Sector Spotlight: Restaurant

In 2025, the restaurant industry is projected to reach $1.5 trillion in total sales, marking a 4% year over year increase on 2024. With over 700,000 restaurants and food service locations nationwide and a workforce of 15.9 million (up 200,000 from 2024), the sector remains a major driver of employment and economic activity.

Key Trends

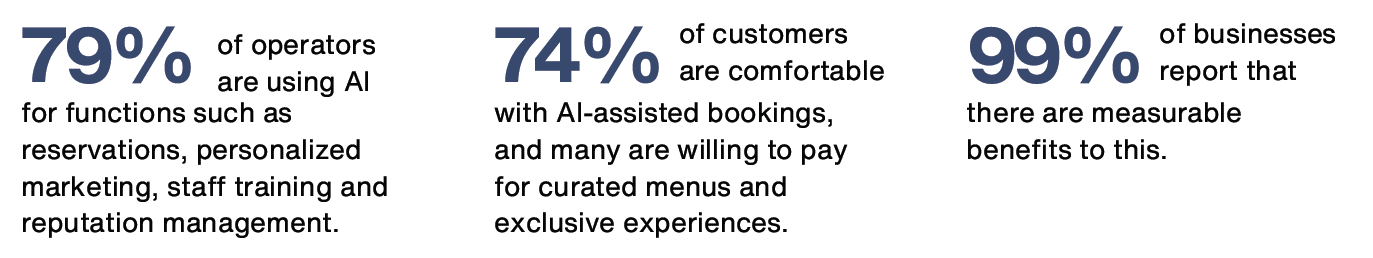

AI and automation are transforming operations.

Restaurants are evolving into lifestyle brands, with 87% of diners open to buying merchandise, cookbooks, or meal kits. Digital marketing plays a key role in discovery, with 1 in 3 diners using Google to find restaurants.

Multi-Unit & Chain Segment

Quick-service restaurants (QSR) chains dominate the industry, with approximately 208,000 locations, while full-service chains have approximately 137,500.

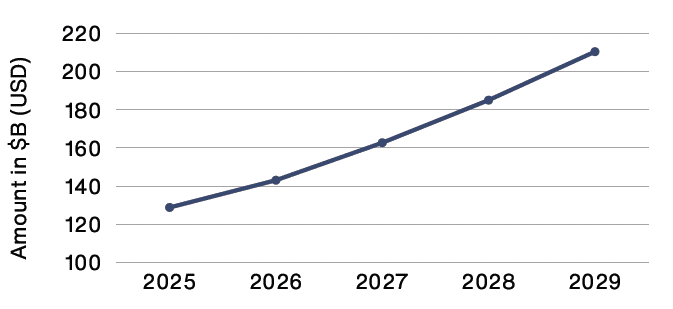

Fast-casual restaurants continue rapid expansion, with a projected 13.7% CAGR through 2029. QSR revenues are forecast to exceed $330 billion in 2025.

Projected Fast-Casual Market Size Over Time

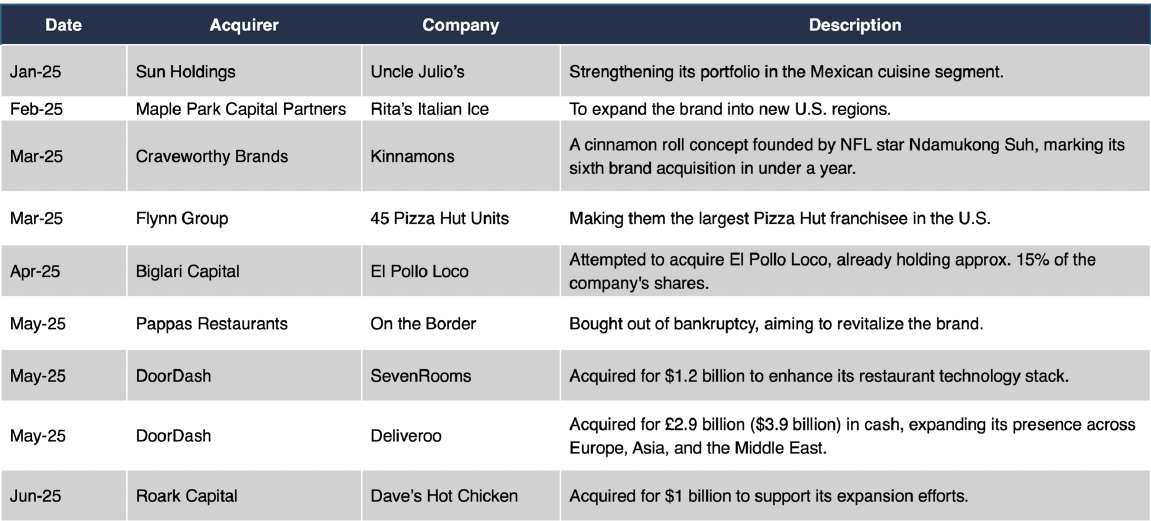

M&A and Market Restructuring

M&A activity remains strong in Food & Beverage, with approximately 100 deals per quarter. Strategic buyers and private equity are targeting tech-enabled, scalable, and health-forward brands.

2025 Deals

However, financial strain is visible: Red Lobster, TGI Fridays, Rubio’s Coastal Grill, and others have filed for bankruptcy or closed stores. Hooters of America filed Chapter 11 and sold over 100 units to franchisees.

Consumer Behavior

Off-premises dining continues to dominate, with 75% preferring drive-thru, takeaway or delivery, highlighting convenience as a top priority. Experience matters, with 51% of using apps for deals and loyalty rewards.

Stay tuned for our article, a deeper dive into the External Factors Impacting the Sector.