Grocery Private Label: Trends Create Opportunities for Proven Players

More options for proven performers. It’s an interesting time for suppliers to the private label (aka “store brands” or PL) grocery market in the U.S. Just as the products themselves are getting more attention from shoppers, the companies that make them are attracting interest from investors and acquirers.

We look at some of the trends shaping this “moment” in the private label sector, and consider how the opportunities for industry players may be changing as well.

Why now?

» European blueprint shows the way: innovations and companies coming to the U.S. market

» Retailer strategy shift: compete on quality and price

» Retailer marketing shift: more attention to consumer preferences, packaging, brand tiering

» Demographics: Millennial and Gen Z shoppers supplant the Boomers, and they are feeling the budget squeeze

» Supply chain: pandemic showed retailers the advantage of having more control of some product lines

No surprises here, but as the landscape changes, so does the value brought by established, profitable, innovative food manufacturers partnering with leading grocery retailers. With value comes options – like investment, growth, acquisitions, mergers, and sale.

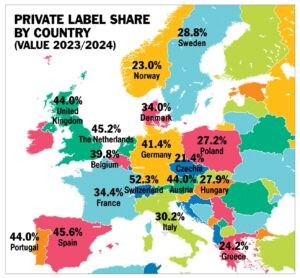

Private label sales: Europe leads the U.s. by a significant margin

European shoppers buy more private label products, and European retailers like Aldi and Lidl have demonstrated that combining value and quality can keep the shoppers coming back for more. In Switzerland, over half of the sales value of grocery food and nonfood categories came from PL sales.

Private Label Share (sales value)

» Europe overall: 38.6%

» 3 largest markets combined:

U.K., France, & Germany: 40.4%

» U.S.: 18.9%

Source: PLMA International Council, Nielsen IQ data, prior 12 months thru H1 2024

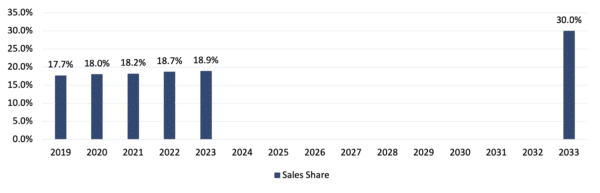

30% by 2033?

According to a new report from Rabobank, the U.S. market for store brand products could reach 30% by 30331, with a variety of factors at play:

» Constrained consumer spending from rising prices at the grocery store

» Retailer consolidation (Kroger/Albertson’s, for example)

» Increase in Aldi, Lidl and Trader Joe’s stores (Aldi is expected to open 800 new stores by 2028)

» Improved quality in PL brands from:

» Investment

» Vertical integration

» Supplier expansion and capacity growth

» Growth in international specialty suppliers entering US market through acquisitions, partnerships, and greenfield openings

Potential Sales Share: PL in the U.S. (per Rabobank report)

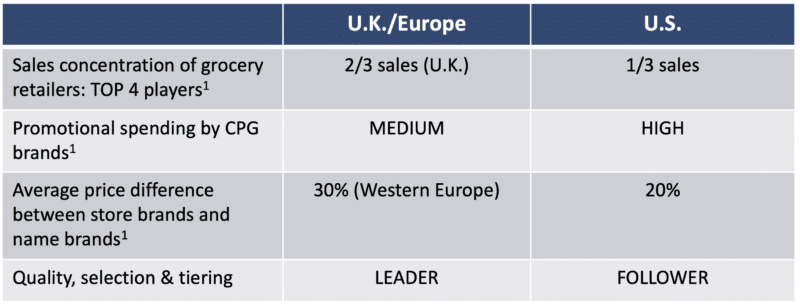

Comparison shopping: A closer look at the u.k. & Europe

1News report from JustFood, 10/18/2024, by Fiona Holland

European retailers have more leverage than U.S. retailers do, overall.

» Retailers control the supply chain (which is more manageable in Europe than in the U.S.)

