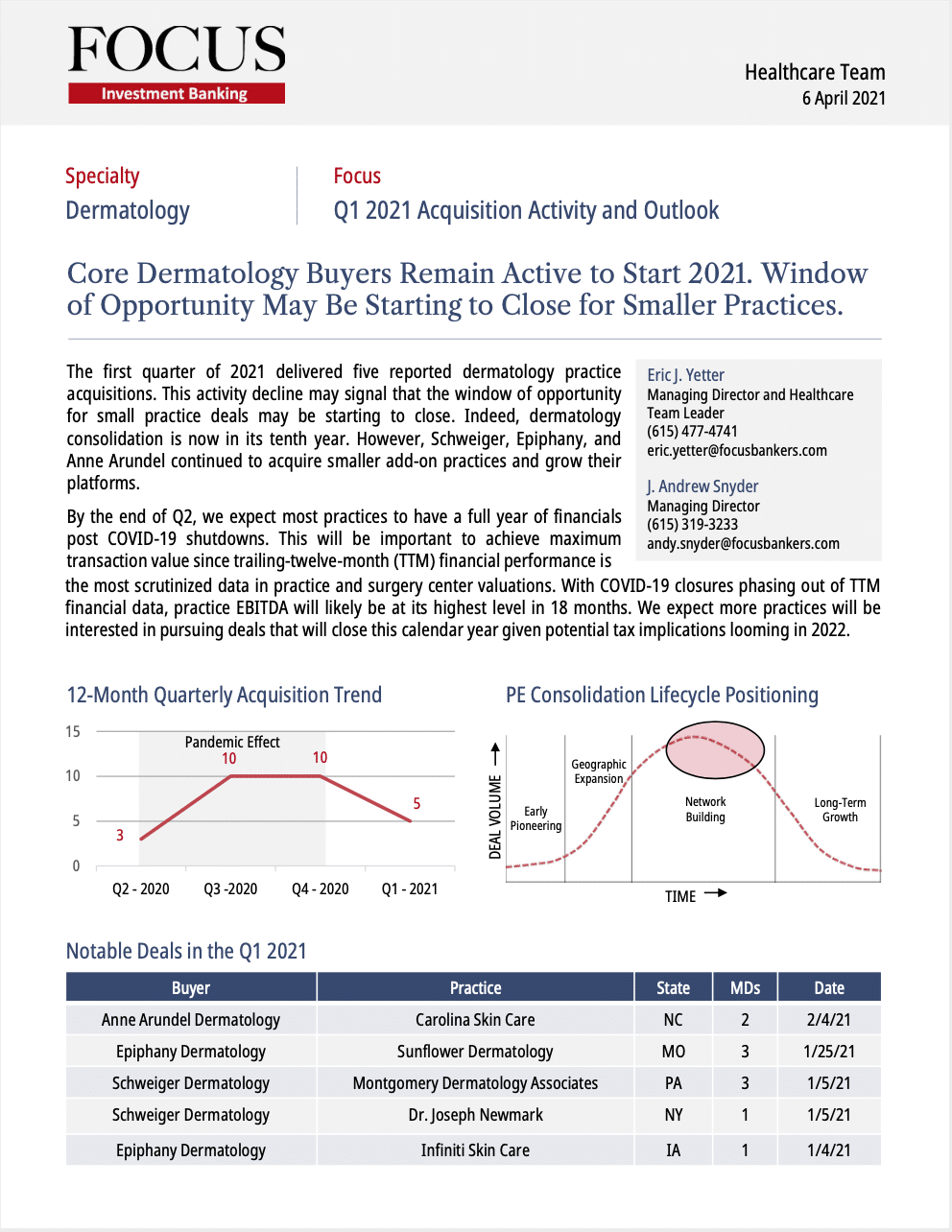

Dermatology Report – Q1 2021 Acquisition Activity and Outlook

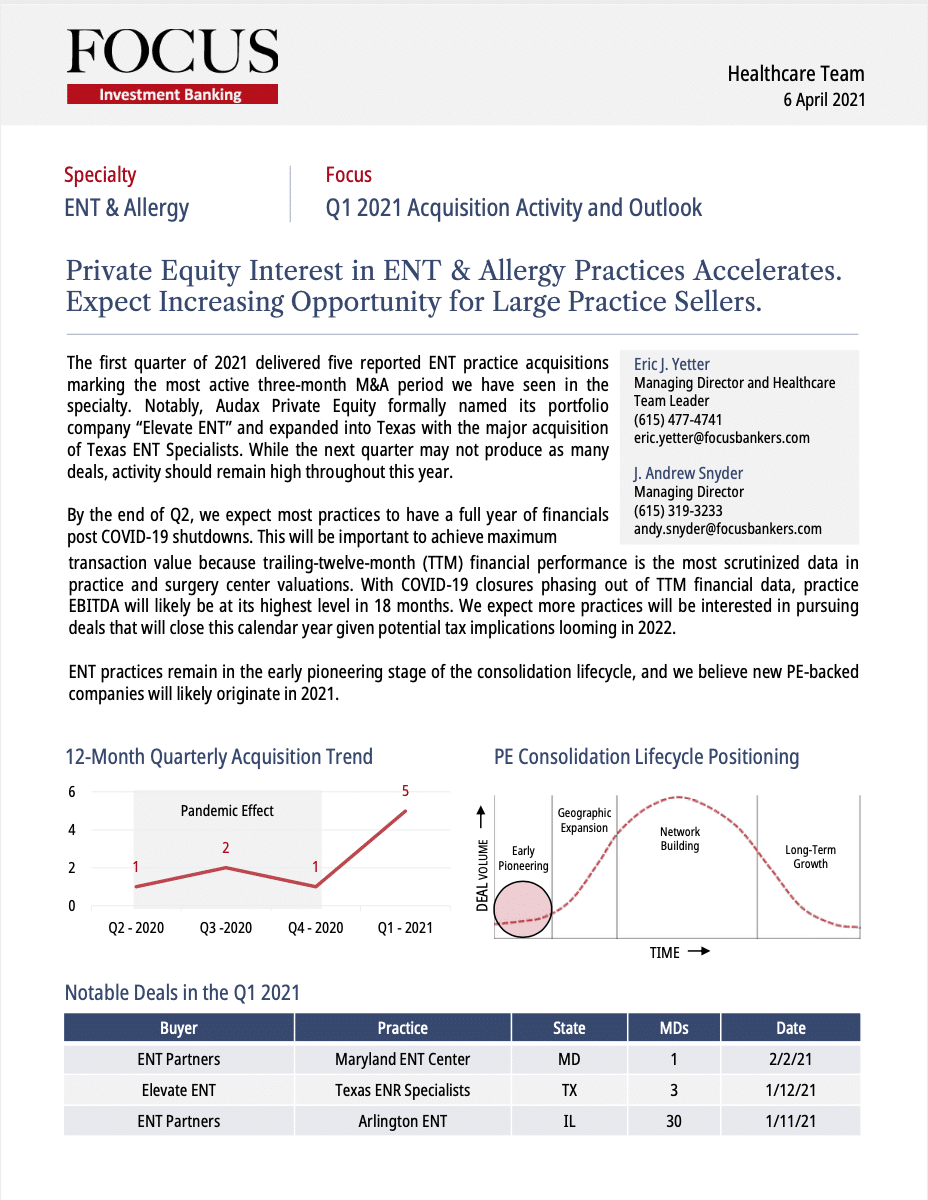

