Telecom Business Services Quarterly: Spring 2024 Report

FOCUS believes that the Telecom Business Services sector is an attractive (and often overlooked) segment of the telecom market. The companies in this sector perform services such as distributing communications-related products, designing and installing communications infrastructure and providing repair and other logistics services for both communications service providers and businesses. These companies often benefit from the same exciting trends that drive growth in the larger telecommunications industry. However, as professional services businesses they tend to be much less capital-intensive than network-based telecommunications service providers. Furthermore, they typically face little threat from shifts in technology. In fact, more often than not they benefit from technology shifts as upgrade cycles drive client demand for their services and expertise. FOCUS is proud of its commitment to the Telecom Business Services sector and we are excited about the prospects for companies in this space. The FOCUS Telecom Technology and Services group consists of two professionals with a combined 30+ years of transaction experience across a wide variety of telecommunications-related companies. The FOCUS Telecom team is uniquely qualified to help middle market clients reach their strategic objectives because the group:

- Devotes significant senior level resources to executing t Save ransactions for lower middle market clients,

- Has a breadth of knowledge that covers most segments of the telecom industry,

- Has seasoned bankers with decades of telecom industry experience,

- Has a proven transaction methodology for delivering results,

- Is equally comfortable with buy side and sell side M&A,

- Leverages an experienced team of research professionals,

- Has a national presence with coverage of both east and west coasts.

Sub Sector Definitions

Distributors and Logistics Services: This sub sector includes companies that distribute communications-related products or that provide repair, refurbish and other supply chain management solutions. Companies in this segment may serve either telecom service providers, businesses or both. Engineering and Construction: Engineering and Construction companies provide a variety of services including network planning and design, systems integration, installation and construction. Customers are primarily service providers but may also include large enterprises and governments.

Public Markets

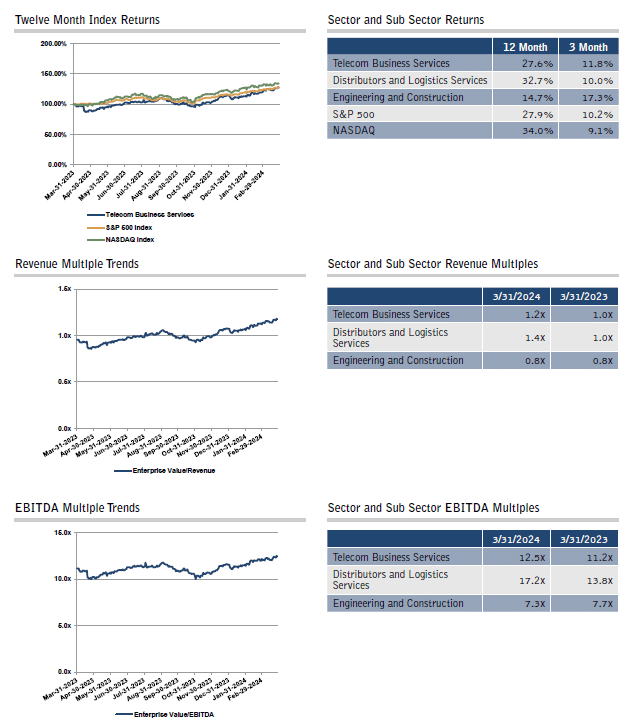

For the second straight reporting period the FOCUS Telecom Business Services Index (TBSI) enjoyed a double digit return as it jumped up 11.8% in the past three months. This outperformed both the 10.2% gain in the S&P 500 and the 9.1% gain in the NASDAQ over the corresponding time period. The TBSI also delivered a strong return of 27.6% over the past 12 months. However, this return lagged the year-over-year performance of both the S&P 500 (up 27.9%) and the NASDAQ (up 34.0%). Sector multiples are also higher than they were at this time a year ago. The sector revenue multiple increased from 1.0x a year ago to 1.2x currently, while the sector EBITDA multiple increased from 11.2x to 12.5x. Distribution and Logistics Services

