Human Capital Management 2024 Year in Review

Overview

In the FOCUS HCM 2024 Year in Review, we take a closer look at M&A activity in two key parts of the HCM market: 1. the Staffing and Recruiting market including the full range of staffing segments (IT, healthcare, professional, etc.), executive search, and permanent placement; and 2. the HR Outsourcing/PEO and HR Consulting market including payroll services, HCM technology implementation and support, training, background screening, and organization, leadership development, and HR audit/compliance consulting.

Both markets continued to benefit from historically low unemployment rates and continued GDP growth. However, labor market trends remained challenging for much of the staffing and recruiting market as job openings and hiring levels have declined compared to recent historical experience. Additionally, GDP while remaining positive throughout the year was weaker than expected particularly in the first and last quarter of 2024.

On a brighter note, the Federal Reserve cut interest rates for the first time in four years, starting in September with a 50 basis point cut followed by 25 basis point cuts in November and December. While the outlook for further cuts in 2025 is uncertain the full percentage point reduction should benefit the many acquirers, particularly private equity, who utilize debt to finance deals.

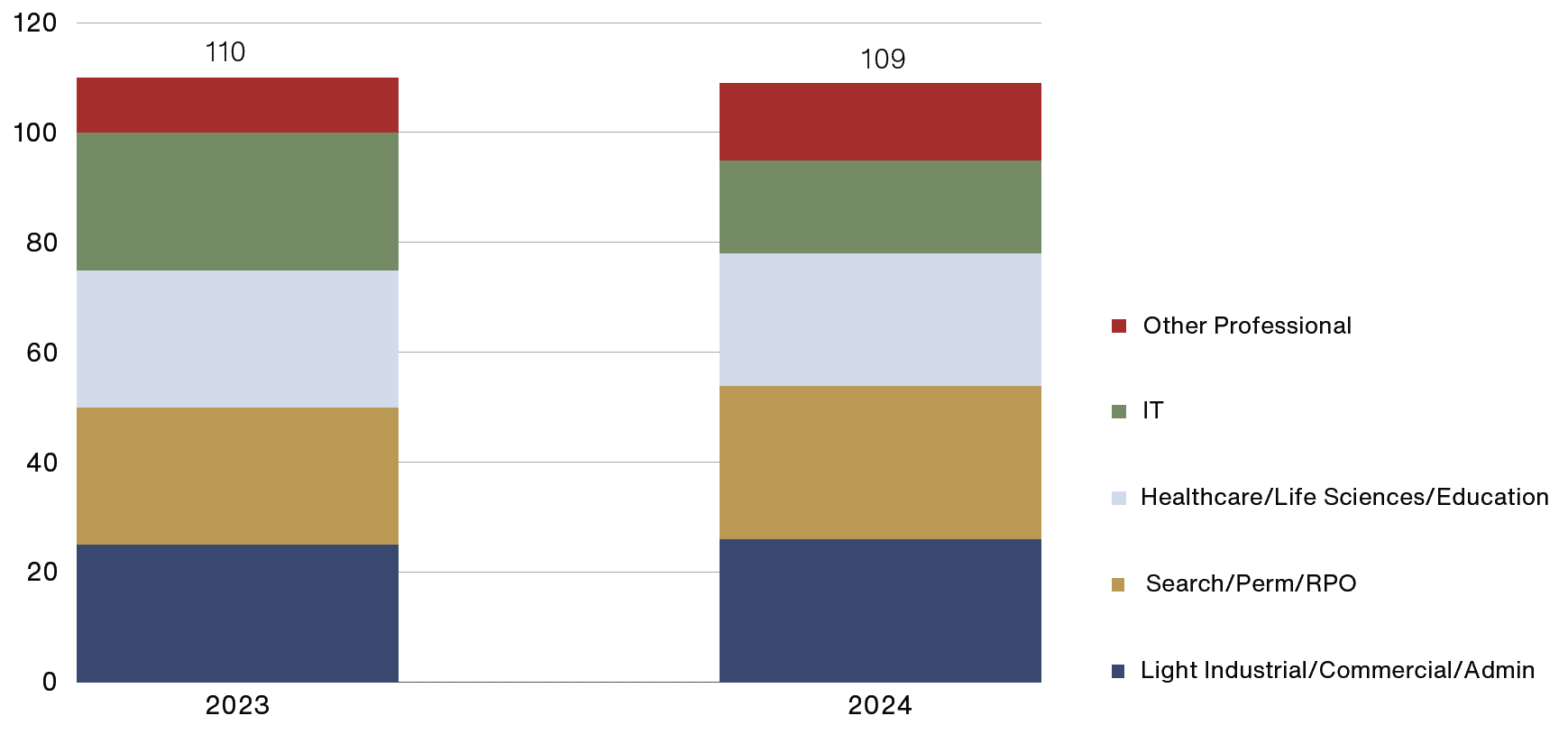

Staffing and Recruiting Services

Despite a second consecutive year of headwinds in key segments of the staffing and recruiting market, M&A activity remained strong, notching another year of 100+ announced M&A deals. However, deal activity remained below the highs seen in recent years. A drop in IT deal activity was backfilled with an increase in Search/Perm and Professional (non-IT, non-Healthcare) transactions. Deal activity in the healthcare market remained robust even as much of the segment continued to grapple with post Covid normalization.