» U.S. retailers have less leverage sourcing manufacturers for their private labels – often the same CPG brand companies do both jobs – which can set up a complicated competitive dynamic1

But some factors are consistent.

» Grocery prices are higher everywhere — in the U.S. about 26% higher than they were in 20192

» Consumers are anxious about higher food prices, and have noticed how CPG brands have gotten more expensive since the pandemic (shrinkflation)

1Research paper from Prof. Jan-Benedict Steenkamp, UNC Chapel Hill, cited in “Knockoffs No Longer: Store Brands Get Fancy in a Private Label Revolution,” Jinjoo Lee, WSJ, 6/21/2024. 2“Knockoffs No Longer: Store Brands Get Fancy in a Private Label Revolution,” Jinjoo Lee, WSJ, 6/21/2024

Shifting Demographics at the checkout

Baby Boomers remember generic, black and white labels on sad boxes of frozen peas – perhaps supporting the U.S. consumer’s loyalty to national grocery brands. But as Millennials and Gen Z’ers cruise the supermarkets they are finding a different landscape and it appears they like what they see.

Are times changing?

For Gen Z shoppers, store brands (aka private label or PL) are core shopping habits. According to a 2024 PLMA study, 64% of Gen Z shoppers buy store brands always/frequently. Are U.S. demographics aligning with the quality, pricing and variety that today’s store brands offer??

Dynamic at work: THEY Came for the cost savings & Stayed for the quality – Shift to private label

With product improvements & astute marketing, U.S. and European grocery retailers are pressuring CPG leaders in selected categories. Innovation, sustainability, and taste profiles are no longer the exclusive domain of branded companies.

Thoughtful packaging design and effective tiering strategies draw shoppers in. Retailers are investing in and paying closer attention to their target markets.

» Europe: Tesco Finest; Sainsbury’s Taste the Difference; Carrefour’s Reflet de France

» U.S.: Albertson’s Signature Select (revamped in 2023)& O Organics; Target’s Favorite Day (2021); Walmart’s bettergoods (launched 2024); Kroger Smart Way (2022)

“Over the years, the quality of private label products has improved significantly, resulting in a positive shift in consumer perception.”

1Donna Eastlake, “Private label grows again – why brands should be worried,” FoodNavigator, 10/21/2024

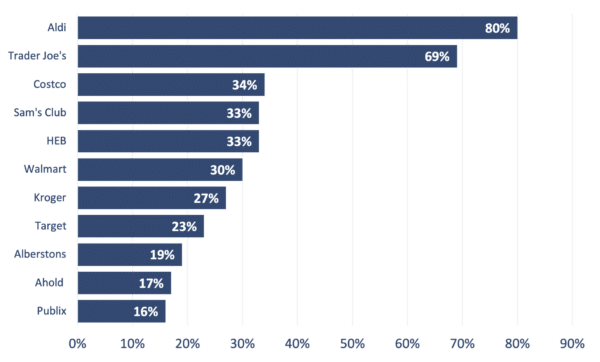

SOME grocery retailers are all in on store brands – others not (yet?)

Stores that have seriously invested in their own branded products chose a path — to become a destination. And they sell a lot of private label products.

Private Label share of total sales (U.S)1

Will the U.S. catch up to Europe?

Chasing its biggest rival:

Lidl and Aldi are direct competitors in their home market, but Aldi is far ahead of Lidl in the U.S.

» 1st Lidl discount store opened in 1973 in Germany.

» Entered U.S. market 2017, today ~175 stores (Aldi has 2,428)

» Brand relaunch in U.S. in Oct. 2024

» In 2024, 12,279 stores in 31 countries

1Numerator data, 12 months ending 6/30/2024. Includes categories other than grocery

Consumers speak: How do Store Brands Stack up in the U.K. Ice cream Market??

