Telecom U.S. Communications Service Provider: Summer 2025 Report

Telecom U.S. Communications Service Provider: Summer 2025 Report

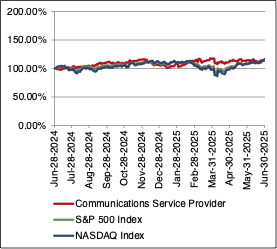

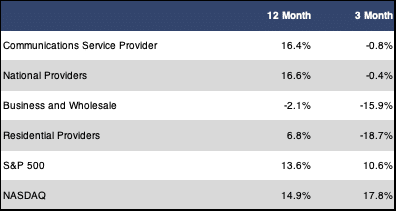

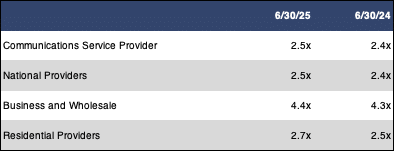

The FOCUS Communications Service Provider Index (CSPI) suffered a slight dip in our summer reporting period as the sector declined 0.8% over the past three months. This was despite the fact that the broader indices were up strongly. The S&P 500 gained 10.6% over this time frame, while the NASDAQ was up 17.8%. Compared to the year-ago period, the CSPI is trading 16.4% higher. This means that it outperformed both the S&P 500 (up 13.6%) and the NASDAQ (up 14.9%) over this time frame. Multiples for the sector are slightly higher than they were in the year-ago period.The revenue multiple inched up from 2.4x to 2.5x, while the EBITDA multiple went from 6.4x to 6.5x.

The National Providers sub sector was the best performing sub sector in the CSPI for the second straight reporting period.Even so, the sub sector still experienced a slight decline of 0.4%. Losses at Comcast and Verizon were responsible for this negative return, while the other companies in the sub sector posted gains. In particular, Lumen had a particularly strong reporting period with a gain of 11.7% over the past three months. The other two sub sectors in the CSPI both fared much more poorly than the National Providers. The Business and Wholesale sub sector fell nearly 16% as steep losses at Cogent Communications and Uniti more than erased a 21.4% gain at Bandwidth. The Residential Provider sub sector suffered an even steeper decline as it plummeted 18.7% this period. Losses were broad-based, with all of the companies in the sub sector trading in negative territory over the past three months.Cable One was the hardest hit as its stock shed nearly half of its value, but Altice and WOW also experienced losses of 19.5% and 18.0%, respectively.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

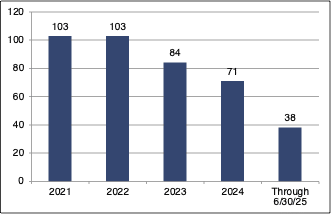

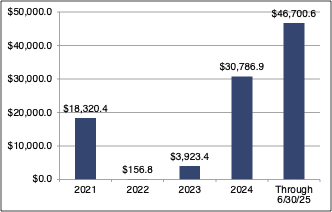

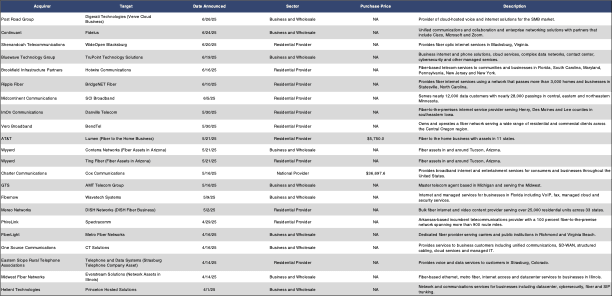

M&A activity in the Communications Service Provider sector skyrocketed over this past three months with a total of 22 transactions. Even more impressively, two large transactions pushed total announced transaction dollar value for the period north of $42 billion. With 2025 halfway in the books, we count 38 total transactions for the year.While this figure is still on the low side of what we have seen historically, it does seem like the sector is picking up momentum in terms of the level of M&A activity. When we look at the total announced dollar value of transactions for the first six months of the year, we are already up to an eye popping $46.7 billion. This means that 2025 has already exceeded any year since 2015 based on total announced transaction dollar value.

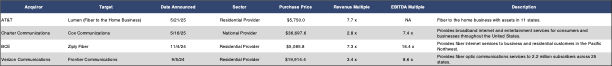

Clearly the most noteworthy transactions this period were the two largest. In the first of these, Charter announced that it would acquire fellow cable operator Cox Communications for $36.7 billion. In another huge transaction impacting the residential broadband space, AT&T acquired the fiber-to-the-home business of Lumen for $5.8 billion. The residential broadband space also accounted for a number of other transactions this period. These included an investment in Hotwire Communications by Brookfield Infrastructure Partners as well as Vero Broadband’s acquisition of BendTel and Ripple Fiber’s acquisition of BridgeNET Fiber. Finally, Wyyerd staked out a presence in the Tucson, Arizona area with its purchase of middle mile assets from Conterra as well as Ting Fiber’s operations in the region. On the business fiber side, we noted that FiberLight inked the acquisition of Metro Fiber Networks in Virginia, while Midwest Fiber Networks acquired Everstream’s assets in Illinois. Not all of the activity in the Business and Wholesale sub sector was focused on fiber network operators. Private equity firm Post Road Group acquired the Verve Cloud business from Digerati Technologies. In addition, Helient Technologies acquired Princeton Hosted Solutions to create a combined provider of managed telecom and IT services.

The two transactions this period with announced multiples were also the two largest. The Charter acquisition of Cox Communications had multiples of 2.8x revenue and 7.4x EBITDA.Demonstrating the premium for residential fiber assets, the AT&T purchase of Lumen’s fiber-to-the-home business had a multiple of 7.7x revenue. There was no announced EBITDA multiple for this transaction.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (4/1/25– 6/30/25)

ANNOUNCED TRANSACTIONS WITH REVENUE MULTIPLES (7/1/24 – 6/30/25)