FOCUS Telecom Technology Quarterly: Spring 2025 Report

Overview

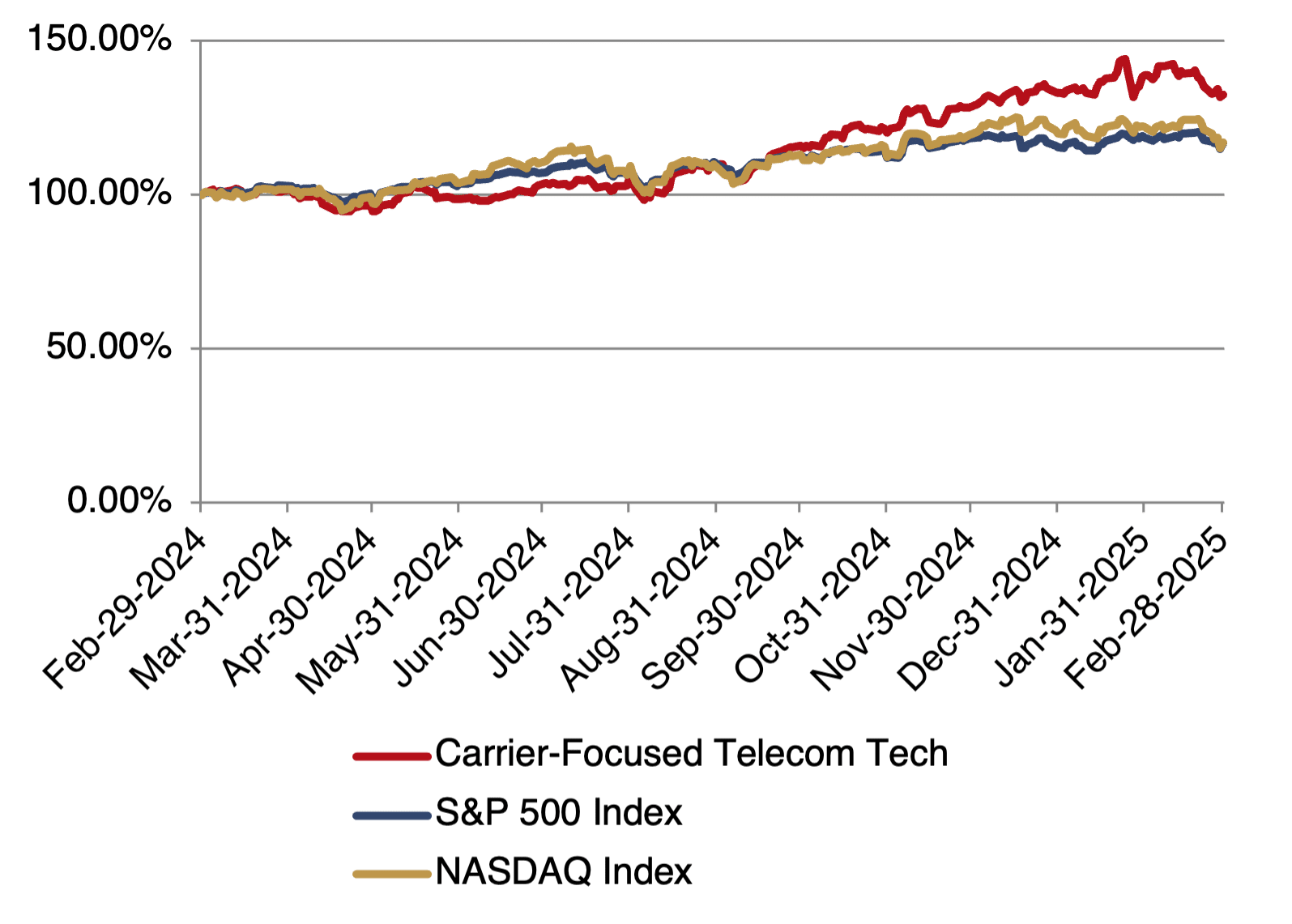

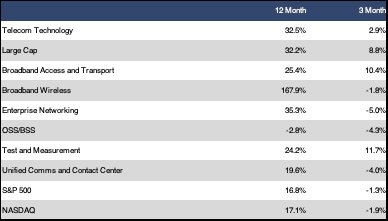

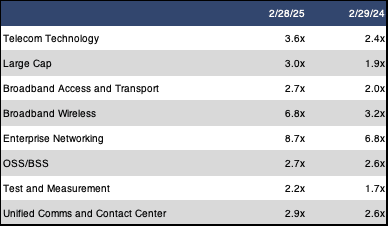

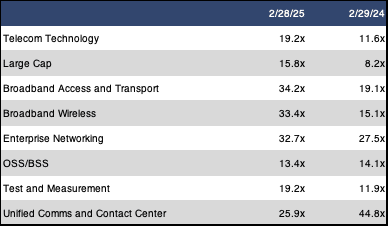

After two straight reporting periods with double digit gains, the FOCUS Telecom Technology Index (TTI) cooled off somewhat this period with a 2.9% gain over the past three months. Even so, the TTI still handily outperformed both the S&P 500 (down 1.3%) and the NASDAQ (down 1.9%) over the same time frame.When measured over the past year, the TTI is up 32.5% over the past twelve months. Once again, this compares favorably to the broader indices, nearly doubling both the16.8% gain in the S&P 500 and the 17.1% gain in the NASDAQ. Not surprisingly given these impressive gains, sector multiples are significantly higher than they were a year ago. The sector revenue multiple increased from 2.4x a year ago to 3.6x currently, while the sector EBITDA multiple jumped from 11.6x to 19.2x.

The top two sub sectors in our spring reporting period were Test and Measurement (up 11.7% over the past three months) and Broadband Access and Transport (up 10.4% over the past three months). Gains in the Test and Measurement sub sector were broad-based, with all three companies in the sub sector posting solid gains.

Performance in the Broadband Access and Transport sub sector was more mixed. Leading last-mile access companies ADTRAN and Calix were both top performers, as was transport company CIENA. The other sub sector in the TTI that had a strong performance this period was Large Cap, which gained 8.8% in the past three months. All of the other sub sectors in the TTI had a negative three-month return. The OSS/BSS Software sub sector brought up the rear with a loss of 4.3%. This loss was related to double digit declines at Lumine Networks and Subex, as well as a 9.0% decline at Synchronoss. The Unified Communications and the Contact Center sub sector also suffered a relatively steep decline of 4.0%. Losses in this sub sector were broad-based, with seven of the nine companies in the index trading down over the past three months.This included six companies that suffered losses of 10% or more.

