As of the end of 2019, there were 25 private equity firms actively investing in ophthalmology practices and surgery centers. It is among the most active physician practice consolidations currently taking place in the United States.

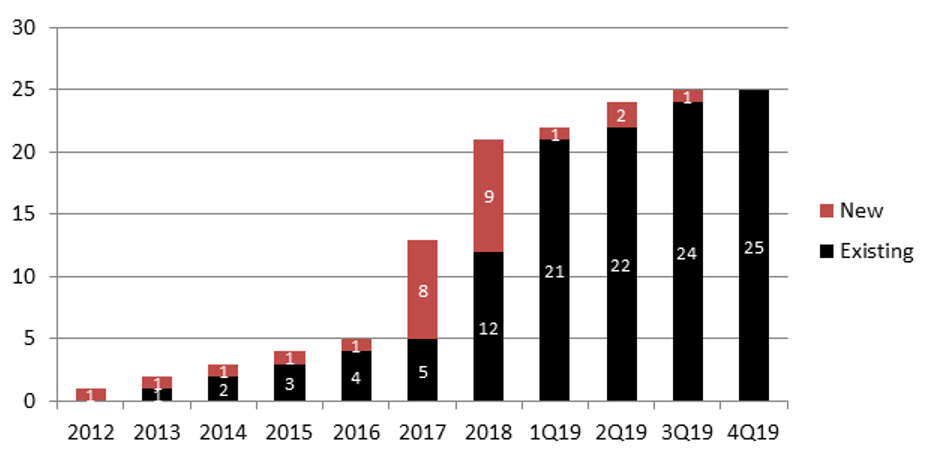

Investor Entry Over Time

There was a significant increase in the number of private equity investors during the 2017-18 period when 17 new firms entered the space. Note that one existing firm exited through a sale to a new entry in 2018. Four new firms entered in 2019.

Number of PE Firms Investing in Ophthalmology

Names of Investing Companies

- American Vision Partners

- Atlantic Vision Partners

- Blue Sky Vision

- California Retina Associates

- Century Vision Global

- CVP (CEI Vision Partners)

- Comprehensive EyeCare Partners

- Covenant Physician Partners

- EVP EyeCare

- EyeCare Partners

- Eye Health America

- Eyecare Services Partners

- EyeSouth Partners

- Midwest Vision Partners

- NVision Eye Centers

- OOMC

- Ophthalmic Specialists of Michigan

- Prism Vision Group

- ReFocus

- SEES Group

- SightMD

- Spectrum Vision Partners

- Unifeye Vision Partners

- US Eye

- Vision Innovation Partners

- Vision Integrated Partners

Private Equity Firms and Their Practice Management Company Subsidiaries

Private equity firms usually create a subsidiary Practice Management Company within their portfolios to acquire and manage ophthalmology practices and ambulatory surgery centers. Most transactions include some equity ownership in that parent management company.

The combination of the private equity firm names and the new practice management company names can be confusing and is simplified below.

To learn more about our healthcare investment banking services or to discuss your specific situation with no obligation please feel free to call. We are happy to share our knowledge and help you understand your options. All conversations are strictly confidential.

Eric Yetter

Eric Yetter

FOCUS Managing Director and Healthcare Team Leader

Direct: 615-477-4741