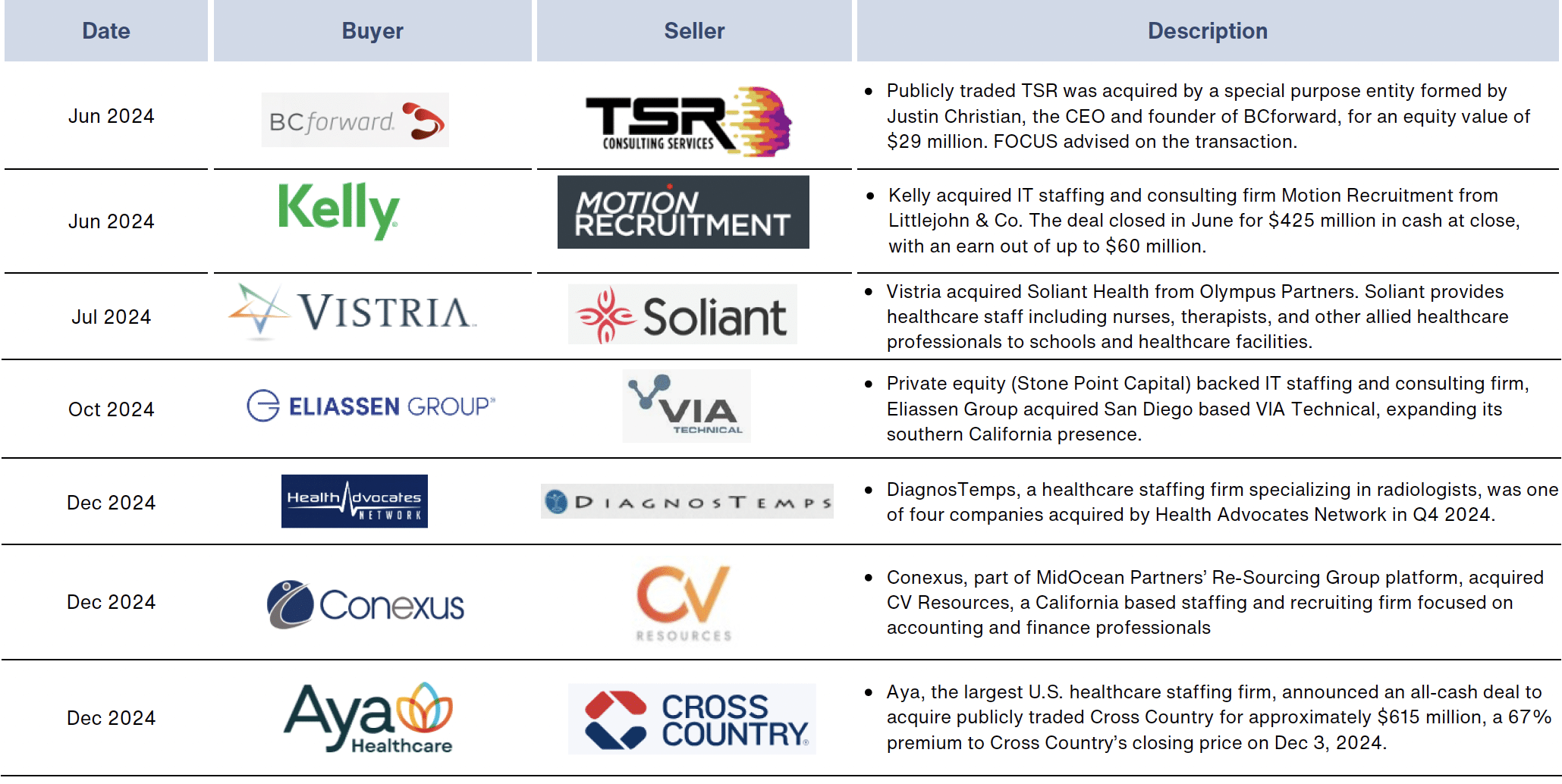

HCM Staffing & Recruiting – Notable 2024 M&A Deals

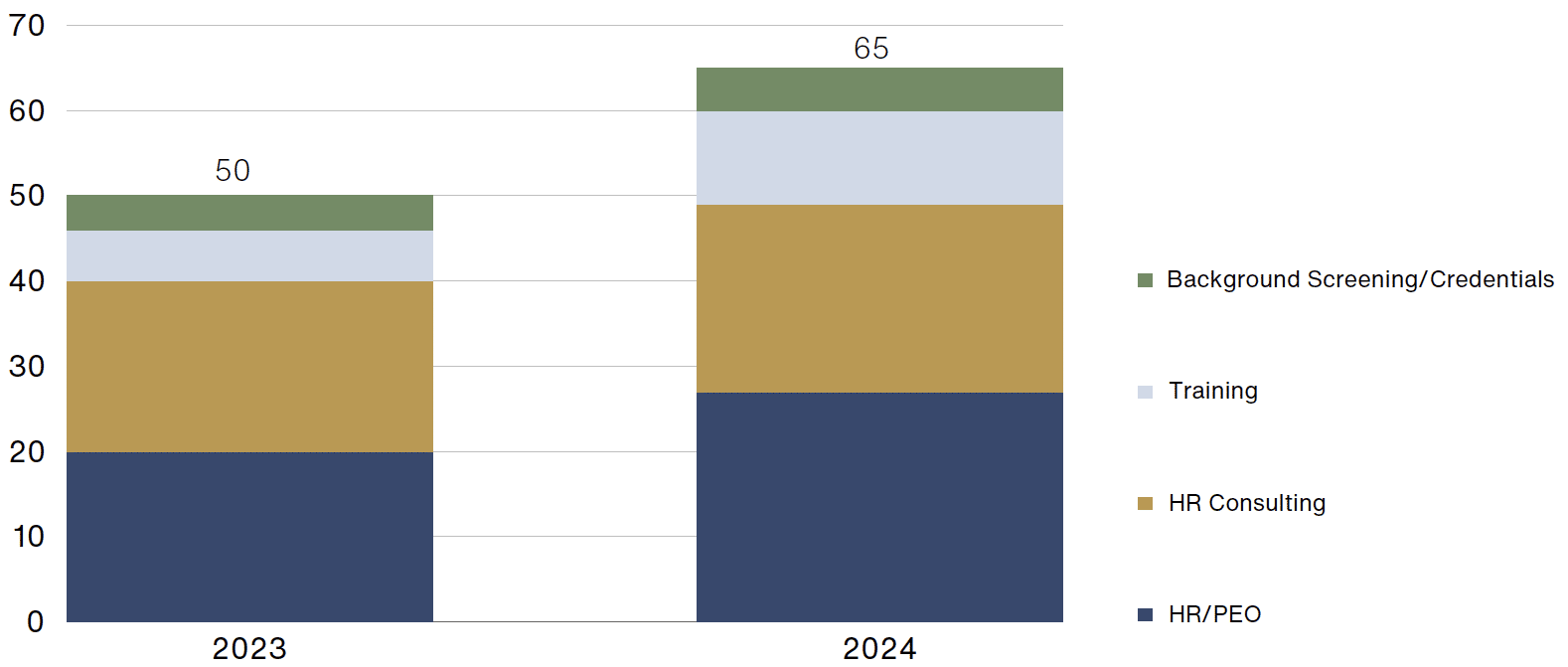

HR Consulting and Outsourced Services

2024 was a strong year for M&A activity in the HR Consulting and Outsourced Services sector. After a decrease in deal activity in the second half of 2023, the first half of 2024 saw a rebound in M&A activity that continued for the balance of the year. Private equity backed PEO platforms such as Vensure, Engage PEO, Prestige PEO, and G&A Partners continued to make add-on acquisitions. The sector also continues to benefit from the attention of insurance brokers such as Arthur J. Gallagher and One Digital and accounting firms such as EY and Smith+Howard, who see opportunities to grow their businesses and better serve clients by acquiring HCM capabilities.