ENT & Allergy Report – Q1 2021 Acquisition Activity and Outlook

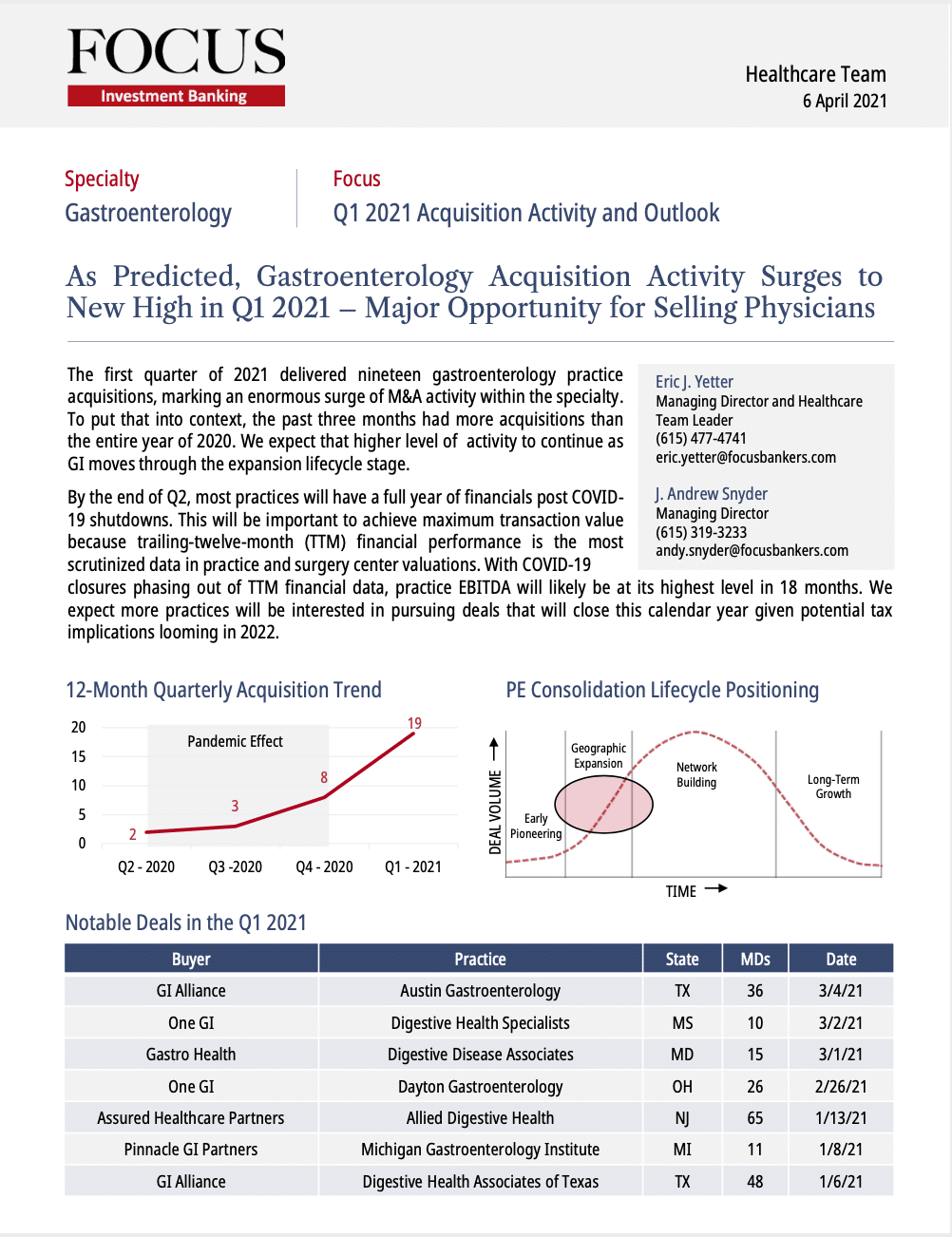

