FOCUS Telecom U.S. Communications Service Provider Quarterly: Summer 2024 Report

OVERVIEW

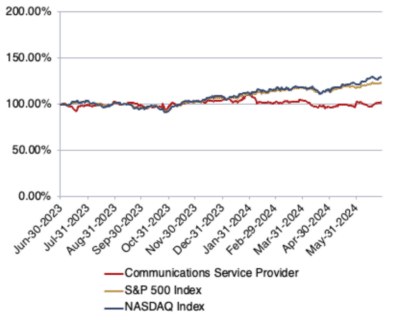

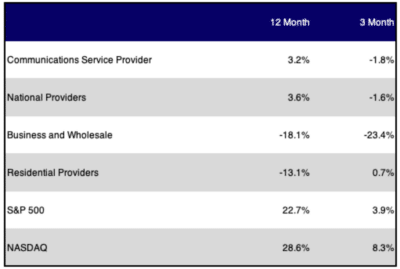

After turning in positive returns in each of our last two reports, the FOCUS Communications Service Provider Index (CSPI) fell into negative territory with a three-month loss of 1.8%.

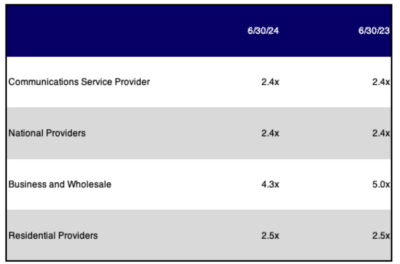

This loss was despite a generally positive market backdrop that saw the S&P 500 gain 3.9% and the NASDAQ gain 8.3% over the corresponding time period. Over the last 12 months, the CSPI was up 3.2%. This performance once again trailed the broader indices, as both the S&P 500 and the NASDAQ were up more than 20% over the past year. Sector multiples closed out the period at 2.4x revenue and 6.4x EBITDA. These multiples are unchanged from this same time last year.

The only sub sector in the CSPI to post a positive return over the past three months was the Residential Providers, which inched up 0.7%. The sub sector’s best performers were Telephone and Data Systems and WOW, both of which were buoyed by potential M&A rumors. The National Providers sub sector declined 1.6% this period as Comcast dropped nearly 10% and Lumen dropped nearly 30%. However, it was not all gloom and doom for the sub sector as AT&T jumped up 8.6%. The CSPI’s worst performing sub sector by a wide margin was Business and Wholesale.This sub sector plummeted nearly 25% in the past three months. While all of the companies in the sub sector posted negative returns, Uniti was the worst performing stock as the company shed half of its value after announcing it would merge with Windstream.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

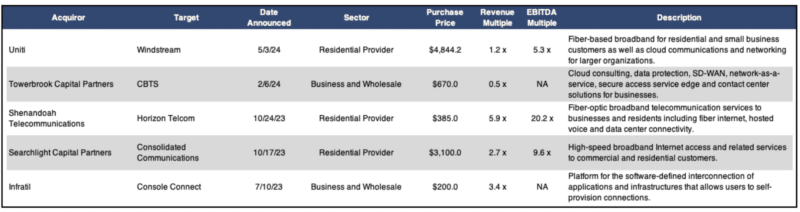

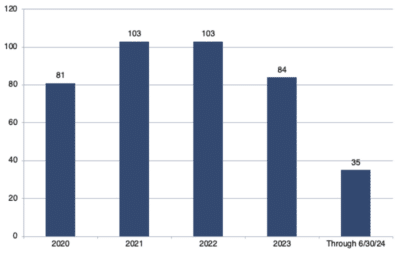

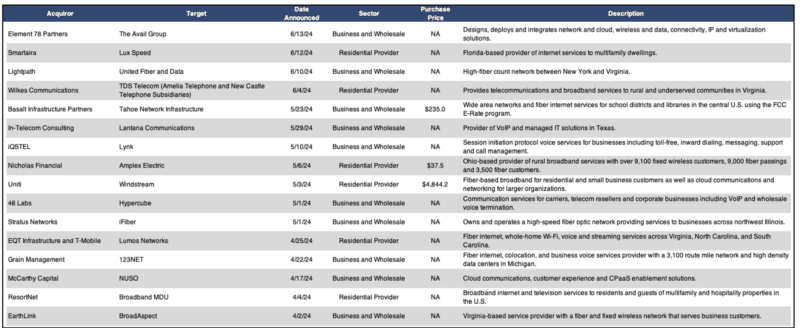

M&A ACTIVITY

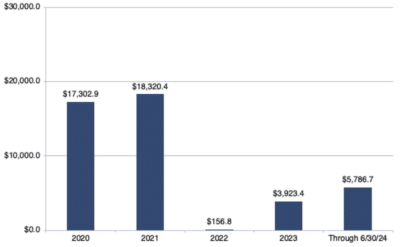

Based on the number of announced transactions, the Business and Wholesale sub sector dominated M&A activity as it accounted for 10 of our 16 total transactions. Basalt Infrastructure Partners and Grain Management both inked new business fiber investments in Tahoe Network Infrastructure and 123NET, respectively.In a platform transaction involving an asset light provider. McCarthy Capital acquired cloud communications company NUSO. While the Residential Providers sub sector saw fewer transactions, it did account for the majority of announced transaction dollar value with Uniti’s purchase of Windstream for $4.8 billion. In another notable transaction in the Residential Providers space, EQT and T-Mobile are banding together to invest in Lumos Networks to expand its FTTH platform.

The only transaction with an announced multiple this period was Uniti’s acquisition of Windstream. The multiple for this transaction was 1.2x revenue and 5.3x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (4/1/24 – 6/30/24)

M&A TRANSACTIONS WITH ANNOUNCED MULTIPLES (7/1/24 – 6/30/24)