The Case for Not Selling Goodyear’s Stores

I was recently talking with someone who returned from a trip to China and learned something valuable from his visit to the Great Wall. In the U.S., he said, we have a quarter-to-quarter mentality or perhaps a year-to-year field of vision. But based on how long it took to build that wall, he said, the Chinese must have a 500-year view.

We’re seeing this short-term mentality in the U.S. up close with Elliott Investment Management, an investment group that owns 10% of Goodyear Tire & Rubber Co., recently suggesting that Goodyear divest its company-owned locations. Based on its presentation, Elliott Investment Management is looking to increase Goodyear’s share price from where it was on May 10 at about $11 to more than $32/share in the near term.

I have no knowledge or insight into how profitable or well-run those company-owned Goodyear stores are, but if I were senior Goodyear management, I’d do everything possible to keep those stores. Here are a few reasons why.

Goodyear is one of the best-known and highest-regarded tire brands in the U.S. today. One way it got there – besides by making quality products at fair prices – is by long ago employing a controlled distribution strategy through a sizeable footprint of company-owned stores.

Controlled distribution in the form of company-owned stores allows a manufacturer to push what it wants, where it wants and when it wants. And it allows that manufacturer to capture the extra margin that exists between the manufacturer and the distributor, the distributor and the store and from the store to the consumer. The most loyal channel Goodyear has, by far, is its company-owned store channel.

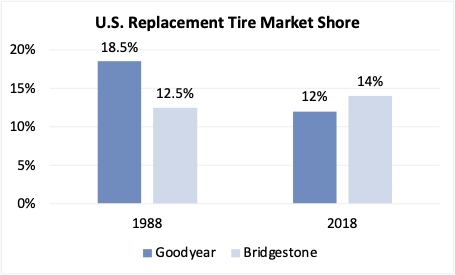

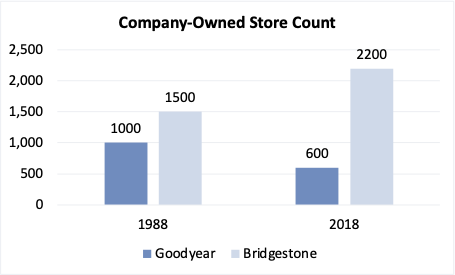

But as company-owned store count decreases, so does market share, as the charts to the right point out:

In looking at U.S. passenger tire replacement market share in 1988, the Goodyear brand had a market-leading 16% share, according to my research. When you add the Kelly brand, Goodyear, as a company, had 18.5% passenger tire market share. Bridgestone (2%), Firestone (8.5%) and the Dayton brand (2%) had a combined share of 12.5%.

Thirty years later, that flipped. I believe it’s no coincidence that Bridgestone’s market share went up as its company-owned store count increased and that Goodyear’s market share declined as its store count was nearly halved. Goodyear’s replacement passenger tire share in the U.S. is now 10.5%, while Bridgestone and Firestone are a combined 14%.

While selling the Goodyear stores would no doubt generate cash in the short run, it would do nothing for Goodyear’s long-term market share nor the Goodyear brand, which I believe will likely decline under their strategy. There’s no way that a new owner of those Goodyear stores will ever be as loyal and there’s no long-term supply agreement that can ever make up for that.

I find it ironic that the investor group is pushing Goodyear to boost its stock price while the company is investing in the exact same omnichannel direct-to-consumer strategy that is driving valuations of companies like Warby-Parker, Allbirds, Discount Tire/Tire Rack and others. With time, an omnichannel Goodyear retail strategy should improve the customer experience by providing more purchasing options, whether it is on mobile, web, at dealers or in company stores.

The end objective of any omnichannel strategy is higher customer retention and loyalty through a better buying experience. This turns into higher profits. Instead of divesting those company-owned stores, Elliott Investment Management should be pushing Goodyear to deploy its omnichannel strategy better and faster. And who knows? Maybe Goodyear’s competitors are “over-stored” and Goodyear has the right store count for an omnichannel strategy today? Perhaps over time, Goodyear has off-loaded its worst locations to dealers and kept the best? I know every time I drive by a Goodyear company store in any market, it’s in a great location.

I can think of lots of other good reasons to keep those stores. For example, Goodyear can signal to the market what to price its tires at by setting the market price in its own stores and keeping margins high. And it can launch new tire lines more effectively or develop new retail programs that benefit the rest of the distribution channel, particularly independent Goodyear dealers. Staying close to the customer and providing similar experiences as Goodyear dealers will help the Goodyear brand stay relevant in the future.

If for some reason, those company-owned Goodyear stores are not performing as needed, here’s a pretty simple fix that I’ve seen work before:

- Physically relocate the headquarters of the store group away from the corporate headquarters in Akron;

- Give the store group full autonomy to run the business the way they see fit, but give them clear profit and tire unit sales objectives

- Only hire senior managers – from the CEO on down – and field managers who specifically know how to make money in the tire and service retail business. Best Buy, Toys R’ Us or other similar retail experience just won’t cut it;

- Hire, retain, train, motivate and reward your store people. They’re all that matter, and;

- Incentivize tire unit sales, profit and customer retention.

This could be a winning formula for Goodyear.

Michael McGregor is a Managing Director of the Automotive Aftermarket team. He advises and assists multi-location tire dealers on mergers and acquisitions in the automotive aftermarket. For more information, contact him at [email protected].