Telecom U.S. Communications Service Provider: Fall 2025 Report

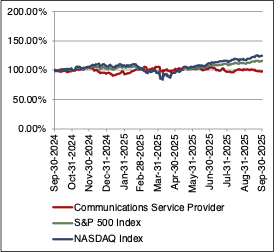

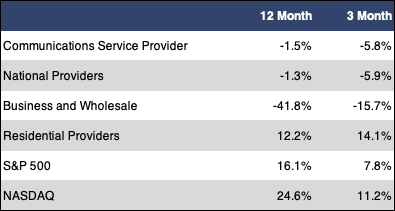

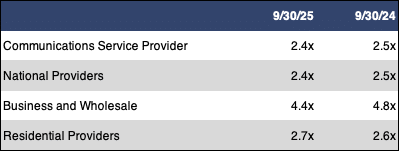

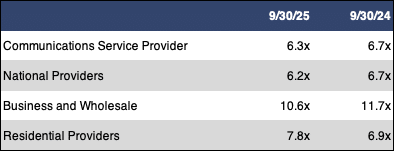

The FOCUS Communications Service Provider Index (CSPI) was in the red for a second straight reporting period as it fell 5.8% in the past three months. This was despite the fact that the broader indices showed solid gains, with the S&P 500 up 7.8% and the NASDAQ up an even more impressive 11.2%. The picture is also similar for the full year period. While the S&P 500 and the NASDAQ were able to boast gains of 16.1% and 24.6%, respectively, the CSPI dropped 1.5%. Sector multiples closed out the period at 2.4x revenue and 6,3x EBITDA. Both of these are lower than year-ago multiples of 2.5x revenue and 6.7x EBITDA.

The star of the CSPI for our fall reporting period was clearly the Residential Providers sub sector. This sub sector jumped 14.1% in the past three months.While every single stock in the sub sector had a double-digit gain, Cable One (up 30.4%) and WOW (up 27.1%) were far and away the top performers. Unfortunately, performance in the CSPI’s remaining two sub sectors was not particularly good. The National Providers sub sector fell 5.9% over the past three months. This was primarily the result of steep losses at both Charter and Comcast. Finaly, the Business and Wholesale sub sector brought up the rear in terms of performance as the sub sector plummeted 15.7% in our fall reporting period. While Bandwidth was up 4.8% during this time frame, this was not nearly enough to overcome a 20.5% decline at Cogent Communications and a 14.6% drop at Uniti.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

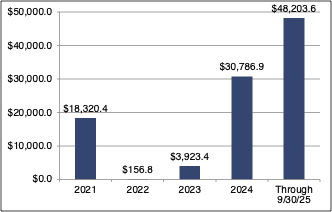

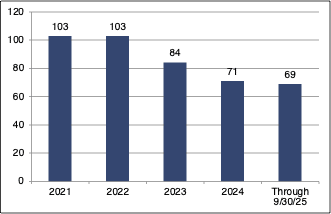

The pace of M&A activity in the Communications Service Provider sector continued to accelerate with a whopping 29 total transactions for the period. This is the highest level of deal volume that we have seen since the M&A boom of 2022.Despite the large number of deals, total announced transaction dollar value was relatively modest at $1.5 billion.Year-to-date, we count 69 total transactions for a total announced transaction dollar value of more than $48 billion. This means that 2025 is on pace to be one of the best M&A years for the Communications Service Provider sector in recent memory.

The Residential Providers sub sector accounted for 16 of the period’s 29 transactions. This included the largest transaction in terms of announced dollar value, which was the take private acquisition of WOW by Digital Bridge and Crestview Partners for $1.5 billion.The Residential Providers sub sector had a number of other notable transactions as well. Missouri-based Socket Telecom combined with Kansas-based IdeaTek to create a significant regional player in the Midwest. In the MDU provider space, Zentro acquired Bel Air Networks, a provider serving the Southern California and Las Vegas markets.Finally, after having a previous transaction fall through, Houston-based Tacchus successfully sold to Ezee Fiber.In the Business and Wholesale sub sector, Blue Owl Capital had a particularly busy three months as it established two new fiber platforms with its acquisitions of Gigabit Fiber in Dallas and South Reach Networks in Florida. Grain Networks-backed Spectrotel acquired SD WAN and SASE specialist Mosaic NetworX. Finally, we noted a relatively high volume of transactions for hosted VoIP and other asset light carriers. These included Clearspan’s acquisition of Broadsoft partner Averistar, the Synpact acquisition of HighComm, the ClearlyIP acquisition of Pulsar360 and the Y2J acquisition of SCS Telecom.

The lone transaction with an announced multiple this period was the acquisition of WOW by a private equity consortium consisting of Digital Bridge and Crestview Partners. This transaction had multiples of 2.5x revenue and 6.5x EBITDA.

Number of Transactions

$ Value of Transactions in Millions