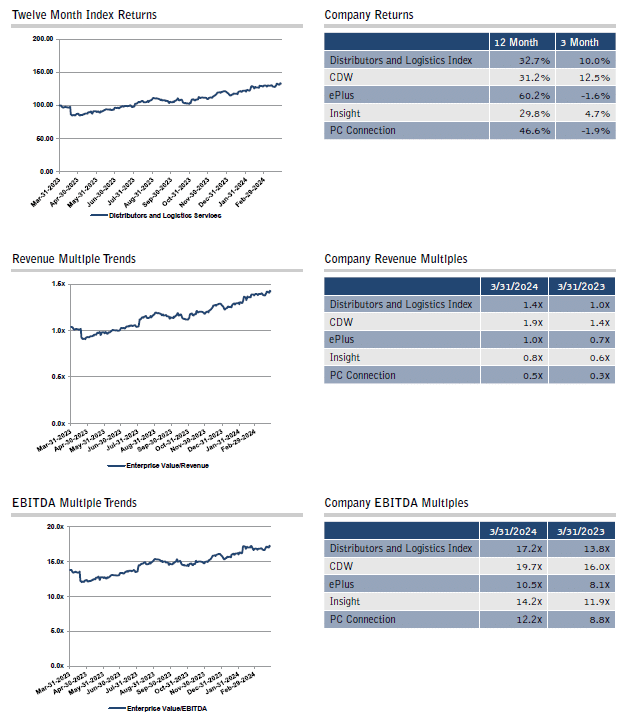

While the Distributors and Logistics Services sub sector broke its streak of being the strongest performer of the TBSI’s two sub sectors, it still enjoyed a strong return of 10.0% over the past three months. The sub sector was evenly split between winners and losers with two apiece, but a 12.5% return at CDW and a 4.7% return at insight were enough to bring the sub sector solidly into positive territory. The sub sector is also up 32.7% compared to this same time last year. Over this time frame, every single stock in the sub sector had a double-digit return, with the strongest gains coming from ePlus and PC Connection. Sub sector multiples closed out the period at 1.4x revenue and 17.2x EBITDA. Both of these compare favorably to year-ago multiples of 1.0x revenue and 13.8x EBITDA.

Engineering and Construction

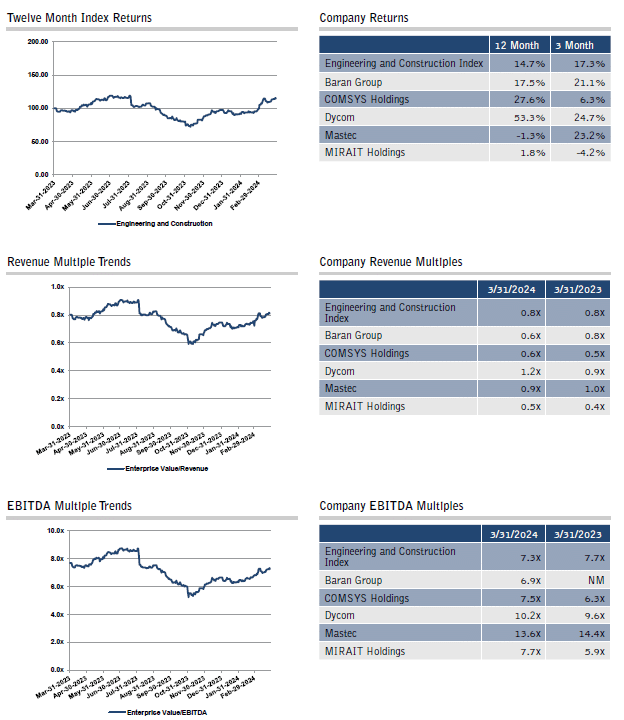

The Engineering and Construction sub sector also enjoyed a second straight reporting period with a double-digit gain. In this case, it leaped up 17.3% in the past three months. Gains were broad-based as four of the five stocks in the sub sector were in positive territory, including three with a return of 20% or more. These included U.S. companies Dycom (up 24.7%) and Mastec (up 23.2%). This period’s gains helped propel the sub sector to a 14.7% return over the past 12 months. Dycom was the best performing stock over this time period with a gain of 53.3%, while Mastec was the lone company in the sub sector to suffer a year-over-year loss with its 1.3% decline. Sub sector multiples were flat to down over the past year. The sub sector revenue multiple held steady at 0.8x, but the EBITDA multiple dipped from 7.7x down to 7.3x.