Gastroenterology Report – Q1 2021 Acquisition Activity and Outlook

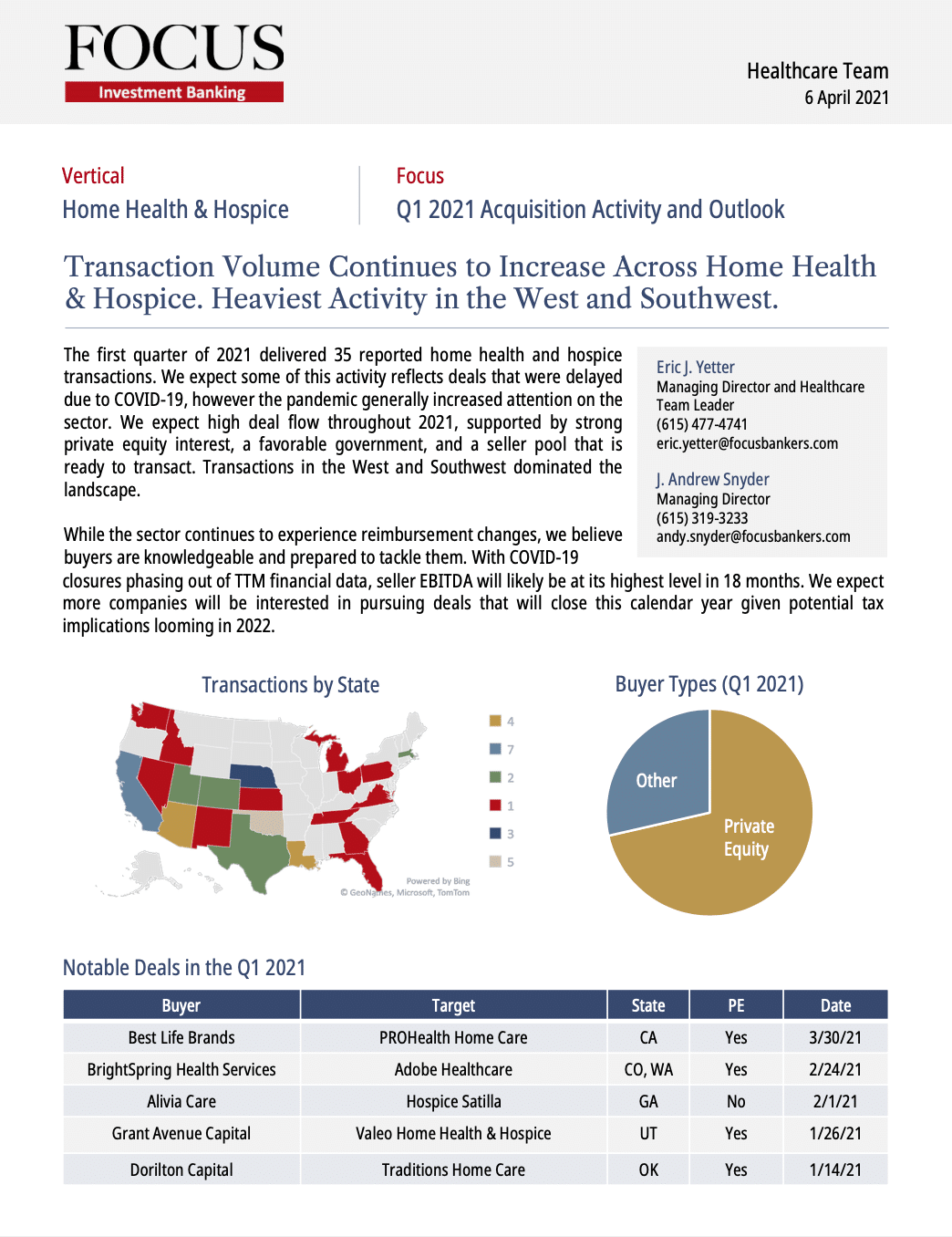

Home Health and Hospice Report – Q1 