FOCUS Telecom U.S. Communications Service Provider Quarterly: Spring 2024 Report

FOCUS believes that the need for communications services has never been greater. Large enterprises, small and medium sized businesses and individuals have all come to rely upon ubiquitous access to voice, video and data services to run their day-to-day activities. Furthermore, the importance of Communications Service Providers (CSPs) appears poised to increase further. For businesses, these providers are enabling a variety of new services ranging from videoconferencing to software defined networking and security. On the residential side, many of these companies are on the forefront of bringing broadband access to historically underserved areas. Access to capital and the benefits of scale will mean that a small number of large companies will continue to dominate certain areas such as mobile wireless and video. However, FOCUS continues to see opportunities for middle market CSPs. While not as large as the industry giants, they continue to thrive by developing innovative business models that share one or more characteristics such as capital efficiency, customer responsiveness, an advanced technology platform and a focus on an underserved industry vertical or geography. Furthermore, it is often the middle market CSPs that point the direction for the future of the industry. FOCUS is proud of its commitment to the CSP sector and we are excited about the prospects for middle market companies in this space.

The FOCUS Telecom Technology and Services group consists of two professionals with a combined 30+ years of transaction experience across a wide variety of telecommunications-related companies. The FOCUS Telecom team is uniquely qualified to help middle market clients reach their strategic objectives because the group:

Sub Sector Definitions

National Providers: Large, nationwide telecommunications and cable operators that offer a diverse array of services throughout much of the U.S.

Business and Wholesale: Companies that focus on providing connectivity, voice and transport services to businesses and other telecom service providers.

Residential Providers: Regional providers that have a large component of their business that serves residential and small business customers.

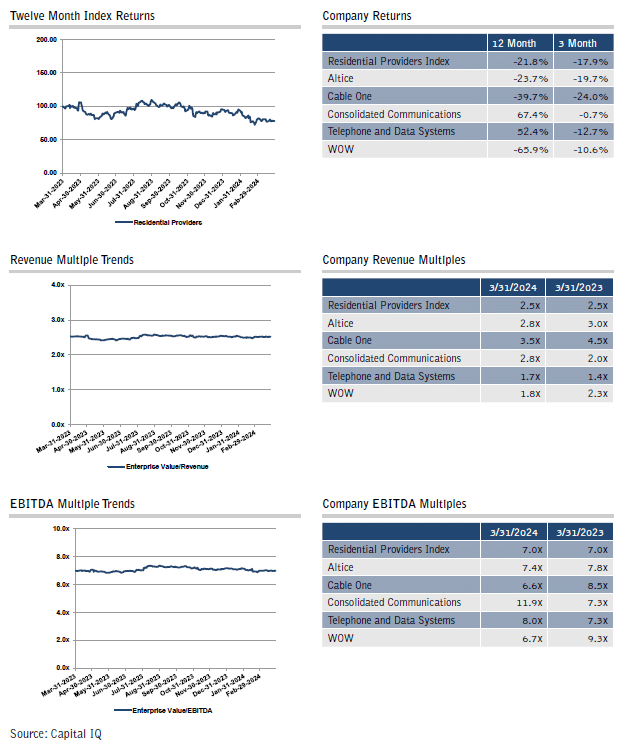

Public Markets

The FOCUS Communications Service Provider Index (CSPI) managed a second straight reporting period in positive territory, although with a three-month gain of only 1.0% the return was fairly slim. This gain was made even less impressive by the fact that the S&P 500 was up 10.2% and the NASDAQ was up 9.1% over the same time period. The CSPI also lagged the broader indices for the full year period. While the CSPI gained 2.2% over the past 12 months, the S&P 500 jumped up 27.9% and the NASDAQ delivered an even more impressive return of 34.0% over the same time frame. Sub sector multiples are virtually unchanged from this time last year. The CSPI’s revenue multiple held steady at 2.4x, while the EBITDA multiple ticked up slightly from 6.4x a year ago to 6.5x currently.

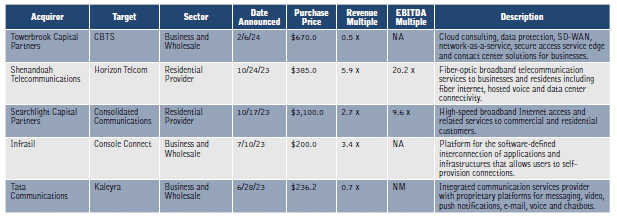

National Providers

The National Providers sub sector gained 1.4% in the past three months. This was entirely due to gains of 4.9% at AT&T and 11.3% at Verizon. All of the other companies in the sub sector traded in negative territory this period, including a 25.2% loss at Charter. For the full year period, the sub sector gained 2.5%. Verizon enjoyed a year-over-year gain of 7.9%, while Comcast actually turned in the sub sector’s best full year performance with a gain of 14.3%. At the other end of the spectrum, Lumen shed more than 40% of its value over the past year. The sub sector revenue multiple remained unchanged compared to this time last year at 2.4x. The sub sector EBITDA multiple increased from 6.4x to 6.5x over the same time period.