Public Markets Summary

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

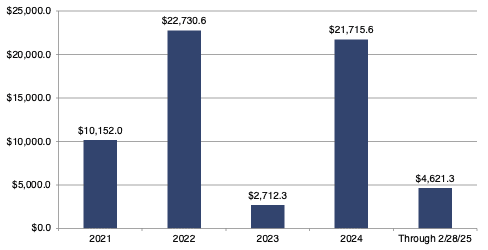

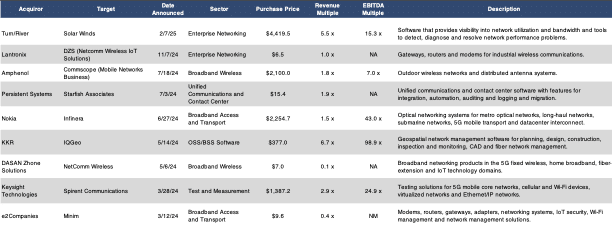

The level of M&A activity in the Telecom Technology sector continued to run at a very low level with only nine transactions for the current reporting period. Most of the activity this period was in the Unified Communications and the Contact Center sub sector. This sub sector was very active with a total of five transactions over the past three months. There were also two transactions in the Enterprise Networking sub sector, both of which involved network management software companies. Finally, the Broadband Wireless and Test and Measurement sub sectors each accounted for one transaction apiece. On the plus side, total announced transaction dollar value was extremely high by historical standards at $4.6 billion. This was driven by the $4.4 billion acquisition of Solar Winds by Turn/River.

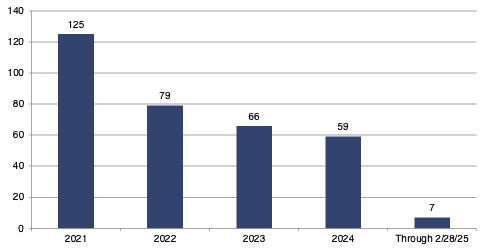

Looking back on 2024, the year continued the sector’s overall downward trend in terms of the total number of deals. The 59 completed transactions for the year was the lowest of any year in the last five. On the other hand, the total announced transaction dollar value for 2024 came in at $21.7 billion, which is much higher than we typically see. So despite a shrinking number of transactions, a handful of large deals kept M&A dollar volume high.

We had one transaction with an announced multiple this period. This was the Turn/River acquisition of network management software company Solar Winds. The transaction was done at multiples of 5.5x revenue and 15.3x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (12/1/24 – 2/28/25)

M&A Transactions with Announced Multiples (3/1/24 – 2/28/25)

DOWNLOAD THE FULL REPORT HERE.