As investment bankers, we believe strongly in the value of our services to a selling physician group. Medical practice deals are particularly complicated, and most sellers are first timers dealing with sophisticated buyer organizations. Selling groups often have multiple owners with varying interests and concerns, all of whom are usually working full-time in-patient care. For those reasons and more, an investment banker specialized in medical practice deals can greatly improve the process and outcome of a sale.

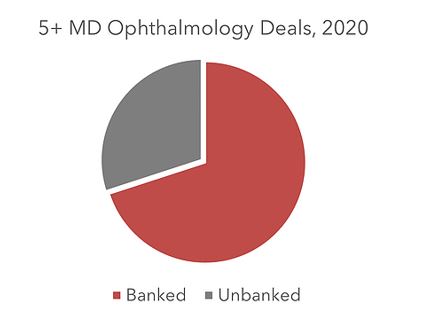

We looked specifically at ophthalmology transactions completed in 2020, and then at selling groups with five or more physicians. Our findings suggest that approximately 70% of those groups used a financial advisor.

Eric Yetter

FOCUS Managing Director and Healthcare Team Leader

Direct: 615-477-4741