In the previous blog we discussed why now might be a good time to sell your E-commerce business. Here we discuss the different ways private companies are valued.

In general, the larger the business, the more it is worth. But size isn’t everything. Investment bankers calculate the value of a business using several different formulas. Here are the most common ones.

EBITDA

Many large private companies, and some public ones, calculate their earnings using the EBITDA method. It stands for earnings before interest, taxes, depreciation, and amortization. This method is used frequently by analysts and investors as an alternative to net income because it focuses on the profitability of a company’s core operations. Essentially, EBITDA measures a company’s return on investment (ROI) and helps normalize differences in capital structure, taxation, and fixed assets to allow comparisons for similar businesses. It also more accurately represents the company’s future earnings capability. As a result, valuing a company using the EBITDA method generally earns a higher multiple.

Valuations of a business are usually derived as a multiple of EBITDA. For example, an E-commerce business with an EBITDA of $5,000,000 and a multiple of 4x would be worth $20 million. In our experience, multiples for E-commerce mostly fall within the range of 5 times to 7 times EBITDA.

The exact multiple is a product of current market conditions, what similar businesses are being valued at, and other factors. This holds true for the other valuation methods as well.

Seller’s Discretionary Earnings (SDE)

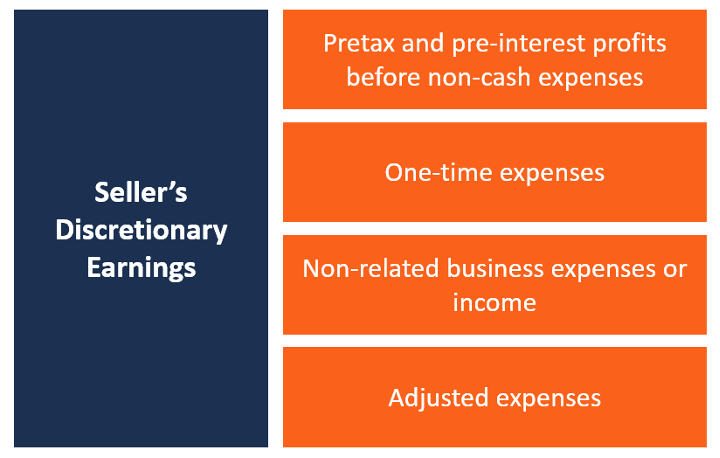

Another common valuation method, generally used with smaller companies, is based on the seller’s discretionary earnings. SDE is calculated by taking the company’s profit as shown on its tax return and adding back potential expenses that may not be incurred by a new owner, such as the previous owner’s compensation and personal expenses, as well as other expenses such as non-recurring or non-related business items.

Generally, companies using the SDE model attract a smaller multiple, about 2x to 4x in 2020. So, a company with $1 million in SDE with a 2x multiple would be worth $2 million.

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/sellers-discretionary-earnings/

Revenue

As the name implies, the REV model is based on the company’s revenue, not its earnings. Since sales can fluctuate a great deal from year to year, and the volume of sales doesn’t necessarily translate into profit, this method is used less often. It also generally garners a much lower multiple, usually less than 0.5x.

For example, a company with $5,000,000 in sales with a 0.5x multiple would be valued at $2,500,000.

Discounted Cash Flow Analysis

DCF analysis tries to determine the present value of a company based on its estimated future cash flows. It’s the approximate return on investment for buying the company, adjusted for inflation and time. While DCF analysis isn’t the most common method for determining an E-commerce company’s value, it can be a helpful tool.

Traditional companies with a long track record are a better fit for a DCF review and valuation. Since online retailers’ profits generally fluctuate more than those of traditional companies, this method is less applicable to E-commerce. It also involves making a lot of assumptions about the future, which may or not be accurate. However, it can help indicate what an organization may be worth in the future.

Precedent Transactions

This method—also called comparable company analysis—values a company based on recent sales of similar businesses. It starts with determining what exactly is a “similar” or “comparable” company. This may include things like industry, product menu, size, years in existence, number of employees, growth rate, annual sales and profitability, among other things. Precedent transactions can provide both the buyer and the seller a reality check and make both parties comfortable with what a realistic valuation expectation is.

Of course, the best way to find out how much your E-commerce business may be worth is to speak to an investment banker. If you’d like to find out more about selling your E-commerce business, please contact FOCUS Principal Leah White at [email protected] or 724-448-6180.

In our next blog, we’ll look at what prospective buyers are looking for and how you can increase the value of your E-commerce business.