Go Big or Get Bought: Surviving the GovCon Hunger Games

The government aerospace and defense (A&D) market is among the world’s most complex and strategically significant sectors. Companies within this industry often engage in mergers and acquisitions (M&A) as a means of achieving diverse objectives, from boosting technological capabilities to expanding market share. Private Equity has played an increasing role in buying and growing companies since the GovCon companies depend on government spending that always seems to grow in key areas. Over the past few years between 45 and 50% of the M&A activity in this market is backed by private equity, making it a major player that influences valuations and growth strategies through acquisitions. This document discusses the primary reasons companies pursue acquisitions in the government A&D market.

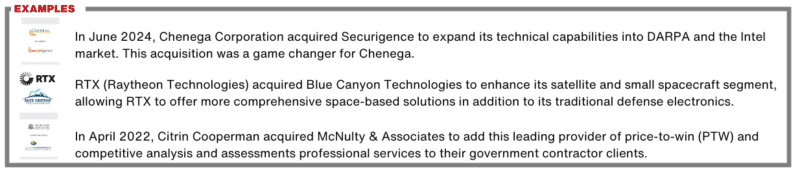

Expanding Product and Service Portfolios

One of the foremost reasons for A&D acquisitions is to broaden a company’s product and service offerings. The defense sector, in particular, is marked by rapid technological evolution and the need for integrated, end-to-end solutions. Specifically, companies want to fill capability gaps, create cross-selling opportunities and just stay competitive.

Accessing New Markets and Customers

Geopolitical shifts and changing defense budgets often open new opportunities—or close old ones. Acquisitions can provide a direct route into previously inaccessible markets. Company strategies include diversifying their customer base and entering emerging or growing markets.

Accelerating Innovation and Gaining Access to Technology

The pace of innovation in government A&D is relentless. Whether it’s next-generation avionics, cybersecurity, artificial intelligence, or autonomous systems, technology is a major battleground for competitive advantage. Companies strive to acquire proprietary technologies, expand their innovation ecosystems and acquire companies that meet strict security and regulatory standards.

Enhancing Scale and Cost Efficiency

The pace of innovation in government A&D is relentless. Whether it’s next-generation avionics, cybersecurity, artificial intelligence, or autonomous systems, technology is a major battleground for competitive advantage. Companies strive to acquire proprietary technologies, expand their innovation ecosystems and acquire companies that meet strict security and regulatory standards.

Securing Strategic Assets and Capabilities

Certain assets in the A&D industry are strategically vital due to national security concerns or their role in critical infrastructure. Many acquirers are looking to strengthen their strategic positioning by controlling supply chains and acquiring unique expertise or geographic presence.

Defensive Moves and Survival Strategies

The A&D sector has a long history of consolidation, driven by budgetary pressures, evolving customer needs, and the desire for scale. Many companies are interested in controlling pricing power or taking out a pesky competitor.

Improving Financial Performance and Shareholder Value

Acquisitions can also be a tool for financial engineering—boosting revenues, improving margins, or generating more predictable cash flows. New products, markets and customers can drive top line revenue and increasing scale can improve profitability ratios.

Talent Acquisition and Knowledge Transfer

People remain a company’s most valuable asset, especially in specialized, knowledge-intensive fields. Gaining access to highly skilled scientists, engineers or executives with deep industry experience can open and grow new markets.

Adapting to Geopolitical Shifts and National Security Priorities

The A&D sector is inextricably linked to changing geopolitical realities. Fluctuations in defense budgets, shifting alliances, and emerging threats all impact strategy. Companies seek to align with national priorities in cybersecurity, space exploration, or unmanned systems by quickly acquiring relevant capabilities and make acquisitions that expand and protect supply chains.

Purely Financial Gain

Private Equity Groups (PEGs) are simply in the business of making extraordinary returns for their investors. The A&D market is a specialty market that has attracted numerous PEGs due to the sector’s stable revenue streams, long-term contracts, and potential for growth. The strategy employed by most PEGs is to buy a platform company and acquire bolt-on acquisitions to grow the platform, so the PEG sells the company in a few years for multiple of their original investment.

Conclusion

Acquisitions in the government, aerospace, and defense market are driven by a complex interplay of strategic, operational, financial, and political factors. Companies pursue M&A not only to grow and diversify, but also to acquire vital technologies, enhance efficiency, and respond to the unique regulatory and national security imperatives of the sector. As the industry continues to evolve, shaped by technological disruption and geopolitical uncertainty, acquisitions will remain a central strategy for companies seeking to thrive in this demanding environment.