2021 Acquisition Activity and Outlook

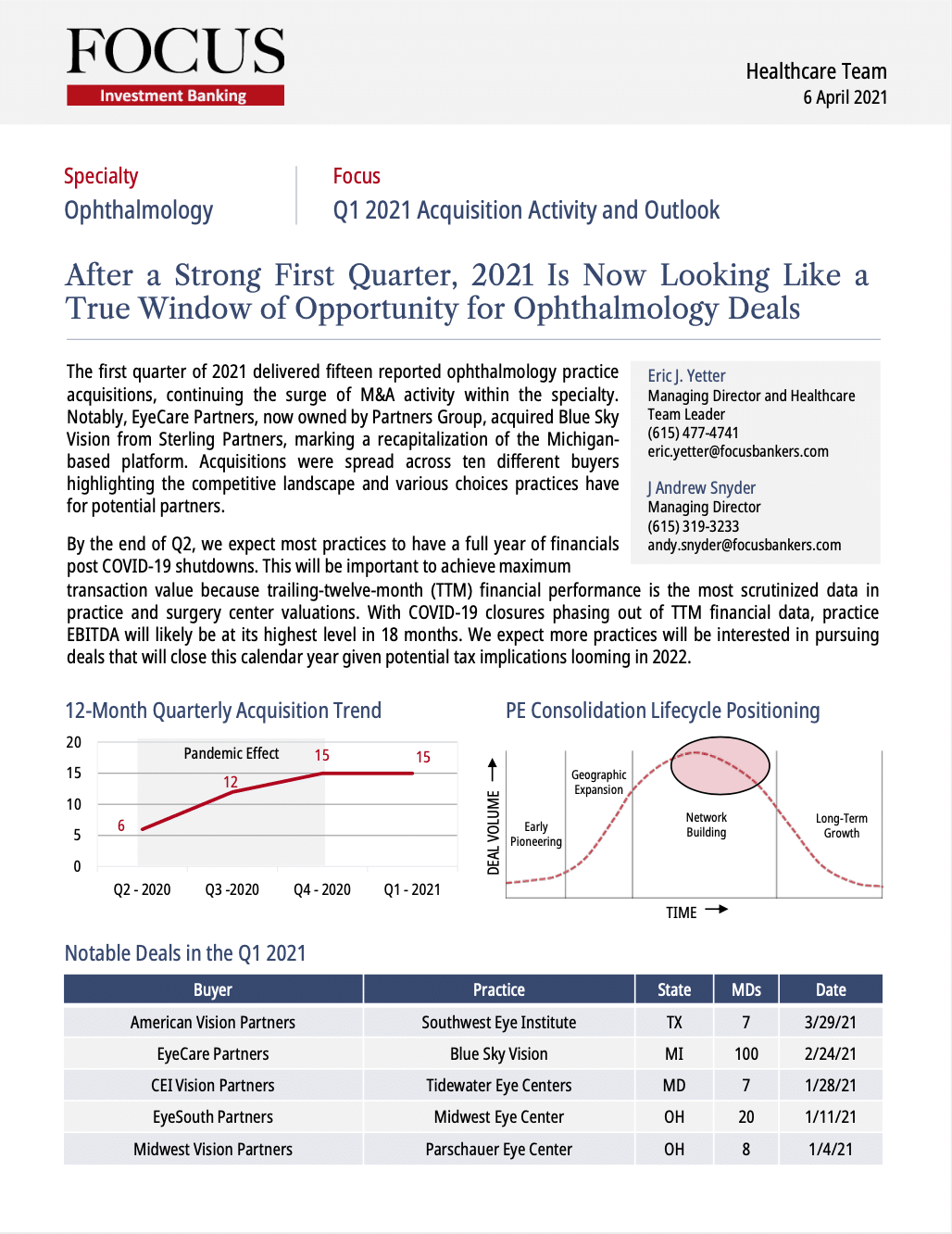

Ophthalmology Report – Q1 2021 Acquisition Activity and Outlook

