FOCUS Sale Preparation Advisory Services

As a leading provider of sell-side advisory services to middle market companies, FOCUS Investment Banking understands how to execute a successful transaction process and deliver maximum value for our clients. It is our mission to enable owners to achieve the best price and find the best partner/acquirer for the business they have built.

As part of that effort, we work hard to learn our clients’ businesses and the markets they serve. Sometimes owners are ready to transact – but their businesses may not be, and that lack of readiness can result in a reduction in value or a failed process.

FOCUS Sale Preparation (FSP) is a flexible, targeted program designed to clarify and remedy business shortcomings which we believe will impede a sale process or adversely affect the outcome. Our experienced FSP advisory staff, in close alignment with the transactional and industry expertise provided by our banking team, works with clients to identify key issues and execute on practical, measurable, high impact activities to make concrete improvements in reasonable time frames.

The FSP offering focuses all parties on achieving the objective: a successful transaction at maximum value.

Contact us to learn more about how we can help you.

Jeb Connor

Managing Director and Team Leader, FOCUS Sale Preparation Advisory Services

Services

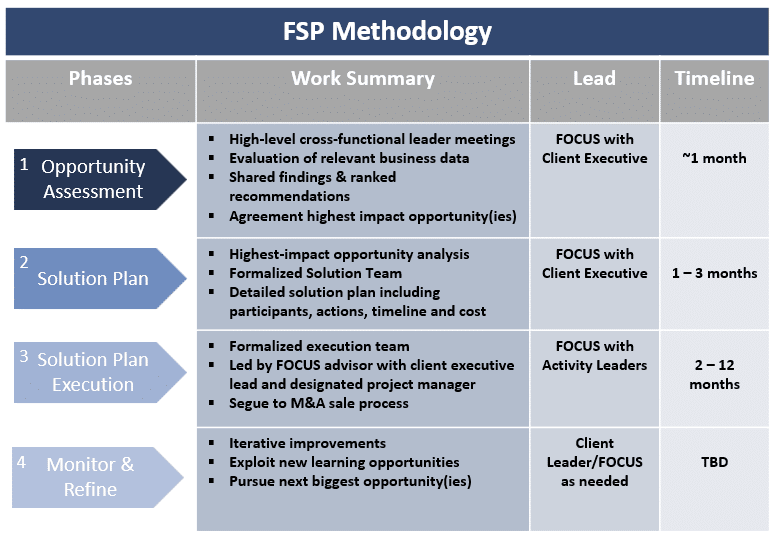

The FSP offering is tailored to each client’s situation and circumstances, guided by the FSP IMPACT METHODOLOGY approach, led by a FOCUS executive advisor who has been in your shoes. Jeb previously was a CEO and has extensive operational and M&A exit experience. A time and results-focused, cross-disciplinary assessment and planning phase is followed by a solution execution phase. The FSP team is hands on with the client, keeping all parties focused on the highest impact activities to reach “transaction-ready” status. In addition to assistance with operational and strategic issues, the FSP team provides critical insights on how external market factors (tax policy, M&A activity levels) can impact value, and how acquirers view and value key attributes in an acquisition target.

FSP program activities often include:

FOCUS Sale Preparation program provides highly experienced operational and transaction professionals to actively assist companies in assessing, planning, and executing on the highest impact change(s) to rapidly ready them for achieving their exit goals.

Why FOCUS?

FOCUS Investment Banking has a singular mission for its sell-side clients – to execute a successful transaction process and deliver maximum value. In pursuit of that objective, FOCUS’ banking teams leverage the FOCUS Sale Preparation Advisory team when it makes sense for the client. Clients know they are still on the path to transact, working collaboratively with an aligned team on a holistic and integrated route to achieve their goals.

FOCUS Banking and Sale Preparation Advisory teams are ideally suited to work together, because:

FOCUS Advisory Differentiators

A singular mission to assist great companies achieve the changes needed to ready them for a successful corporate development outcome.

Led by a “been in your shoes” FOCUS executive advisor with direct access to FOCUS Investment Banking resources and external network

FSP IMPACT METHODOLOGY

Getting Started

Engagement Fit Analysis