Private Equity Continues Push Into Professional Services

There was a time in the not too distant past when private equity investors eschewed investments in accounting and consulting firms. Reliant on the unique talents and reputations of founders and partners and the cozy relationships they often had with large clients, professional services firms were viewed by outside investors as risky propositions. In addition, given the cyclical nature of many of the firms’ project-based service offerings, it’s easy to understand why many investors stayed away from the sector. The ill-timed departure of a key employee (or two) or a hiccup in the economy could easily spell doom for an investment.

Much has changed in recent years. At well-established firms, successive generations of leaders have developed repeatable processes to ensure consistent, high-quality client service delivery. Firms established organizational structures, training and professional development programs, and incentive plans to sustain and grow the business even as talented employees come and go. Finally, professional services firms have invested in technology to make both client service delivery and firm operations more consistent and efficient.

At the same time professional services firms matured in their operating practices, their clients have grown increasingly comfortable outsourcing non-core functions. Instead of pursuing often futile efforts to recruit and retain specialized and expensive expertise, clients instead rely on their professional service firm partners.

Together, these trends have resulted in the emergence of professional services firms with sticky client relationships, repeating (if not recurring) revenue streams, and attractive profit margins. With these highly sought after characteristics, it’s no wonder that private equity investors have taken note.

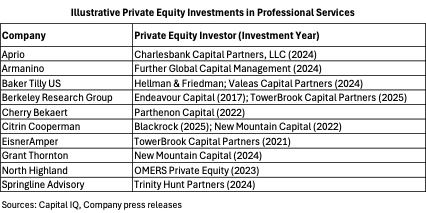

In recent years, private equity investors have made multiple platform investments in the sector with accounting and advisory firms garnering the greatest interest to date. In turn, these platforms have ushered in a wave of add-on acquisitions as the platforms seek to add scale, expand geographic reach and further extend their expertise and service offerings. Not surprisingly, private equity backed platforms such as Aprio, Baker Tilly, and Citrin Cooperman have been among the most prolific acquirers in the professional services sector recently. In the last 18 months, eight (8) of the 10 most acquisitive firms in the sector were private equity backed platforms.

While there has already been a significant volume of deal closings in the sector, it’s a fragmented space with a lot of runway for further consolidation. In the first half of 2025, the FOCUS Professional Services team has had conversations with dozens of private equity groups eager to invest in the sector whether seeking an initial platform investment or add-on investments to help round out an existing investment platform. We don’t see this trend ending and believe the ballgame is in the early innings.