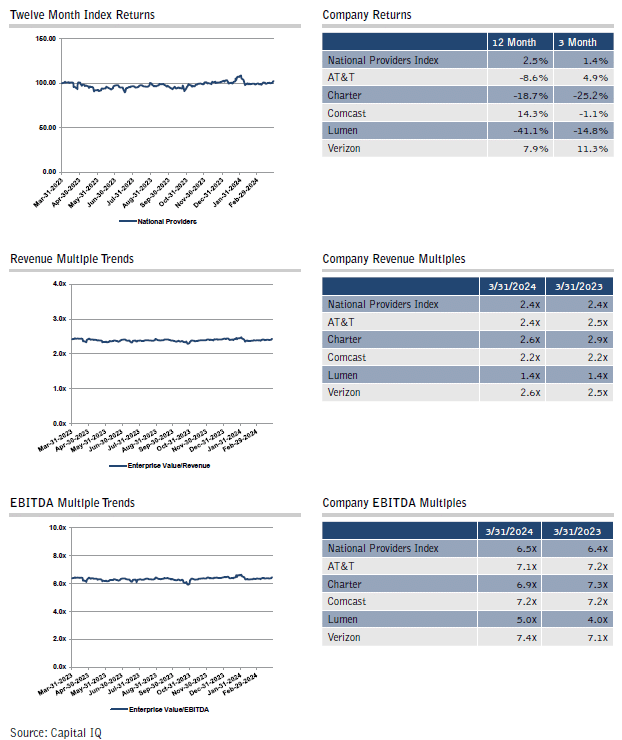

Business and Wholesale

The Business and Wholesale sub sector was solidly in negative territory in our spring reporting period with a loss of 7.1%. Bandwidth and Uniti actually delivered positive returns, but a 14.1% drop at Cogent Communications was enough to drag the entire sub sector into the red. On the plus side, the sub sector’s 16.8% year-over-year gain made it the CSPI’s best performing sub sector over the past 12 months. All of the stocks in the sub sector traded higher over this time period, including a 20.1% return at Bandwidth and a 66.2% gain at Uniti. Sub sector multiples closed out the period at 4.9x revenue and 11.3x EBITDA. Both of these are higher than multiples at this time last year of 4.8x revenue and 9.7x EBITDA.

