Telecom Business Services: Fall 2025 Report

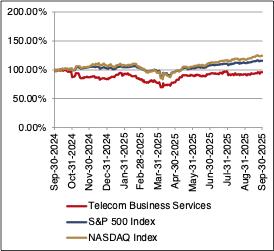

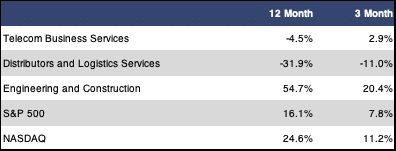

While its performance was not nearly as strong as its 20%+ return in our summer report, the FOCUS Telecom Business Services Index (TBSI) still managed to stay in the black with a three-month gain of 2.9%. This performance put the sub sector well behind the broader indices as the S&P 500 gained 7.8% and the NASDAQ gained 11.2% over the corresponding time period. The TBSI’s underperformance is even more pronounced over the full year time frame. While the TBSI is down 4.5% over the past year, the S&P 500 and the NASDAQ gained 16.1% and 24.6%, respectively. Sector multiples are also down slightly compared to this same time last year.The revenue multiple dropped from 1.2x to 1.1x, while the EBITDA multiple fell from 12.3x to 11.2x.

This reporting period was clearly a tale of two very different sub sector performances. The Engineering and Construction sub sector enjoyed a second straight strong performance with a gain of 20.4% over the past three months.U.S. companies Dycom and MasTec were the two strongest performers as Dycom gained 19.4% and MasTec gained 24.9%.After two straight periods with significant gains, the Engineering and Construction sub sector is now up 54.7% year-over-year. Sub sector multiples closed out the period at 1.3x revenue and 10.5x EBITDA. Both of these are significantly higher than year-ago multiples of 1.0x revenue and 8.1x EBITDA. On the other hand, the Distributors and Logistics Services sub sector did not fare nearly as well. The sub sector plummeted 11.0% in our fall reporting period. Every single stock in the sub sector had a negative return over the past three months, including double-digit losses at both CDW and Insight. After this poor performance, the Distributors and Logistics Services sub sector is now down 31.9% compared to this time last year. Sub sector multiples have also dropped sharply in the past 12 months.The sub sector revenue multiple fell from 1.4x to 1.0x, and the EBITDA multiple fell from 16.4x to 11.8x.

Public Markets Summary

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

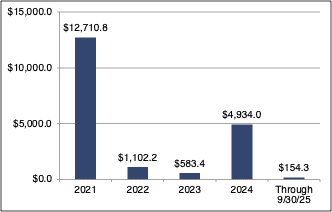

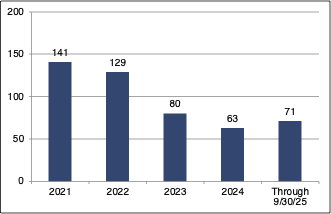

M&A activity in the Telecom Business Services sector was strong with 26 total transactions in our fall reporting period.As has been the case for all of 2025, the total announced transaction dollar value was very low at only $23.3 million. However, this number is a bit misleading, as there were certainly some large deals that occurred over these past three months that just did not have an announced value. With three quarters of 2025 complete, we count 71 transactions with a total announced transaction dollar value of just more than $150 million. This puts 2025 to be on track to be much stronger than either of the last two years in terms of the total number of deals, but well behind previous years in terms of the announced dollar value of these deals.

Activity was split evenly between the two sub sectors with 13 transaction apiece. In the Distributors and Logistics Services sub sector, the most noteworthy transaction was the Service Express acquisition of Park Place Technologies. This acquisition combined two of the largest players in the third-party maintenance space. While there was no announced transaction dollar value for this deal, the transaction was certainly of a very considerable size. In another transaction in the Distributors and Logistics Services sub sector, Talley made its first acquisition since it brought on its private equity backer Rexel. This was the acquisition of fellow wireless distributor Connectronics. Moving to the Telecom Engineering and Construction sub sector, we noted that ITG Communications acquired the assets of Tilson Technology Management out of bankruptcy for $22.0 million. We also saw two acquirers ink multiple acquisitions this period.Circet Groupe acquired fiber engineering firm SourceOne as well as fiber construction company Gemini Communications.Likewise, FBR acquired telecom engineering firm RTS Associates as well as fiber construction company Johnson Communications.

There were no transactions with announced multiples in our fall reporting period.

Number of Transactions

$ Value of Transactions in Millions