Food and Beverage Industry: Dairy Sector Spotlight

Unlock the potential of the dairy market by embracing change and innovation in an evolving industry. For business owners in the food and beverage industry, the dairy market presents both challenges and opportunities. With a wide range of products like milk, cheese, yogurt, and butter, the market is shaped by shifting consumer demands for both classic dairy items and innovative new offerings. Health trends, dietary preferences, and sustainability concerns are key drivers influencing these changes. The rise of plant-based alternatives has impacted traditional dairy sales, but the industry remains strong. By focusing on product diversification, embracing new technologies, and prioritizing sustainability, business owners can navigate this evolving landscape and meet the changing needs of their customers.

Ice Cream Industry

The global ice cream market is valued at approximately $91 billion and is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% over the next three years, according to Euromonitor. This growth is driven by rising consumer demand for indulgent treats and innovative product offerings.

The North American ice cream market is currently valued at $22 billion in retail sales, with a projected growth rate of 3.4% CAGR through 2027. The take-home segment dominates, accounting for $17 billion of the market. Despite the emphasis on “better for you” options like low-fat, low-sugar, and portion-controlled products, the majority of consumers are still purchasing ice cream for indulgence, gravitating towards premium and super-premium brands.

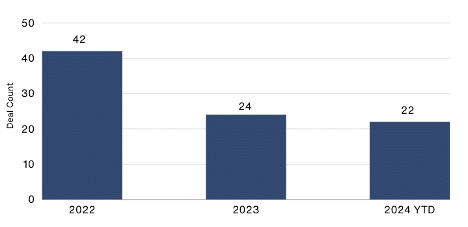

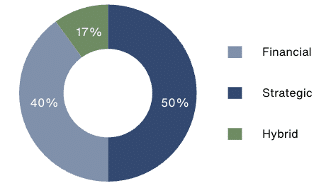

Dairy Sector Transaction Activity: Focusing on Processors, Producers and co-packers

Tracking dairy processors, producers and co-packers in the US and Europe, we saw a softening of activity in 2023 after an active market in 2022. However, the pace has picked up in 2024, nearly matching 2023 in the first eight months of the year. Strategic acquirers dominate the majority of deals within the dairy sector. PEGs have seen reduced activity in the current market, largely due to the challenging interest rate environment. Some deals have involved PEG-backed strategics, where private equity firms support strategic buyers in acquisitions, which are referred to below as Hybrid.

Who Are The Buyers in Dairy Products M&A?

Dairy M&A Deals, 2022 – 2024 YTD

Source: CapIQ and Mergermarket (Deals through 8/29/2024)

*Hybrid buyers are PEG-backed strategics

Two big changes in the global landscape of the ice cream business are underway, expected to transact in 2025 and potentially shift the lineup of some of the industry’s best known brands.

Unilever’s planned spinoff of its ice cream business

Unilever says the planned separation of its ice cream business, announced in March, was “on track” to be completed by the end of 2025, as the company reported its overall first half results in July. The ice cream division, which posted sales of $8.57 billion in 2023, continued its disappointing performance in H1 2024. It saw growth of 0.6% in revenue, with price increases of 1.6% offset by volume declines. Poor performance in China and mixed weather in Europe were noted as reasons in the analyst call. Unilever has five of the world’s top ten brands of ice cream.

Splitting off the ice cream business seems to be part of the company’s refocusing and simplification effort. CEO Hain Schumacher (official start date 7/1/2023) noted that ice cream requires a different operational model from the rest of Unilever’s lines of business, including the demanding and capital-intensive cold-chain system and the mix of in-home/out of home consumption. He also pointed out that 15 years ago, ice cream was but one part of larger food companies, but today the industry has increasingly gone to pure play companies.

Earlier reports indicated 15 billion euros as a ballpark valuation of the ice cream business. On the July earnings call, the possibility of floating the ice cream business separately on the Dutch exchange was again mentioned; a sale is also an option.

UK-Based Froneri Performs Well in 2023; JV Partner Considers Options

Formed in 2016, Froneri is a JV partnership between Nestle and PAI Partners, a global private equity firm with 28 billion euros under management. Froneri’s origins date back to PAI’s acquisition of a large private label ice cream manufacturer, R&R. Today, it includes such brands as Haagen-Dazs, Oreo, Nuii, and Drumstick.

Early in 2024, PAI Partners was reported by Bloomberg to be talking with bankers about options for disposing of its interest in Froneri, which was suggested to have a value of about 5 billion euros (valuing the entire company at 10 billion euros). Froneri reported strong results for 2023, citing revenue growth of 8.5% and noting the cumulative effects of operational improvements. By May 2024, Bloomberg updated its reporting to indicate that PAI was considering keeping its share by forming a continuation fund. As deal-making has slowed and buyout firms find they are running into lifespan limits for some funds, they are exploring the option of a continuation fund which enables them to hold an investment longer than the typical investment cycle.

On the Nestle side of the equation, the recent replacement of Mark Schneider with Laurent Freixe as CEO (August 2024) rattled the company as the move came as a surprise to employees and investors alike.

DOWNLOAD THE ARTICLE HERE.