Telecom Business Services: Public Market Summary

M&A Summary Comments

M&A

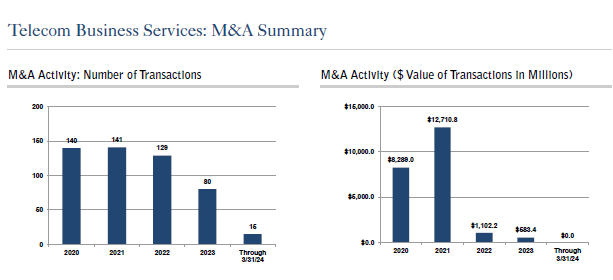

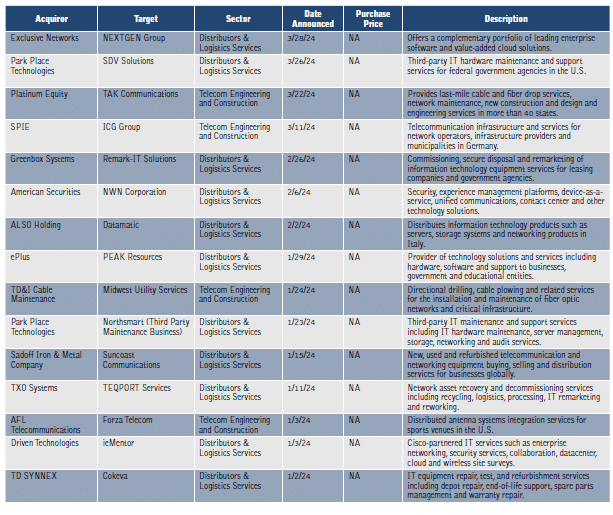

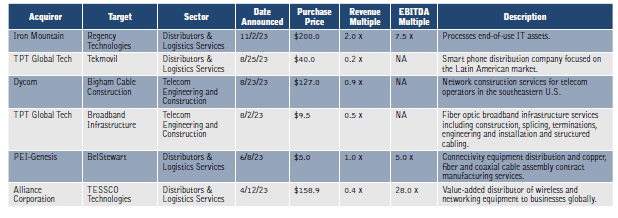

It was a slow start to 2024 in terms of the level of M&A activity in the Telecom Business Services sector. We counted only 15 transactions in these past three months, none of which had an announced dollar value. While we would caution against reading too much into the year’s slow start, it is certainly discouraging to see the pace of M&A activity running below even the relatively anemic pace of activity that we saw in 2023. Distributors and Logistics Services For the second straight reporting period the Distributors and Logistics Services sub sector had 11 transactions. In what was likely the period’s largest transaction, private equity firm American Securities acquired NWN Corporation from its previous private equity backers. Park Place Technologies continued its acquisitive ways with the acquisition of two more third party maintenance providers. These were SDV Solutions and the third party maintenance business of Northsmart. Finally, we also continued to see significant activity involving companies in the secondary equipment market. Transactions this period were the TXO Systems acquisition of German supplier TEQPORT Services, the Sadoff Iron & Metal Company’s purchase of Suncoast Communications and the Greenbox Systems acquisition of Remark-IT Solutions. Engineering and Construction With only four transactions, the Telecom Engineering and Construction sub sector was chiefly responsible for the extremely low level of M&A activity this period. On the plus side, we did see a new platform company in the space with the acquisition of last-mile construction company TAK Communications by Platinum Equity. In addition, existing private equity platform company TD&I Cable Maintenance made its inaugural acquisition with the pickup of Midwest Utility Services. In the sub sector’s other two transactions, AFL Telecommunications acquired distributed antenna system construction company Forza Telecom and SPIE acquired German construction company ICG Group. Transactions with Multiples There were no transactions with announced multiples this period.

Telecom Business Services: M&A Summary

M&A Announced Transactions (1/1/24 – 3/31/24)

M&A Announced Transactions (4/1/23 – 3/31/24)

Sub Sector Analysis: Distributors and Logistic Services

Sub Sector Analysis: Engineering and Construction