Ophthalmology – Q1 2022 Acquisition Activity and Outlook

Private Equity Acquisition Closings Dips in Q1 After Flurry of Deals Pushed to Close Before the End of 2021

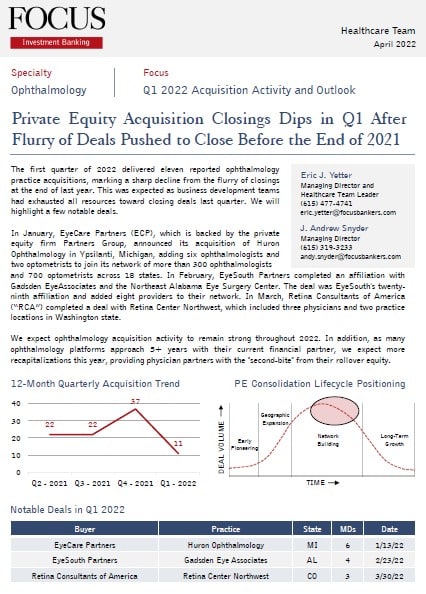

The first quarter of 2022 delivered eleven reported ophthalmology practice acquisitions, marking a sharp decline from the flurry of closings at the end of last year. This was expected as business development teams had exhausted all resources toward closing deals last quarter. We will highlight a few notable deals.