FOCUS Telecom Technology Quarterly: Winter 2024 Report

Overview

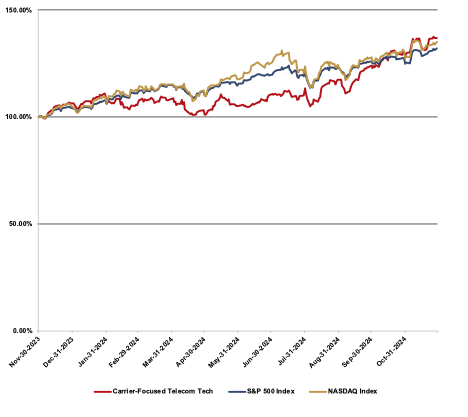

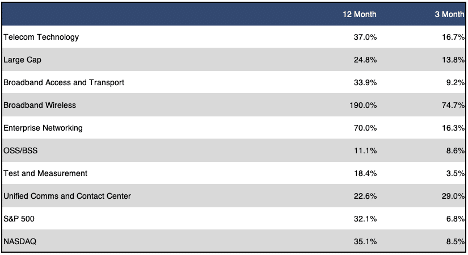

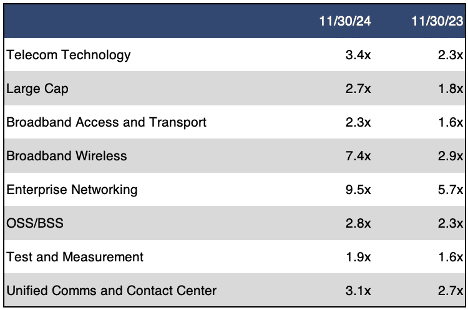

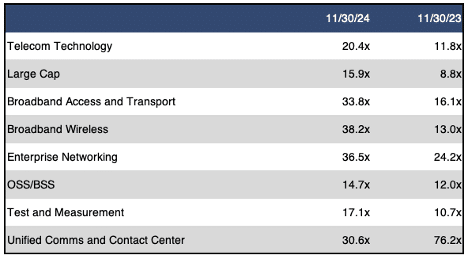

The FOCUS Telecom Technology Index (TTI) had its second straight reporting period with a double-digit gain, this time jumping 16.7%. This significantly outperformed both the 6.8% gain in the S&P 500 and the 8.5% gain in the NASDAQ over the corresponding time period.The TTI also boasted a 37.0% increase compared to this time last year. Once again, this compared favorably to both the 32.1% gain in the S&P 500 and the 35.1% gain in the NASDAQ. Sector multiples are also significantly higher than they were a year ago. The sector revenue multiple increased from 2.3x to 3.4x, while the EBITDA multiple nearly doubled from 11.8x a year ago to 20.4x currently.

Also for the second straight reporting period, every sub sector in the TTI turned in a positive gain. The Broadband Wireless sub sector turned in the most impressive performance with a three-month gain of nearly 75%. This was due primarily to a 79.0% gain at Ubiquiti Networks. The next best performing sub sector was Unified Communications and Contact Center, which enjoyed a 29.0% increase this reporting period.The top performers in this sub sector were Twilio (up 66.6%) and 8×8 (up 64.9%). While the Broadband Access and Transport sub sector was a middle of the pack performer this period with a gain of 9.2%, we did see that DZS leaped up 400%.This made it the top performing stock in the TTI this period. Finally, we note that among the stocks in the Large Cap sub sector, Cisco boasted an impressive three-month return of 17.2%

PUBLIC MARKET SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

PUBLIC MARKET SUMMARY

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

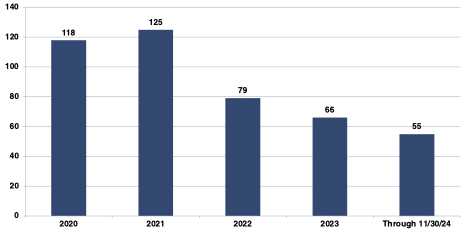

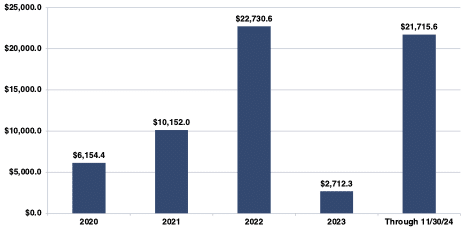

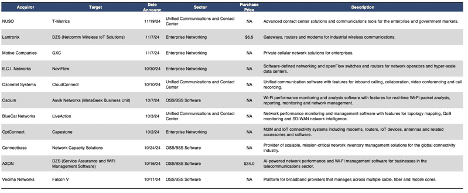

The number of Telecom Technology M&A transactions continued its downward trend as we counted only 11 transactions this period. The Enterprise Networking, OSS/BSS Software and Unified Communications and Contact Center sub sectors were the only three sub sectors in the TTI to notch any M&A activity. The total announced transaction dollar value for the period was also extremely anemic, coming in at a total of only $40.5 million for the past three months. The largest announced transaction dollar value for the period was AXON’s acquisition of the service assurance and Wi-Fi management software assets of DZS for $34.0 million. We also noted that Connectbase returned to the M&A table once again with its purchase of network inventory management software provider Network Capacity Solutions.In the final transaction that we will specifically highlight, E.C.I.

Networks purchased software-defined networking specialist NoviFlow. Year-to-date, the Telecom Technology sector has accounted for 55 total transactions with a total announced transaction dollar value of $21.7 billion. This means that the year is extremely slow in terms of the number of transactions, but total announced transaction dollar value is on the higher end of the typical range.

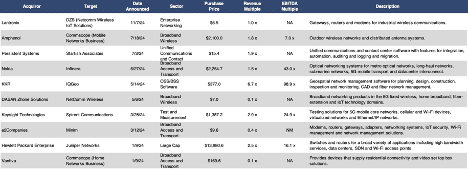

The only transaction with an announced multiple this period was the Lantronix acquisition of the IoT Solutions division of DZS. This transaction had a multiple of 1.0x revenue. There was no announced EBITDA multiple for the transaction.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (9/1/24 – 11/30/24)

M&A TRANSACTIONS WITH ANNOUNCED MULTIPLES (12/1/23 – 11/30/24)

DOWNLOAD THE FULL REPORT HERE.