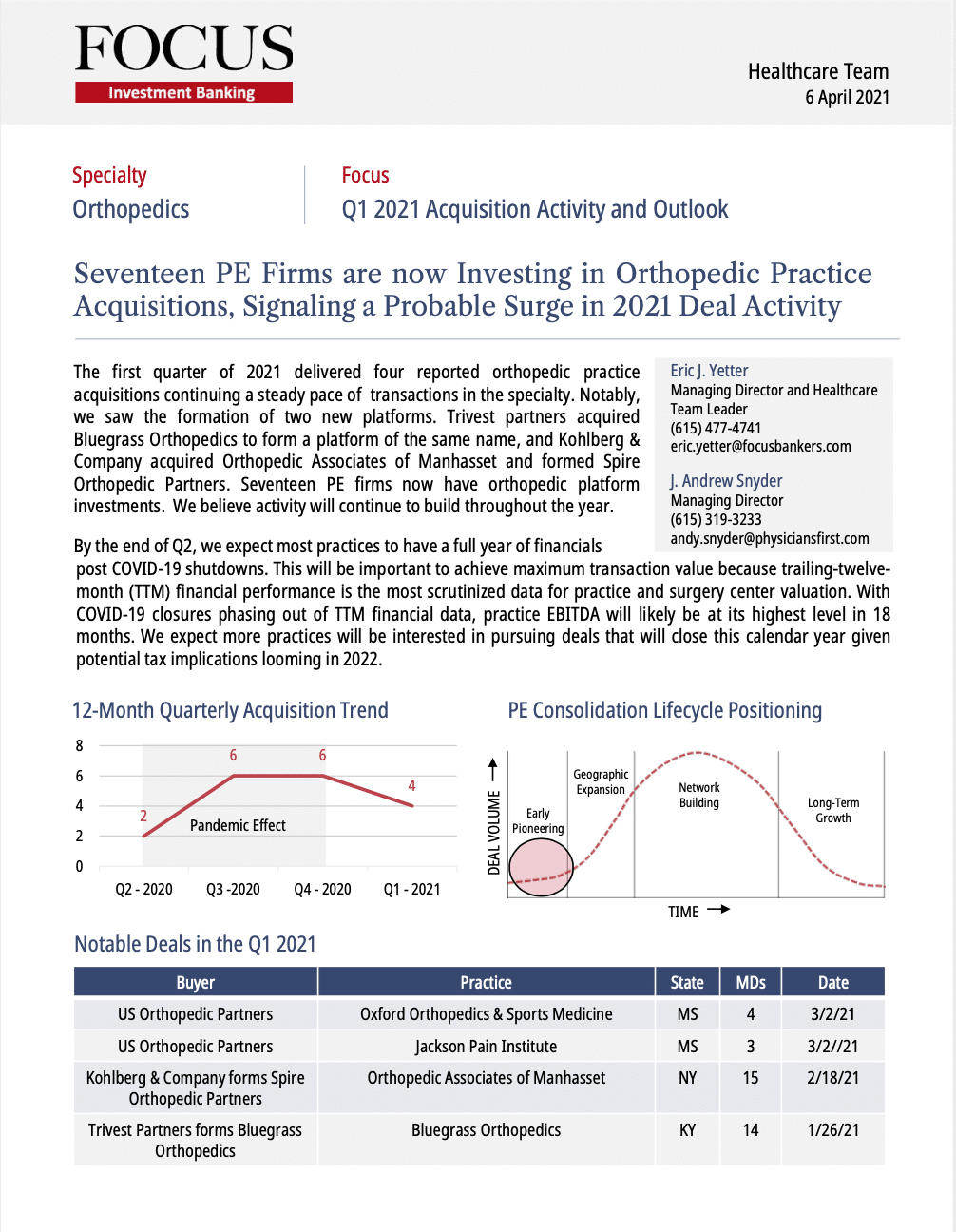

Orthopedics Report – Q1 2021 Acquisition Activity and Outlook

