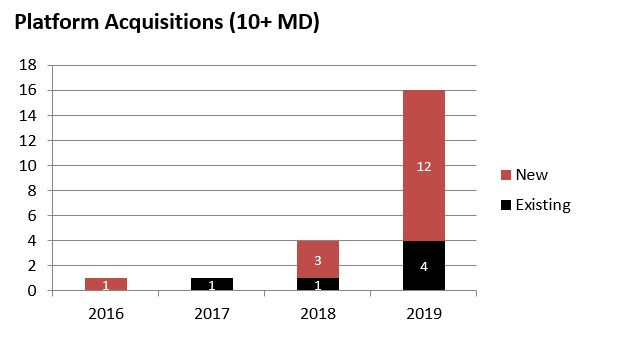

Two key factors provide a view of current and future consolidation speed: 1) the acquisition of platform practices of 10 or more physicians and 2) the geographic footprint of those acquisitions.

Large Platform Practice Acquisition Up 400%

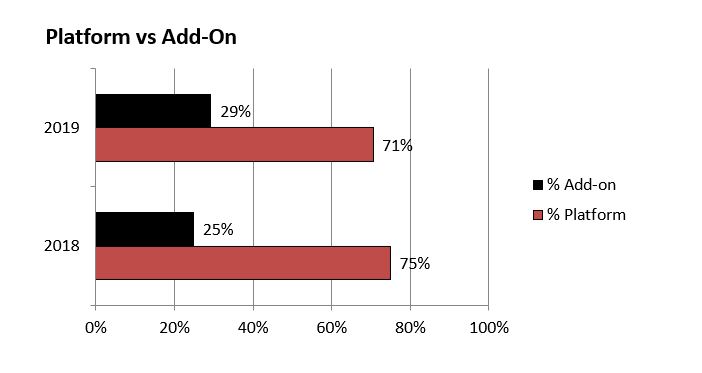

Gastroenterology platform acquisition exploded in 2019 when 12 platform acquisitions represented a 400% increase over 2018 and tripled all platform activity over the prior three years. In the last two years, platform acquisitions have dominated the transaction mix at over 70%. Add-on acquisitions (practices with less than 10 physicians) are more commonly acquired and “added-on” to strengthen the initial platform practice and extend its geographic coverage.

The Rush to Secure New Geographic Areas (NGAs)

The Rush to Secure New Geographic Areas (NGAs)

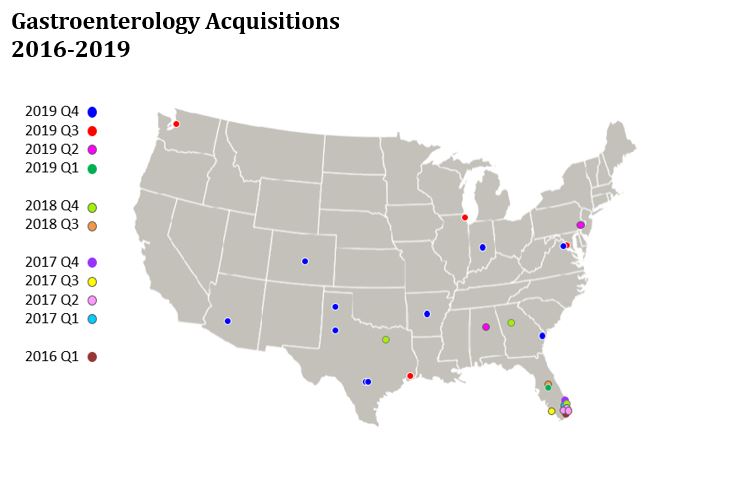

The location of the twelve 2019 gastroenterology platform acquisitions is shown below with their physician count in parenthesis. This one-year geographic expansion is unusually large, fast and widespread. This is a clear indication that participating PE firms are pursuing an aggressive strategy to establish their geographic footprint.

- Birmingham, AL (20)

- Philadelphia, PA (64)

- Evanston, IL (45)

- Washington, DC (55)

- Seattle, WA (24)

- Phoenix, AZ (50)

- San Antonio, TX (13)

- Indianapolis, IN (16)

- Savannah, GA (10)

- Fairfax, VA (18)

- Colorado Springs, CO (25)

- Little Rock, AR (12)

PE has now invested in nineteen key geographic markets throughout the United States (circled areas). We identify these key market entries as New Geographic Areas (NGAs). Of course, NGA market size can vary significantly based on population and practice makeup.

In the 2016-2018 period, only five New Geographic Areas (NGAs) were entered. In 2019, fourteen NGAs were entered spread evenly throughout the US. We believe there will be a significant increase in prospecting activity around those platforms and in new geographies yet to be entered.

Eric Yetter

Eric Yetter

FOCUS Managing Director and Healthcare Team Leader

Direct: 615-477-4741

The Rush to Secure New Geographic Areas (NGAs)

The Rush to Secure New Geographic Areas (NGAs)