FOCUS Telecom Business Services Quarterly: Fall 2024 Report

Overview

The FOCUS Telecom Business Services Index (TBSI) returned to positive territory this reporting period with a three-month gain of 7.7%.

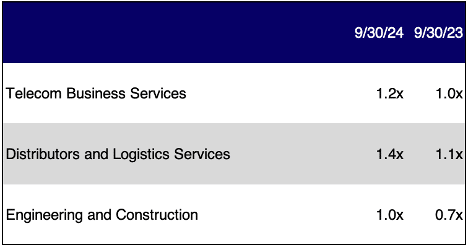

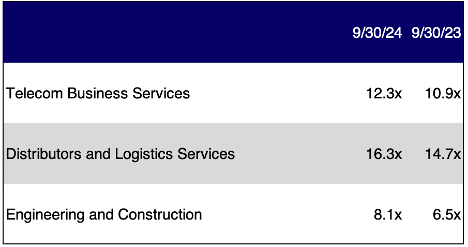

This outperformed both the 5.5% gain in the S&P 500 and the 2.6% gain in the NASDAQ.This period’s gain also brought the year-over-year return for the TBSI to a level that is almost on par with the broader indices. The TBSI had a 12-month gain of 31.1%, which is approaching the 34.4% and 37.6% gains in the S&P 500 and NASDAQ, respectively. Sector multiples are also higher than the year-ago period. The sector revenue multiple increased from 1.0x a year ago to 1.2x currently, while the EBITDA multiple grew from 10.9x to 12.3x over the corresponding time period.

The Distributors and Logistics Services sub sector had a three-month gain of 4.6%. All of the stocks in the index were in positive territory for the period, with ePlus (up 33.5%) and PC Connection (up 17.5%) leading the charge. The sub sector is also up 20.6% for the full year, with every company in the index posting a strong gain. The Engineering and Construction sub sector had an even stronger performance this past three months. In addition to gaining 15.3%, all of the stocks in the sub sector enjoyed a double-digit gain. The sub sector is also up 61.8% compared to this time last year. This included strong gains at both Dycom (up 121.5%) and MasTec (up 71.0%). Sub sector multiples closed out the period at 1.0x revenue and 8.1x EBITDA. These both compare favorably to year-ago multiples of 0.7x revenue and 6.5x EBITDA.

Public Markets Summary

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

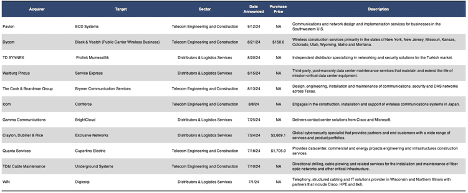

M&A activity in the Telecom Business Services sector remained at a relatively anemic level with 11 total transactions in the past three months. On the plus side, we did have a very high total announced transaction dollar value with $4.5 billion for the period. Six of the transactions were in the Telecom Engineering and Construction sub sector, while the Distributors and Logistics Services sub sector accounted for the remaining five. Year-to-date, we count 38 total transactions for the year with a total announced transaction dollar value of $4.5 billion. This means that as of now, 2024 is not looking to be much of an improvement over 2023 in terms of the total number of transactions. However, with a quarter of the year still remaining, the total announced dollar volume of transactions is already higher than either of the previous two years.

We counted three transactions with announced multiples this period. In the Engineering and Construction sub sector, Dycom’s acquisition of the public carrier wireless business of Black & Veatch had a multiple of 0.6x revenue.In addition, Quanta Services’ $1.7 billion purchase of Cupertino Electric had multiples of 0.9x revenue and 10.9x EBITDA. The final transaction with an announced multiple was in the Distributors and Logistics Services sub sector. This was the acquisition of cybersecurity distributor Exclusive Networks by Clayton, Dubilier and Rice. Not only was this the period’s largest transaction with a value of $2.7 billion, but it was also the transaction with the highest multiples at 1.7x revenue and 13.1x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (7/1/24 – 9/30/24)

Announced Transactions with Revenue Multiples (10/1/23 – 9/30/24)

DOWNLOAD THE FULL REPORT HERE.