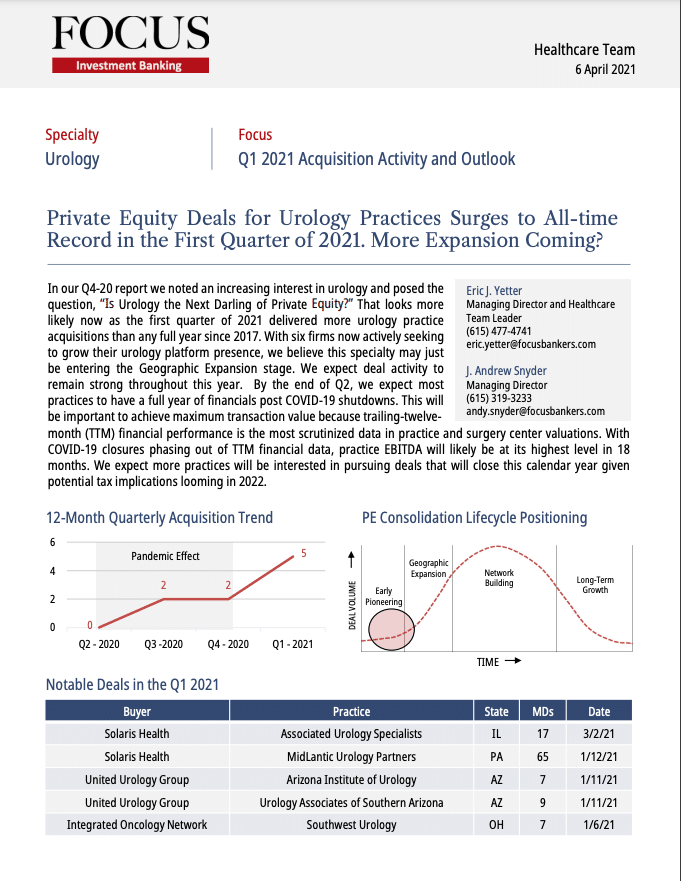

Urology Report – Q1 2021 Acquisition Activity and Outlook

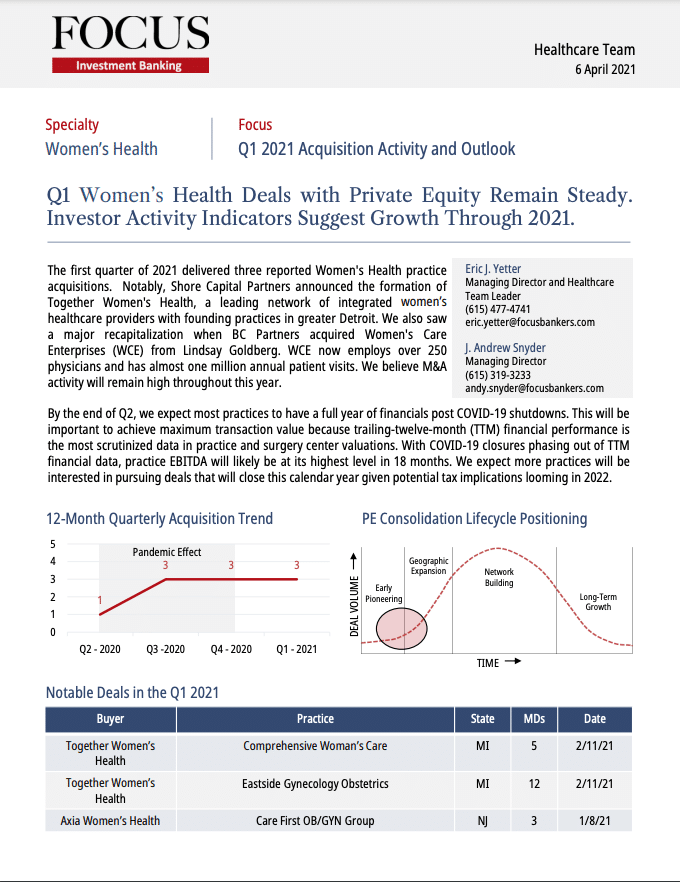

Women’s Health Report – Q1 2021 Acquisition Activity and Outlook

FOCUS Carrier-Focused Telecom Technology Quarterly: Spring 2021 Report