The Valuation Hierarchy of Direct-to-Consumer Businesses in Private Equity

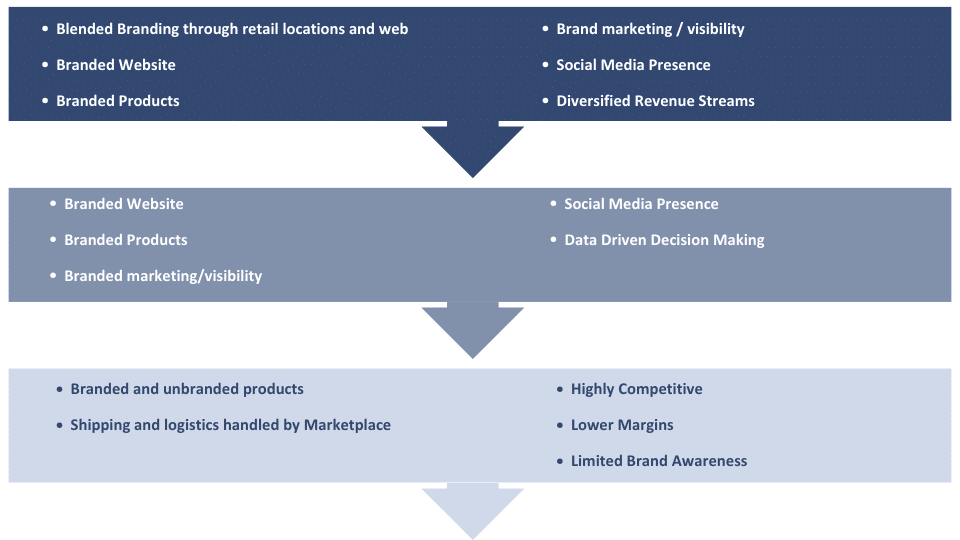

In the dynamic realm of direct-to-consumer (DTC) businesses, a clear hierarchy emerges in private equity valuations, largely based on the perceived stability, scalability, control over supply chains and customer experiences. This hierarchy positions businesses that integrate e-commerce with brick-and-mortar operations at the apex, followed by e-commerce-only entities, and positions marketplace and drop shipping companies at the lower end.

The Apex: E-Commerce Merged with Brick-and-Mortar

The hybrid model of combining e-commerce with physical retail operations is regarded as the most valuable, especially to private equity investors. The hybrid model offers several advantages:

- Customer Experience: Physical stores provide a tangible, sensory brand experience that fosters deeper customer connections, often leading to increased satisfaction and loyalty, while adding the convenience of buy-online and ship or buy online and pick-up in store.

- Diversified Revenue Streams: This blend of online and offline sales channels helps diversify revenue sources, reducing dependence on a single platform and mitigating market fluctuations.

- Integrated Logistics and Data: Brick-and-mortar locations can serve as fulfillment centers for online orders, improving logistics efficiency. . Utilizing physical stores as fulfillment centers for online orders enhances logistics efficiency. The blend of online and in-store customer data provides comprehensive insights to better understand customers and their purchasing habits.

- Brand Visibility and Trust: The presence of physical stores bolsters brand visibility and credibility, signifying market presence and stability, factors crucial for private equity investors. Physical stores increase brand visibility and credibility. They serve as a testament to the brand’s market presence and stability, which is a key consideration for private equity investors.

The Digital Contender: E-Commerce Only

E-commerce-only businesses offer significant advantages but also face distinct challenges:

- Scalability: The digital platform allows rapid expansion without the extensive capital required for physical stores. Their global reach facilitates growth in diverse markets. Most recently, E-commerce businesses have been struggling with the rapid increase in the cost of paid advertising. Most successful brands have spent years building a strong organic presence online.

- Lower Overhead: Operating exclusively online reduces costs related to physical stores, such as rent and staffing, especially with the adoption of outsourced capabilities.

- Data-Driven Strategies: These businesses leverage direct consumer data for sophisticated, personalized marketing approaches such as highly targeted social media and influencer marketing.

However, these online only businesses contend with intense online competition both via alternative brands, marketplace copycats (Amazon), reliance on digital advertising, and lack physical customer interaction, which can be vital for brand loyalty.

The Lower Tier: Marketplace and Drop Shipping Companies

There are two kinds of marketplace companies. Drop shipping companies that resell another brands products, and branded products being sold solely on Marketplaces (Amazon, Walmart, e-Bay).

Marketplace and drop shipping models are perceived as less valuable due to:

- Limited Brand and Quality Control: Drop shipping companies often have minimal control over manufacturing and supply chains. If the products are of low quality, the reseller is held responsible for the poor quality and customer experience. Branded products being sold on the Marketplaces limit brand awareness and presence.

- Dependence on Third-Party Platforms: Reliance on external platforms and suppliers exposes these businesses to the risks and policies of those entities, including internal marketplace competition and copycats. Over the years, the cost of advertising along with the fees associated with listing on the marketplace have made it increasingly more difficult to become profitable.

- Challenges in Customer Loyalty: These models generally result in lower customer loyalty as consumers tend to associate their purchasing experience with the platform rather than the brand and most often are price shopping rather than shopping as a result of brand loyalty.

In my observation, these models struggle with building customer loyalty, as buyers often credit their experience to the platform rather than the individual brand. - Competitive Pricing Pressure /Slim Margins: Operating on crowded platforms necessitates competitive pricing, leading to lower profit margins. Additionally, as most marketplace business owners have experienced, competition continues to increase along with an influx of copycat products. Not only does this dilute the brand and product, but the cost of advertising just to remain relevant can become burdensome to the profitability of the company.

The hierarchy in DTC business valuations reflects a balance between risk and reward. Combining e-commerce with brick-and-mortar creates a synergistic model maximizing customer engagement and revenue diversity. E-commerce-only businesses offer scalability and data-driven insights but face digital competition. Marketplace and drop shipping companies provide an entry-level business model but struggle with brand control and profitability. This hierarchy plays a pivotal role in guiding investment decisions in the DTC sector.

Download the article here.