FOCUS Telecom Communications Service Provider Quarterly: Winter 2025 Report

Overview

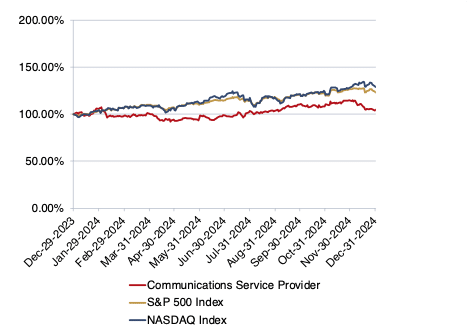

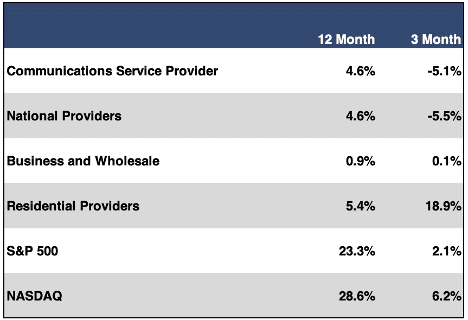

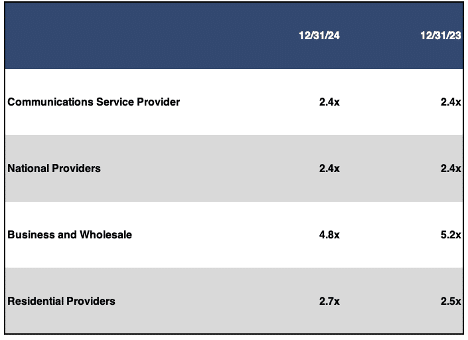

The FOCUS Communications Service Provider Index (CSPI) had a tough reporting period as the sector dropped 5.1% over the past three months. This was despite a generally favorable market environment that saw the S&P 500 gain 2.1% and the NASDAQ gain 6.2% over the corresponding time frame. The CSPI also lagged the broader indices over the past twelve months. While the S&P 500 and the NASDAQ were up 23.3% and 28.6%, respectively, over the past year, the CSPI only had a gain of 4.6%. Sector multiples closed out the period at 2.4x revenue and 6.5x EBITDA. These multiples were both unchanged from the year-ago period.

The National Providers sub sector was the CSPI’s laggard this period as it dropped 5.5% in the past three months. Comcast, Lumen and Verizon all suffered double digit losses over this time frame. The Business and Wholesale sub sector fared somewhat better with a slight gain of 0.1%.Cogent Communications had a 1.5% gain, while the other two companies in the sub sector suffered slight losses.Finally, the Residential Providers sub sector was the star of the CSPI with a gain of 18.9% in our winter reporting period. This strong performance was entirely due to a 46.7% gain at Telephone and Data Systems.The only other company in the sub sector to turn in a positive return was Cable One, which gained a much more modest 3.5%.

PUBLIC MARKET SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

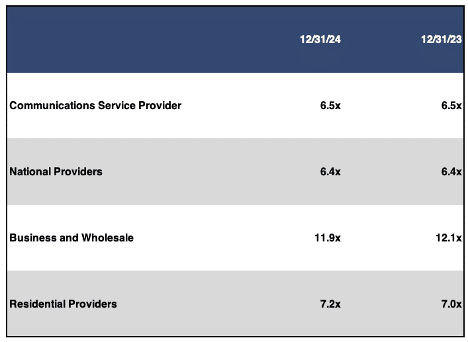

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

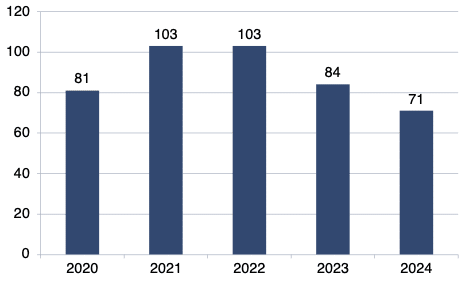

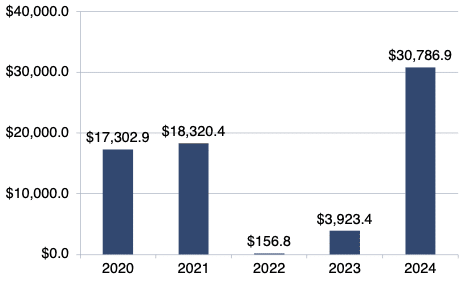

M&A activity in the Communications Service Provider sector cooled off somewhat this period with a total of 17 announced transactions. However, total announced transaction dollar value was very strong at $5.1 billion. For all of 2024, the Communications Service Provider sector had 71 total transactions for a total announced transaction dollar value of $30.1 billion. These two metrics tell very different stories about M&A activity in 2024. From the standpoint of the number of transactions, 2024 was disappointing, with the number of transactions lower than any year in the last five. On the other hand, the total announced dollar value of transactions was more than 50% higher than any year in the last five.

