Food & Beverage 4Q 2024 Report

Overview

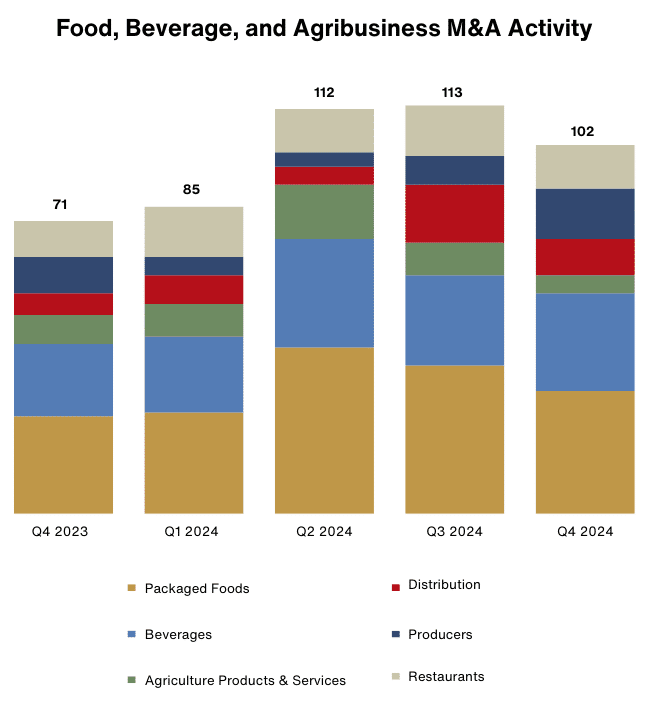

The Food and Beverage industry capped off 2024 with a steady volume of M&A activity, with a total of 412 transactions. Deal volume in Q4 took a slight dip compared to previous quarters, with 104 transactions versus 113 in Q3. The main takeaway of 2024? Food and Beverage businesses remain attractive to buyers thanks to the industry’s stability, resiliency, and opportunities for innovation.

The uptick in Food and Beverage dealmaking in 2024 reflects the relatively strong health of the industry, particularly in CPG (Consumer Packaged Goods) which has benefited from increased pricing. Mirroring previous quarters, most of the transactions in Q4 2024 came from the CPG space, ranging from billion-dollar deals to lower middle market acquisitions. The fourth quarter also continued the trend of large CPG players scooping up better-for-you snack brands, in part to boost sales and in response to changing consumer tastes and shopping habits. Private label producers attracted buyer interest as well, continuing a theme seen throughout 2024, as consumers increasingly make the switch to lower cost private label alternatives.

Large corporate buyers accounted for several mega deals in 2024 including Mars acquiring Kellanova for $36 billion and Campbell’s Soup purchasing Sovos Brands for $2.3 billion. But these deals were the exception with many of the transactions in both Q4 and throughout 2024 being relatively smaller in size. Smaller deals will likely continue to drive M&A activity, due to the limited opportunities for large acquisitions, and as buyers focus on financially palatable acquisitions that can enhance growth and deepen their presence in core areas.

From small brands to large chains, restaurant bankruptcies dominated the news in 2024. Many of these restaurants were still experiencing the damages incurred during the pandemic, coupled with the reality of banks and landlords finally enforcing covenants. However, there were bright spots. Several multi-unit restaurant acquisitions closed in Q4 2024, spanning from purchases of large franchisees to investments in regional fast-casual concepts.

Dealmaking in the agribusiness segment has declined considerably in the past two years, as many companies have experienced financial distress due to volatility in commodity prices and persistently high input costs (e.g., fertilizer, equipment, labor). But things may have started to turn a corner with cooling inflation and rebounding commodity prices (though there is uncertainty around trade disruptions). Specific to Q4, transactions in the agriculture products and services segment included mid-market private equity firm Granite Creek Capital acquiring Global Animal Products, a family-owned manufacturer of feed additives for beef, dairy, and poultry markets.

Dealmakers and advisors often expect the new year will bring a wave of M&A activity, but dealmaking in 2024 did not achieve the anticipated surge in acquisitions as anticipated. That being said, we are optimistic that 2025 could be a strong year for acquisitions across Food and Beverage verticals as a result of slowing inflation, lower interest rates, expected easing of regulatory restrictions, and the significant amount of dry powder available to invest from both private equity firms and corporate buyers.

Sector Highlights

- Packaged foods producers and beverage manufacturers accounted for majority of deals in Q4 2024, with a total of 34 transactions and 27 transactions, respectively. The largest deals included Butterfly Equity’s $1.95 billion acquisition of The Duckhorn Portfolio, a producer of fine wines, and PepsiCo’s announced acquisition of Siete Foods, a maker of better-for-you products, for $1.2 billion. The packaged foods segment also saw several middle market deals including J.M. Smucker selling its Voortman cookie brand to Second Nature Brands, a portfolio company of CapVest Partners, for $305 million.

- Buyers continued to show interest in the fresh segment with 14 total transactions in Q4. Fresh Express, a provider of value-added salads and fresh produce, acquired McEntire Produce, a fresh-cut processor, repacker, and wholesaler. Happy Egg, a free-range egg brand, merged with Egg Innovations, a regenerative egg farming company.

- The restaurant segment produced a consistent volume of deals across each quarter of 2024, with a total of 12 transactions in Q4. The largest transaction was the announcement of Jersey Mikes Subs selling to private equity firm Blackstone for a reported $8 billion. In the middle market, fast casual Hawaiian concept Mo’Bettahs sold a majority stake to Blue Marlin Partners and Trive Capital. The deal marks a major growth milestone for the emerging concept, which plans to add 20 additional locations in 2025 to its approximate count of 50 restaurants.

Trends

Demand for Innovation Puts the Spotlight on Specialty Ingredients

- Demand for specialty ingredients is on the rise, driven by consumers’ evolving tastes, heightened health awareness, and focus on clean-label foods

- CPG companies are developing new products in response, tapping specialty manufacturers for ingredients ranging from sustainably sourced plant-based proteins to sweetener alternatives

- The specialty food ingredient market size was $112.4 million in 2022 and is expected to reach $168.6 million by 2031, growing at a compound annual growth rate of 5.2%

- Specialty ingredients businesses tend to be stable, recurring, and predictable with high margins, making them attractive M&A targets

Food Safety and Quality in Focus

- Food recalls were higher in 2024 compared to recent years, with headline-making outbreaks of listeria and E. coli

- Food and beverage manufacturers are focusing on food safety quality assurance (FSQA) – updating their safety protocols, reviewing insurance policies, and using fewer chemicals, dyes, and additives that could comprise product quality

- From an M&A perspective, companies with demonstratable adherence to FSQA standards will make for attractive acquisition targets

Small Brands Capture Attention of Larger Players

- Recent years have seen consumers shift their shopping habits to small and midsize brands, especially in the fresh produce segment

- Consumers perceive smaller brands as more authentic, trustworthy, and aligned to their values; larger players recognize these companies’ nimble qualities and capabilities to develop innovative products

- Major CPG players focused on smaller, strategic acquisitions in 2024, and this trend will likely continue in the coming quarters

Workforce Challenges Drive Adoption of Automation

- Labor, one of the most critical variables in the Food and Beverage industry, could be impacted by potential immigration policy changes

- If policy changes occur, including mass deportations, then companies may face labor shortages which could lead to increased labor costs

- Many companies are implementing AI and robotics in their operations to automate tasks and enable faster production times

DOWNLOAD THE FULL REPORT HERE.