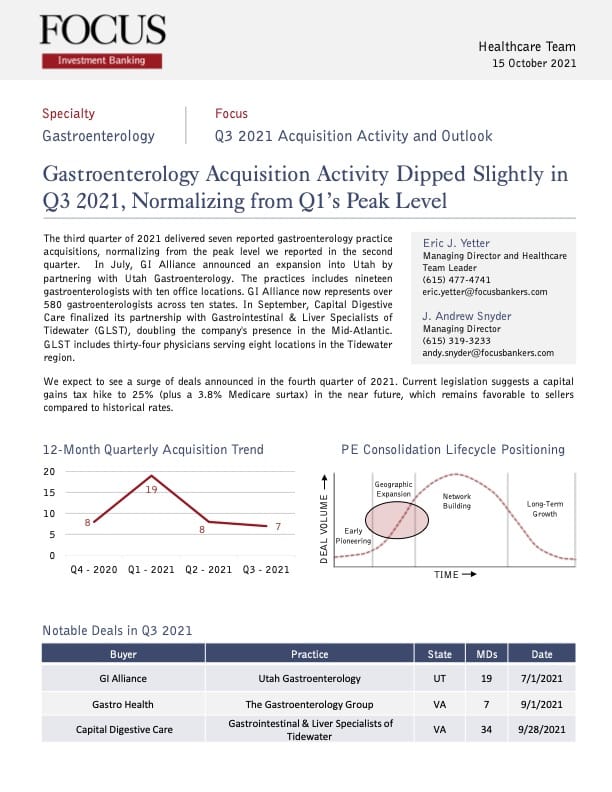

Gastroenterology – Q3 2021 Acquisition Activity and Outlook

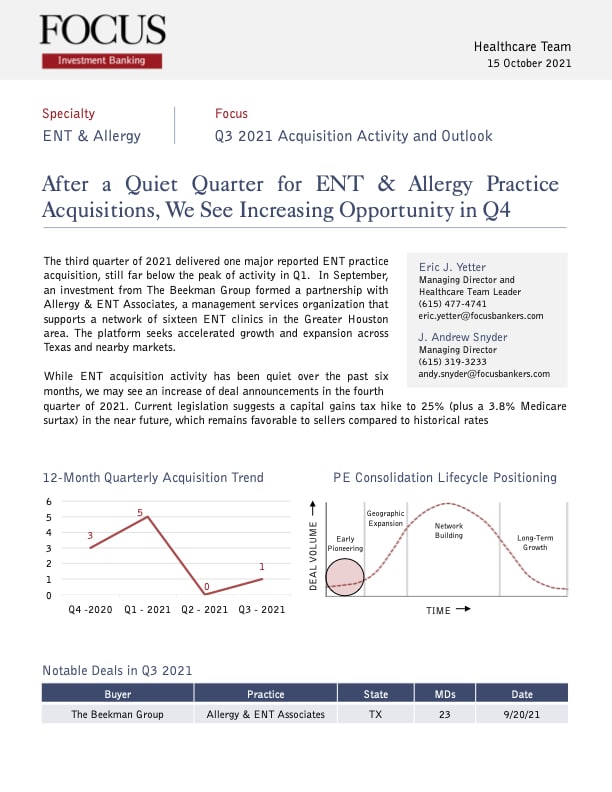

ENT & Allergy – Q3 2021 Acquisition Activity and Outlook

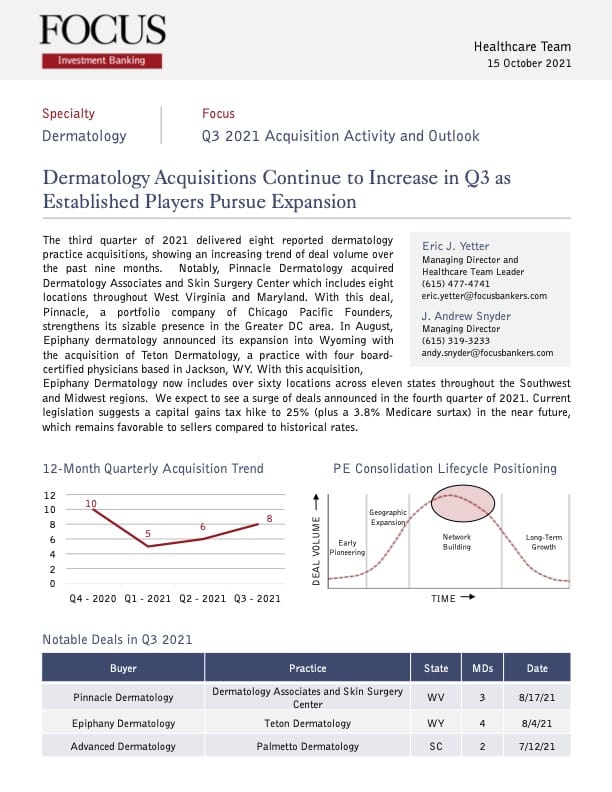

Dermatology – Q3 2021 Acquisition Activity and Outlook

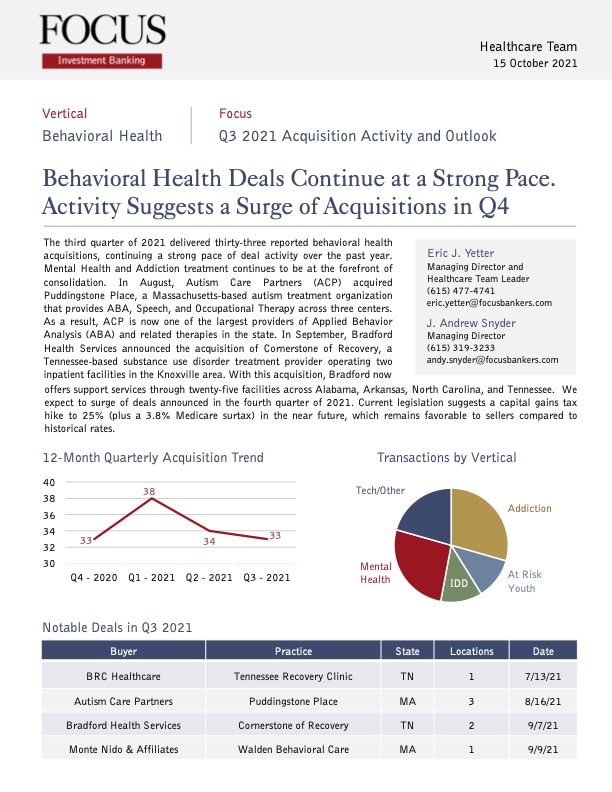

Behavioral Health Report – Q3 2021 Acquisition Activity and Outlook

FOCUS Investment Banking Ranks #1 in Axial’s Top 20 Lower Middle Market Investment Banks

FOCUS Carrier-Focused Telecom Technology Quarterly: Fall 2021 Report

FOCUS Industrials and Energy

FOCUS Telecom

FOCUS Managed Service Providers

FOCUS e-commerce

FOCUS Technology Services

FOCUS Advanced Manufacturing

FOCUS Healthcare

FOCUS Enterprise-Focused Telecom Technology Quarterly – Summer 2021