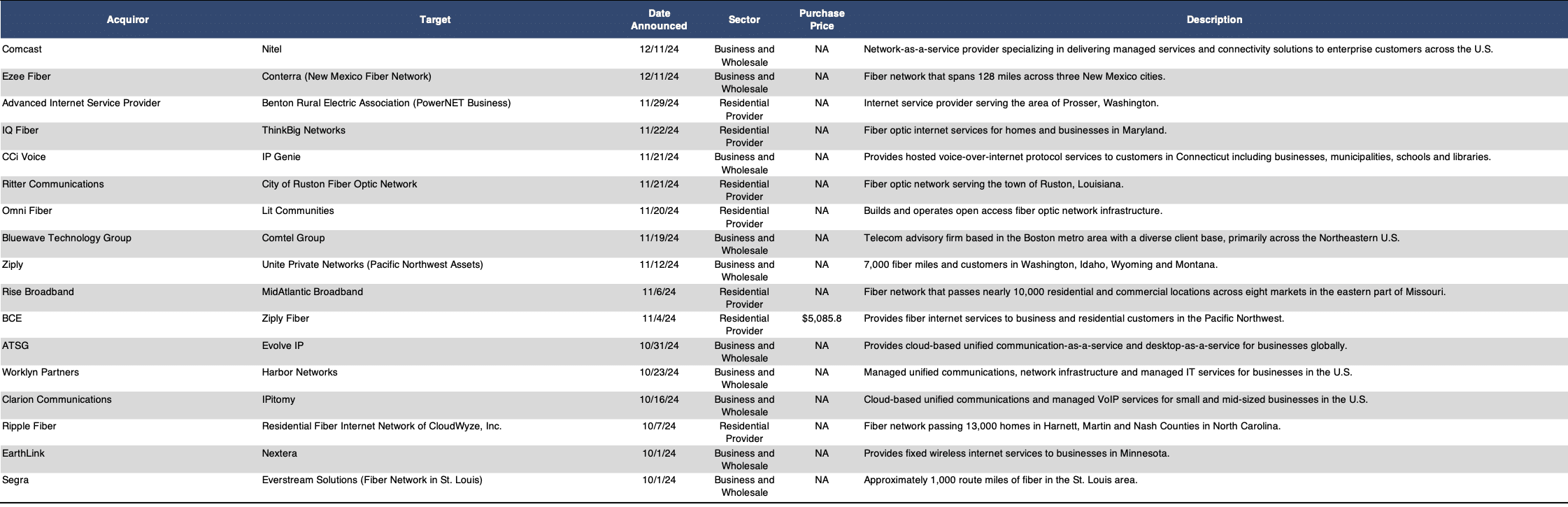

The marquee transaction for this period was BCE’s acquisition of Ziply Fiber for $5.1 billion. Not only was this one of the largest transactions in all of 2024, but it also marks a major strategic move for BCE as it makes a major entry into the FTTH market in the U.S. Other acquirers of FTTH assets over these past three months included IQ Fiber, Omni Fiber, Ritter Communications, Ripple Fiber and Rise Broadband. Transactions for business-oriented fiber companies included EZEE Fiber’s acquisition of Conterra Network assets in New Mexico and Segra’s acquisition of Everstream network assets in St. Louis. Finally, we will also note the acquisition of managed communications service provider Evolve IP by ATSG.

While there was only one transaction with announced multiples this period, it was for the period’s most significant transaction.This was the BCE acquisition of Ziply Fiber, which had multiples of 7.3x revenue and 16.4x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (7/01/24– 12/31/24)

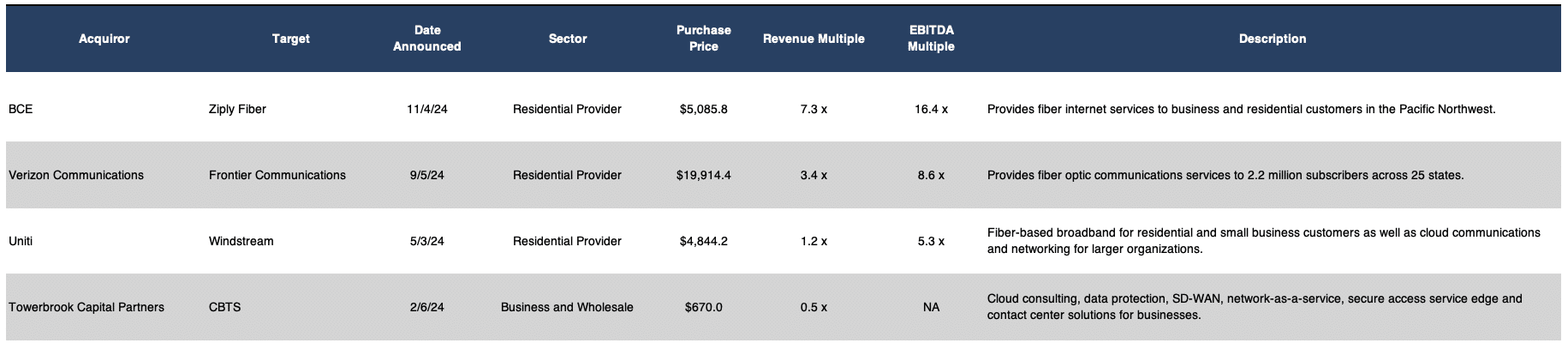

M&A Transactions with Announced Multiples (1/1/24 – 12/31/24)

DOWNLOAD THE FULL REPORT HERE.