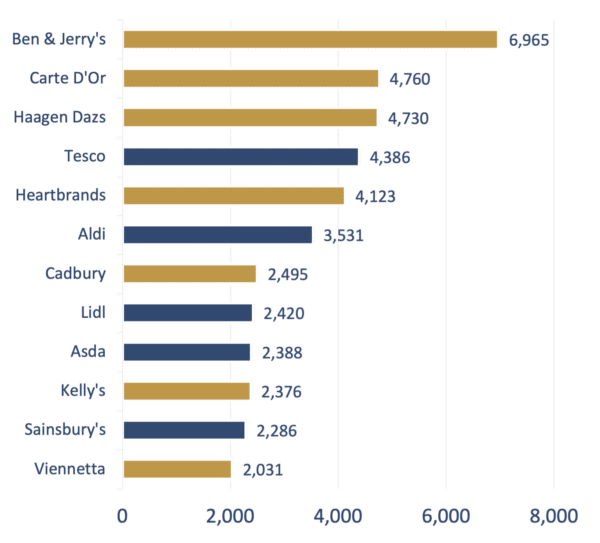

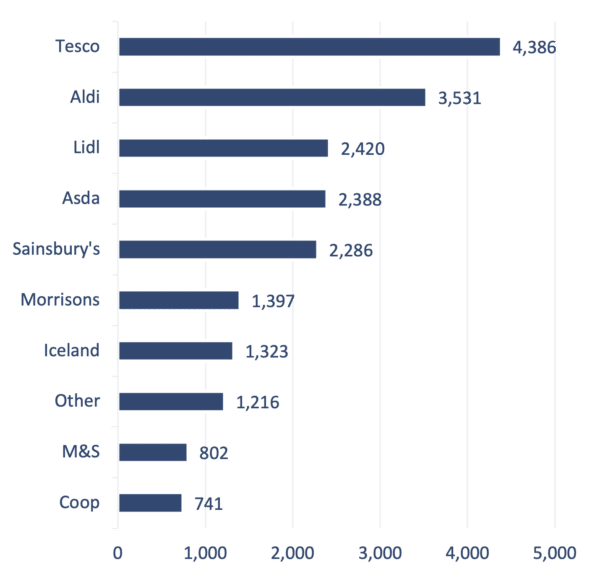

Number of consumers by ice cream brand (tubs & blocks) (1,000s) 20231

Number of consumers by supermarket store brand (tubs & blocks) (1,000s) 20231

Store brands are competitive with the leading brands, many of which are owned by

» Unilever: Ben & Jerry’s; Carte D’Or; Viennetta; Heartbrands

» Froneri: Cadbury; Kelly’s, Nestle

Who manufactures the store brands sold in the U.K.? Probably:

» Froneri (largest private label manufacturer in Europe)

» YSCO (owned by Belgian coop Milcobel, being sold to PEG Davidson Kempner Capital Management)

1Source: Statista

Where does ice cream fit on the grocery Store brand product spectrum?

Not the first and not the last.

» Generic, mostly undifferentiated products tend to be the first place store brands compete.

» Premium, highly distinctive products with very strong CPG company support tend to be harder categories to crack

Ice cream people are passionate and committed – a category with staying power.

» Ice cream lovers have brand loyalty and care about quality. They also like to review, compare, opine and participate on social media about their ice cream finds.

» Ice cream, especially eaten at home, is seen as “small pleasure” or treat that is affordable even when other luxuries are unavailable, so it holds up better to household budget constraints (as compared to a daily Starbucks visit, for example)

Ice cream’s cold chain requirements & dairy inputs enhance the value of “local”.

» Notable: Unilever’s spinoff of its $8.5 bn global ice cream business, at least in part because it is a “different business” from the rest of its shelf-stable portfolio of products – from manufacturing to transportation to point-of-sale.

» Greenfield” entry in a new geography has higher supply chain hurdles than shelf stable packaged products

So what’s the opportunity….or opportunities?

» Quality U.S. providers with infrastructure, facilities and track record are best suited to support retailers replicating the European model of private label offerings

» Ice cream manufacturers have a valuable spot at the nexus of dairy and cold logistics, with proven relationships up and down the value and supply chains

Download the article here.