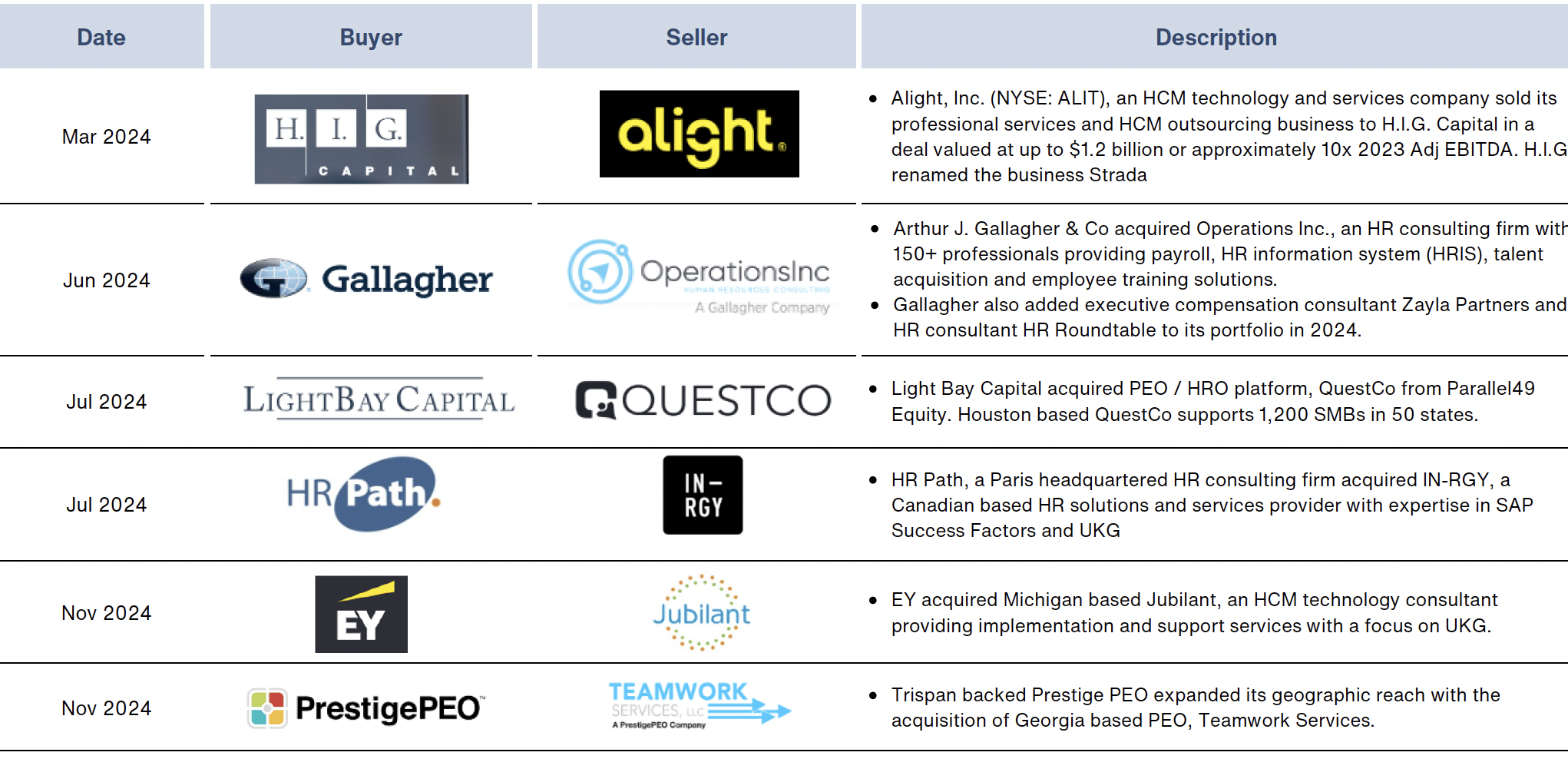

HCM Consulting & Outsourcing – Notable 2024 M&A Deals

DOWNLOAD THE FULL REPORT HERE.