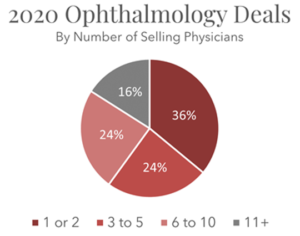

We looked at completed ophthalmology deals in 2020 to understand different practice sizes that transacted. A couple of items are of note –

We saw a fairly even distribution of small vs. medium deals, with fewer “large” deals, as expected. Most private equity firms have acquired their large platforms and are now filling-in with small and medium “add-on” transactions.

Around half of the selling groups were represented by an investment banking firm, with most of the unrepresented groups being small.

The size breakdown is shown below:

Eric Yetter

Eric Yetter

FOCUS Managing Director and Healthcare Team Leader

Direct: 615-477-4741