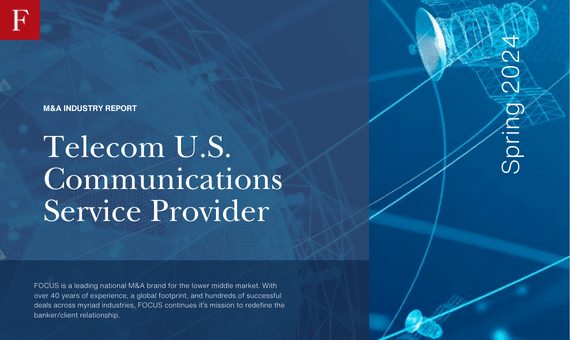

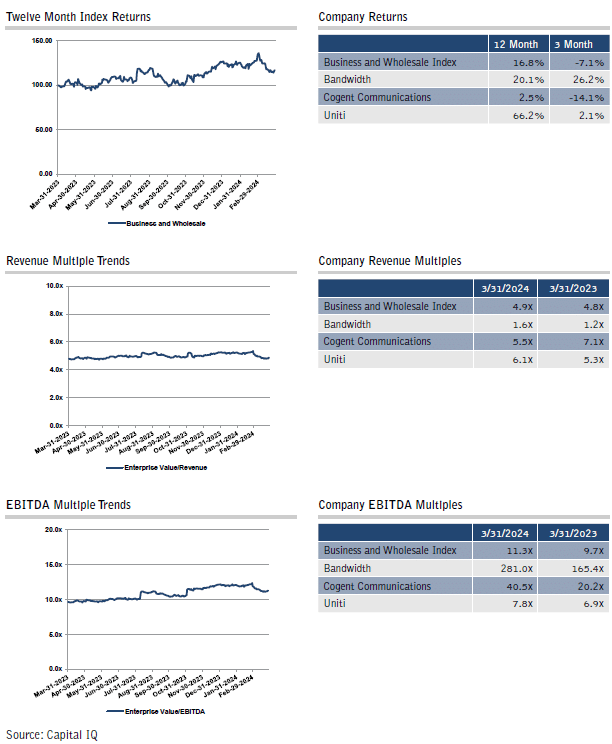

Residential Providers

The Residential Providers sub sector was in the CSPI’s cellar for the second straight reporting period after dropping nearly 18% in the past three months. Losses were broad-based as every single company in the sub sector traded down. The sub sector is also the worst performing sub sector in the CSPI for the full year with a loss of 21.8%. On the plus side, at least there were two companies in the index (Consolidated Communications and Telephone and Data Systems) that are trading meaningfully higher than they were a year ago. However, these gains were not sufficient to overcome steep losses at Altice, Cable One and WOW. Despite the sub sector’s significant losses over the past year, sub sector multiples remained unchanged at 2.5x revenue and 7.0x EBITDA.

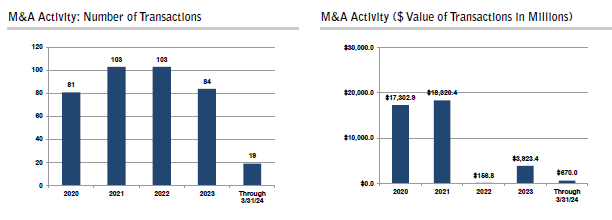

M&A

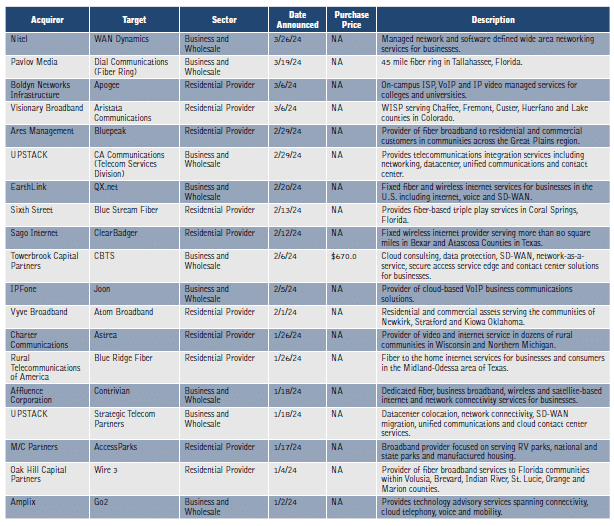

M&A activity in the Communications Service Provider sub sector continued to bump along at a fairly modest rate. We counted 19 total transactions this period for a total announced transaction dollar volume of $670 million. Both of these figures are slightly below historical norms, but there is still plenty of time left in 2024 for the sector to pick up momentum.

Business and Wholesale

The Business and Wholesale sub sector accounted for nine of the transactions this period. The managed network services area was active as Nitel purchased WAN Dynamics, Towerbrook Capital Partners acquired CBTS and Affluence Corporation acquired Contrivian. In contrast, there was only a single transaction involving a target that owns and operates its own business fiber network. This was Pavlov Media’s acquisition of a 45-mile fiber ring in Tallahassee, Florida. We also noted that two serial acquirers of telecommunications agents were both active for the second straight period. Amplix acquired Go2, while UPSTACK acquired both Strategic Telecom Partners and the telecom services division of CA Communications. Earthlink is another company that has been active of late, and this period it acquired yet another provider of fixed wireless services for businesses with its purchase of QX.net. In the sub sector’s final M&A transaction this period, IPFone acquired VoIP communications services company Joon.

Residential Providers

We counted 10 transactions this period in the Residential Providers sub sector. The market for companies serving MDUs and master planned communities has been active of late, and this was reflected in the makeup of this period’s transactions. Transactions that fell into this category were the Boldyn Networks Infrastructure acquisition of Apogee, the Sixth Street investment in Blue Stream Fiber and the Oak Hill Capital Partners acquisition of Wire 3. In addition

to these three transactions, Ares Management also made a significant investment in FTTH provider Bluepeak. We also noted that two large cable providers made acquisitions of smaller cable providers, with Vyve Broadband announcing that it would acquire Atom Broadband while Charter plans to acquire Astrea. The last transaction we will specifically highlight is the investment by MC Partners in AccessParks. AccessParks provides broadband services in non-traditional settings including trailer parks, national and state parks and manufactured housing.

Transactions with Announced Multiples

The only transactions with an announced multiple this period was the Towerbrook Capital Partners acquisition of CBTS, which was done at 0.5x revenue. The EBITDA multiple for this transaction was not announced.

U.S. Communication Service Provider Sector: M&A Summary

M&A Announced Transactions (1/1/24 – 3/31/24)

M&A Announced Transactions with Revenue Multiples (4/1/23 – 3/31/24)

Sub Sector Analysis: National Providers

Sub Sector Analysis: Business and Wholesale

Sub Sector Analysis: Residential Providers